Trends in Taxes and Expenses in Chapel Hill

A perspective from Charles Humble

A recently-published “Viewpoints” on Chapelboro brought up some claims and statistics that deserve further analysis and discussion. The piece selected three newer high-profile buildings and calculated the tax revenues raised from them from FY 2012 to FY 2016 (~$5.1 million), as well as calculating the amount the town spent for services for these three buildings over the same five-year period (~$2.8 million) and concluded that Chapel Hill needs more, not fewer, tall mixed-use buildings. But, how good are these cost of services data points?

Here is a little local history on such analyses: back around 2011 the former town manager was asked, in so many words, “How much growth does Chapel Hill need so as not to increase the amount of individuals’ property taxes?” He hired the author of dozens of identical studies across the state to look into it. The resulting comprehensive report (“Chapel Hill Cost of Community Services”) came out in May of 2012. It showed that residential development costs more to support than it brings in with new revenues. It likewise shows that retail and office development provide excess revenue over associated costs.

This was not the answer that was expected. In response, town staff evaluated the costs and revenues associated with Greenbridge and 140 West (The Berkshire did not exist at the time.) The resulting staff report indeed showed cash positive comparisons for these structures. However, further in-depth review of that staff report showed that a huge amount of Town general expenses were neglected, e.g., the costs associated with demolition to produce the underground parking at 140 West. Likewise, did the cost data for West 140 include the $2+ million we paid the consultants to get the deal done? The approximately $2M spent to cleanup and continue to deal with old oil/gas leaks)? The Town’s cost to put in the charging stations the developer was supposed to provide?

Including any of these items in further analysis gives a very different picture of service costs-to-tax benefits.

Are there other, more comprehensive numbers that describe the effects of recent development around our fair city. Luckily, yes. On January 3, 2018, Kenneth Pennoyer — until recently Chapel Hill’s Business Management Director — described the financial consequences of local development to incoming council members. His analyses used data from FY2010 to FY2017.

During this period there were 41 major developments in Chapel Hill, not just the three cited in the prior discussion. Development was the only source of increased property tax revenue during the seven-year period of constant property assessments (due to the recession and falling property values.) The Town’s New Development web site for that period shows that over 82% of the new development was housing in all forms (apartments, condos, town houses, and single family), around 15% was commercial (office and retail) and 3% was institutional (churches, town buildings, etc).

Here’s the bottom line: From FY10 thru FY17, the average annual increase in the property tax base was 1.31% while the increase in the adopted budgets for the General Fund that pays for the bulk of Town services for the same period was 3.7%. (The shortfalls were covered by sales tax growth of roughly 6% annually and borrowing from cash balances.) This is not a pattern the Town can afford to continue.

The only rational conclusion is that the new development did not cover the increase of services costs that it brought — regardless of what type of development occurred. And maximizing development along already failing transportation arteries promises to further challenge local residents.

I understand how attractive some of the numbers being discussed are to fans of rapid-growth policies. But Chapel Hill will pay in many ways if we ignore the more thorough analyses from Mr. Pennoyer and from the Cost of Community Services report cited above. As we consider whom to elect to Town Council in November and to County Commission next year, let’s support candidates willing to take a more complete view of our financial, aesthetic and environmental options.

“Viewpoints” is a place on Chapelboro where local people are encouraged to share their unique perspectives on issues affecting our community. If you’d like to contribute a column on an issue you’re concerned about, interesting happenings around town, reflections on local life — or anything else — send a submission to viewpoints@wchl.com

Related Stories

‹

Viewpoints: On Campus With Coronavirus -- How Safe?On Campus With The Coronavirus: How Safe? A perspective from Hassan Melehy When the coronavirus first became news, as a UNC-Chapel Hill faculty member since 2004, I was proud to learn that our School of Medicine and Gillings School of Public Health were at the forefront of research on the pandemic. So I had confidence in […]

Viewpoints: Becoming a More Responsible Consumer of Health and Science News in the Age of COVID-19Becoming a More Responsible Consumer of Health and Science News in the Age of COVID-19 A perspective from Julia Soplop There’s nothing funny about COVID-19. But it’s a little funny that in any crisis, we suddenly think we’ve become relevant experts based on our few-days-worth of news consumption. As a hurricane approaches, we become meteorologists. The wind […]

Never Too Far: My Church - The Irrelevant Social Club?It must be the guide and the critic of the state, and never its tool. If the church does not recapture its prophetic zeal, it will become an irrelevant social club […]

