As local businesses continue to experience financial strain due to the coronavirus pandemic, both local and national government have stepped up to provide aid where it is needed.

The Chamber for a Greater Chapel Hill-Carrboro works to help local businesses succeed and become a part of a thriving community.

Aaron Nelson is the President of the chamber. He thinks one of the biggest challenges businesses are facing right now is that they’ve had very little time to adapt to how fast this pandemic is evolving.

“Unlike even a hurricane which you see coming and we might have eight days of forecast ahead of time to track it and follow it and prepare, the quickness with which this hit our community and the severity of how quickly everybody socially distanced, two things have happened,” Nelson said. “One we have pushed out further into the calendar of when the peak will be because we are doing a nice job of being socially distant but we also gave very little time for businesses to adapt.”

Nelson said the chamber serves around 700 businesses and nonprofits in their network that employ about 80,000 people across the region.

For all these businesses, this little time to prepare means there’s also been little time to create the financial cushion needed to wait out a crisis. This is why local and national organizations have stepped up to provide emergency aid to businesses in need.

Locally, Orange County has created a small business fund that provides emergency aid in the form of zero-interest loans up to $20,000 dollars.

While this is a great start, there’s a lot more need than local government can provide for at the county level. Thankfully, state and national government have also stepped up to help.

The CARES Act, short for Coronavirus Aid, Relief, and Economic Security, was signed into law on March 27. This legislation allocates a 2 trillion-dollar fund that provides multiple programs and resources for profits and non-profits alike.

One program included in this act is the Economic Injury Disaster Loan or EIDL.

The EIDL helps severely impacted small businesses and nonprofits overcome temporary loss of revenue with low-interest loans up to $2-million dollars. This loan comes with a 3.75% interest rate for small businesses and 2.75% for non-profits – all repaid over 30 years.

“The Economic Injury Loans you borrow from the federal government directly through the SBA, Small Business Administration, from their website,” Nelson said.

On top of that, the CARES Act, alongside the SBA, is fronting the Paycheck Protection Program or PPP.

The PPP is $350-billion-dollar program designed to provide a direct incentive for small businesses with fewer than 500 employees to keep their workers on the payroll.

The incentive is loan forgiveness. The loan, covering up to 2 and a half months of payroll, will be fully forgiven if the funds borrowed are used only for payroll costs, interest on mortgages, rent, and utilities.

“They’re making available enough funds to cover payroll for eight weeks for your employees,” Nelson said. “If you keep your employees, and you keep them past that period, they will forgive that loan.”

Forgiveness is based on the employer maintaining or quickly rehiring employees as well as preserving salary levels. This loan is pulled directly from your local bank.

Nelson said if and when it comes time to borrow, it’s very important for the small business community to be vigilant in where and with whom they pull out their loans.

“They know you are vulnerable out there,” Nelson said. “They are reaching out to try to snag you into their system. So I try to encourage everyone to be real thoughtful about who you are partnering with and that you’re using trustworthy websites and banks that you have relationships with.”

For more information on loan opportunities for small businesses and non-profits, visit the chamber’s website.

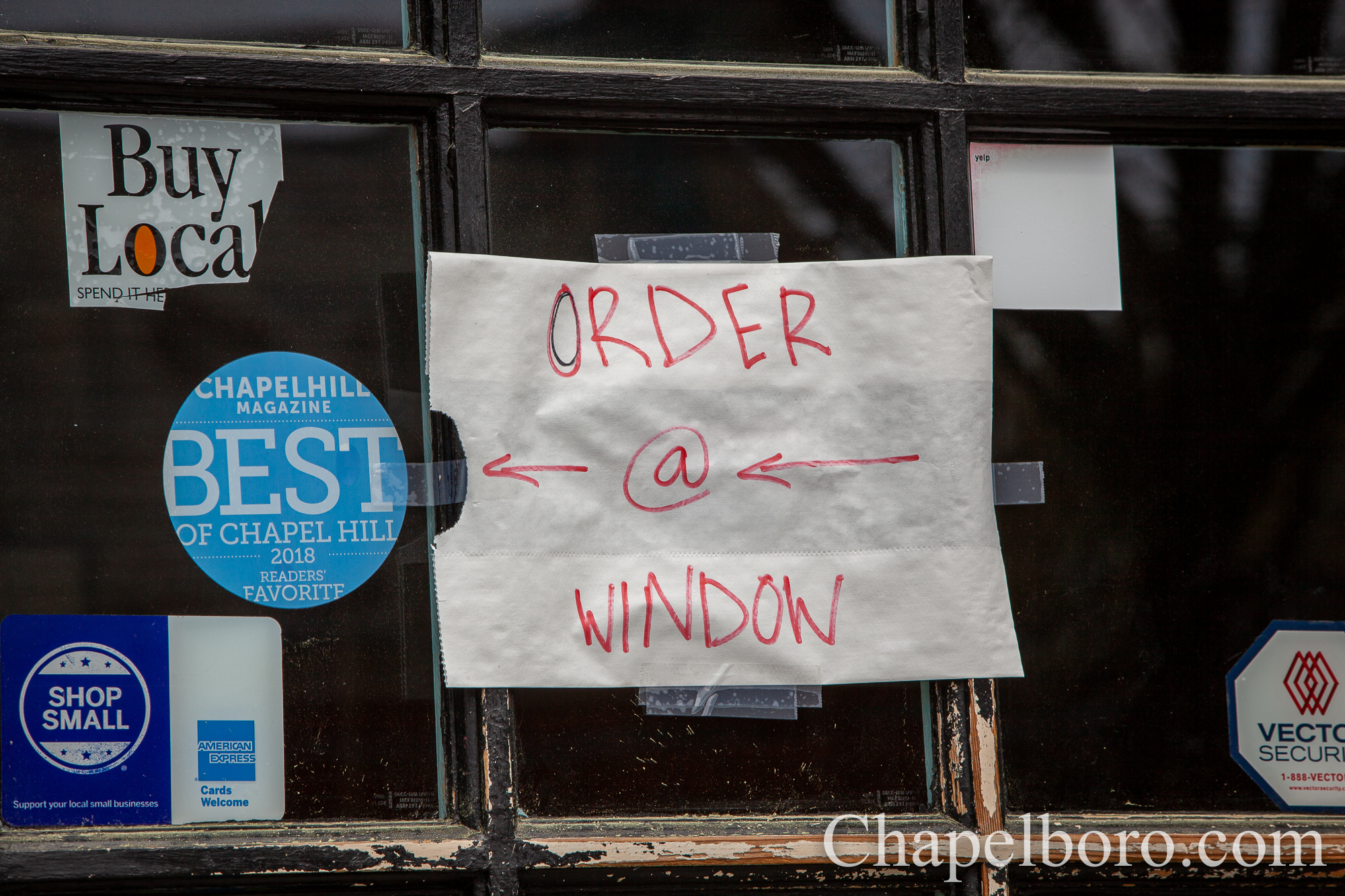

(Photo courtesy of The Chamber for a Greater Chapel Hill-Carrboro)

Note: 97.9 The Hill has been Chapel Hill and Orange County’s daily source for free local news since 1953. Please consider making a donation to continue supporting important local journalism like this.