As daily lives are disrupted due to the coronavirus pandemic, many people have been forced to make difficult financial decisions.

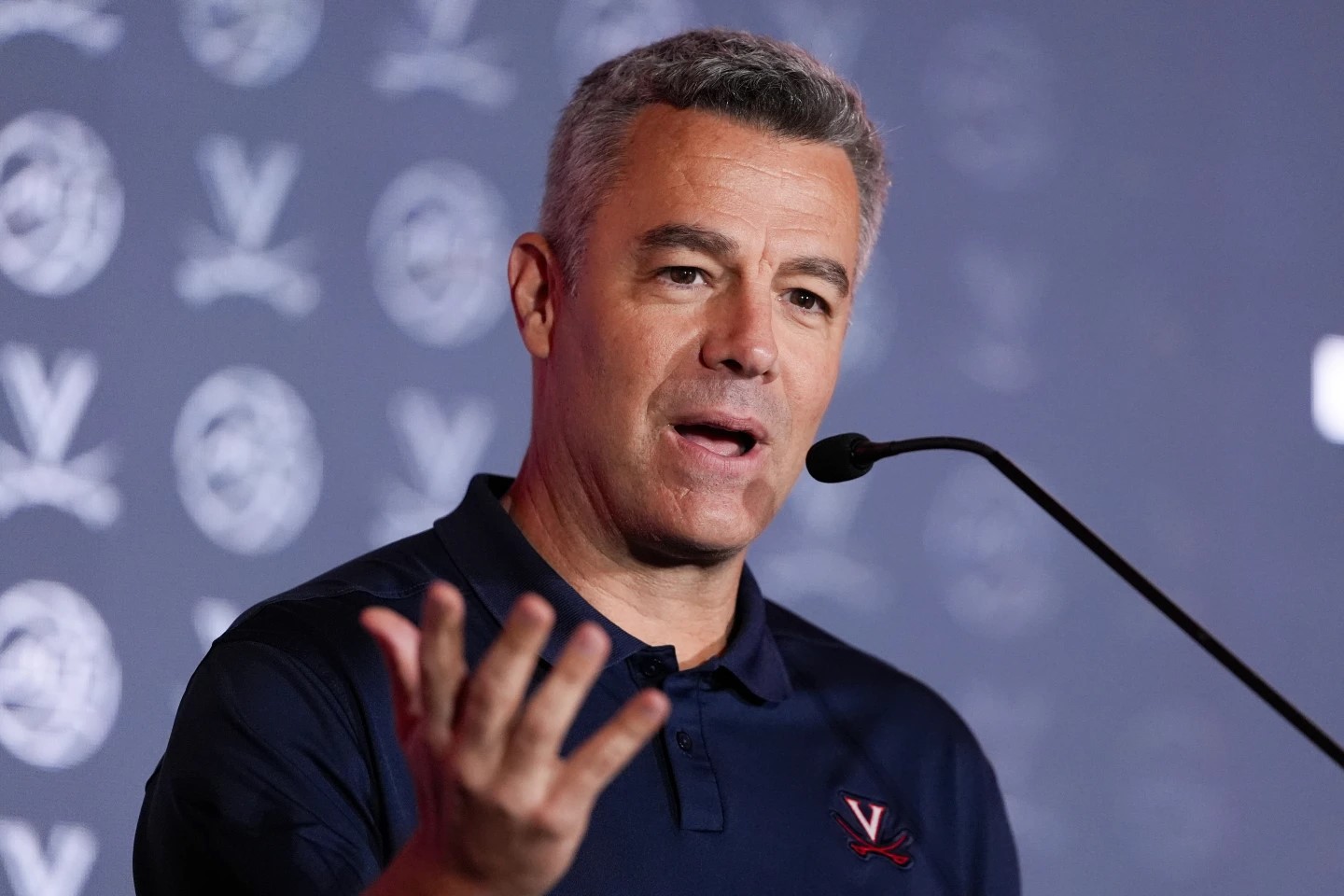

John Stillman is the founder of Rosewood Wealth Management in Durham and is the host of Financial Symphony here on 97.9 The Hill.

Stillman works as a financial adviser. He said, when it comes to managing finances during this time, most of his clients fall into one of three categories: seniors in retirement who are seeing their account balances drop, people who are middle-aged and might use this as a time to buy into the market and the younger person who is seeing paycheck interruptions and doesn’t have any emergency funds.

When it comes to those individuals with little financial stability, Stillman said to think about Maslow’s Hierarchy of Needs and prioritize what is most important to you – whether it be food, shelter or entertainment.

Although, Stillman said not everyone’s basic needs will look the same.

“Some people are going to be perfectly happy to spend nothing on food and just clean out everything they have in the pantry and find creative ways to eat,” Stillman said. “That’s not going to work for other people so you just have to figure out what makes the most sense for you and your household.”

He said when people are prioritizing, they shouldn’t just be thinking about where they are spending their money but also where they are getting their money from.

Stillman said while many people have focused on the stimulus checks they may get as a result of the two-trillion-dollar coronavirus bill, there’s another very important but little-noticed provision.

Tucked in the Coronavirus Aid, Relief, and Economic Security Act, better known as the CARES Act, are several provisions that cover retirement accounts.

“You can actually take money out of a retirement account, so an IRA or 401k, before retirement age,” Stillman said. “So 59 and a half is usually when you can take that money out with no penalty. You still pay taxes on it but are not penalized after that age. If you take money out before 59 and a half [years of age] normally you pay a 10 percent penalty. Well in this bill that that passed, you can take the money out without the penalty.”

Under the CARES Act, withdrawals up to $100,000 made on or after January 1 would not incur the 10% penalty. Additionally, if you pay back what you withdrew within three years, you can avoid paying taxes on your withdrawal altogether.

“For somebody who’s in a position, maybe in their 40s or 50s, where you’ve built up some retirement assets but you just have this temporary issue of your income is gone, well there’s a great place to go,” Stillman said. “You can pull that money out, essentially borrow it from yourself and pay it back.”

For those who do happen to find themselves in a financially secure state during this pandemic, Stillman said now might be the time to further invest in the market.

“If you’re not retiring next week and you don’t need this money to be turned into income very soon, you just have to look at this as a great opportunity for you,” Stillman said. “It’s a great chance for you to be putting money in and buying stuff essentially while it’s on sale. A lot of people, their knee-jerk reaction is ‘oh well the market’s down, I don’t want to be putting money in,’ but no that’s exactly the time to be putting money in if you can.”

Stillman said overall, do what you need to do to survive, but when this is all over, he encourages us to reflect and think about what we can do to put ourselves in a better financial position the next time the unexpected happens.

“For people who have always ignored the idea of having an emergency fund, having some money in the bank where you can weather a storm like this for three to six months – well I think now hopefully this will shake some people awake and make them realize ‘OK I need to be a little more diligent about having some money saved,’” Stillman said.

To learn more about Rosewood Wealth Management and to access their financial services, visit their website.

Note: 97.9 The Hill has been Chapel Hill and Orange County’s daily source for free local news since 1953. Please consider making a donation to continue supporting important local journalism like this.