Viewpoints: Columns From Our ClassroomsIn a special edition of “Viewpoints,” below are four submitted columns from young students currently enrolled in our local schools stating some of their concerns, experiences and thoughts about the community they live in. https://twitter.com/tori_mazur/status/1223327974293999616?s=20 A Lack of Bike Lanes A perspective from Wyatt Grine My concern for our community is our lack of […]

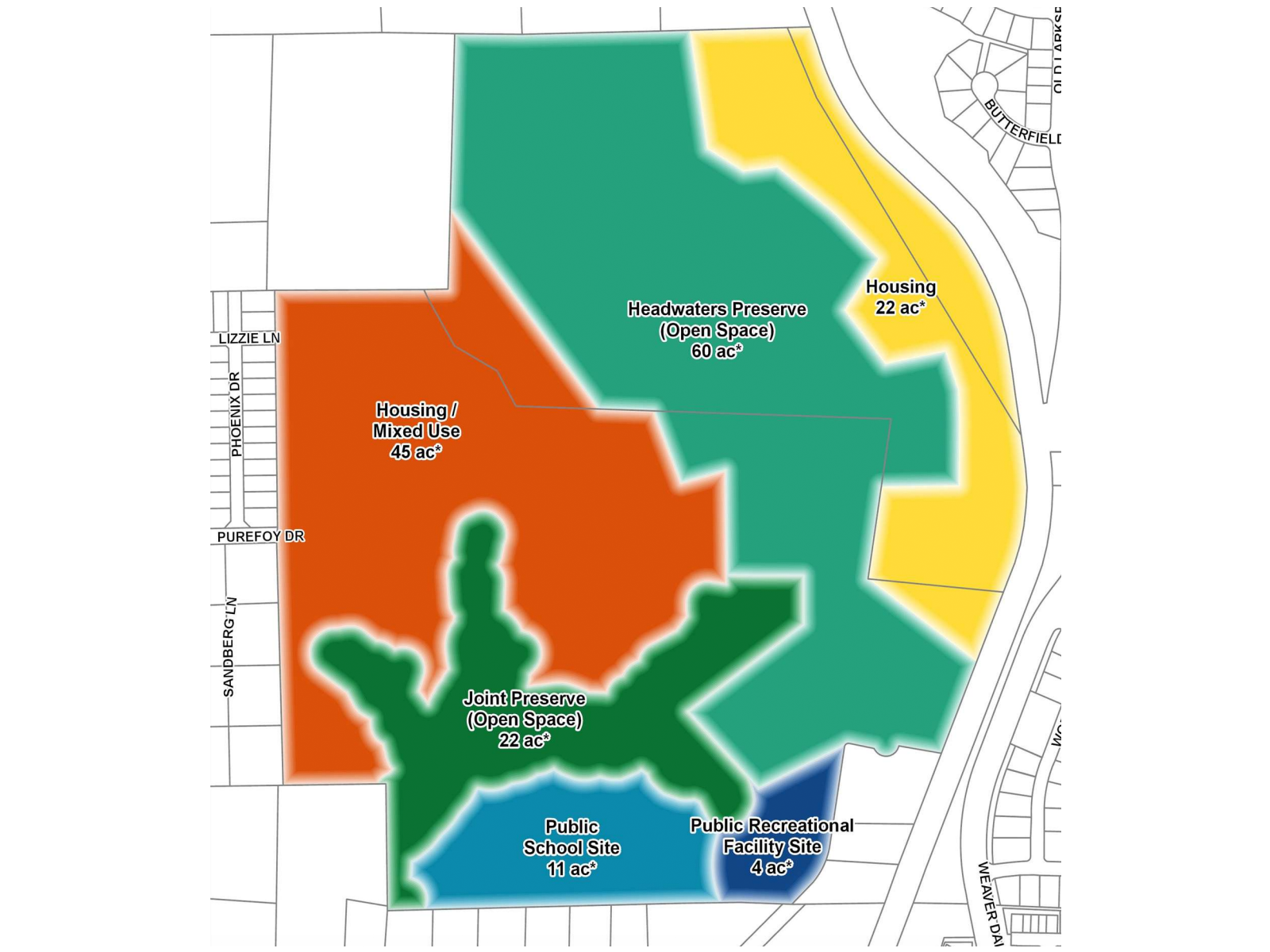

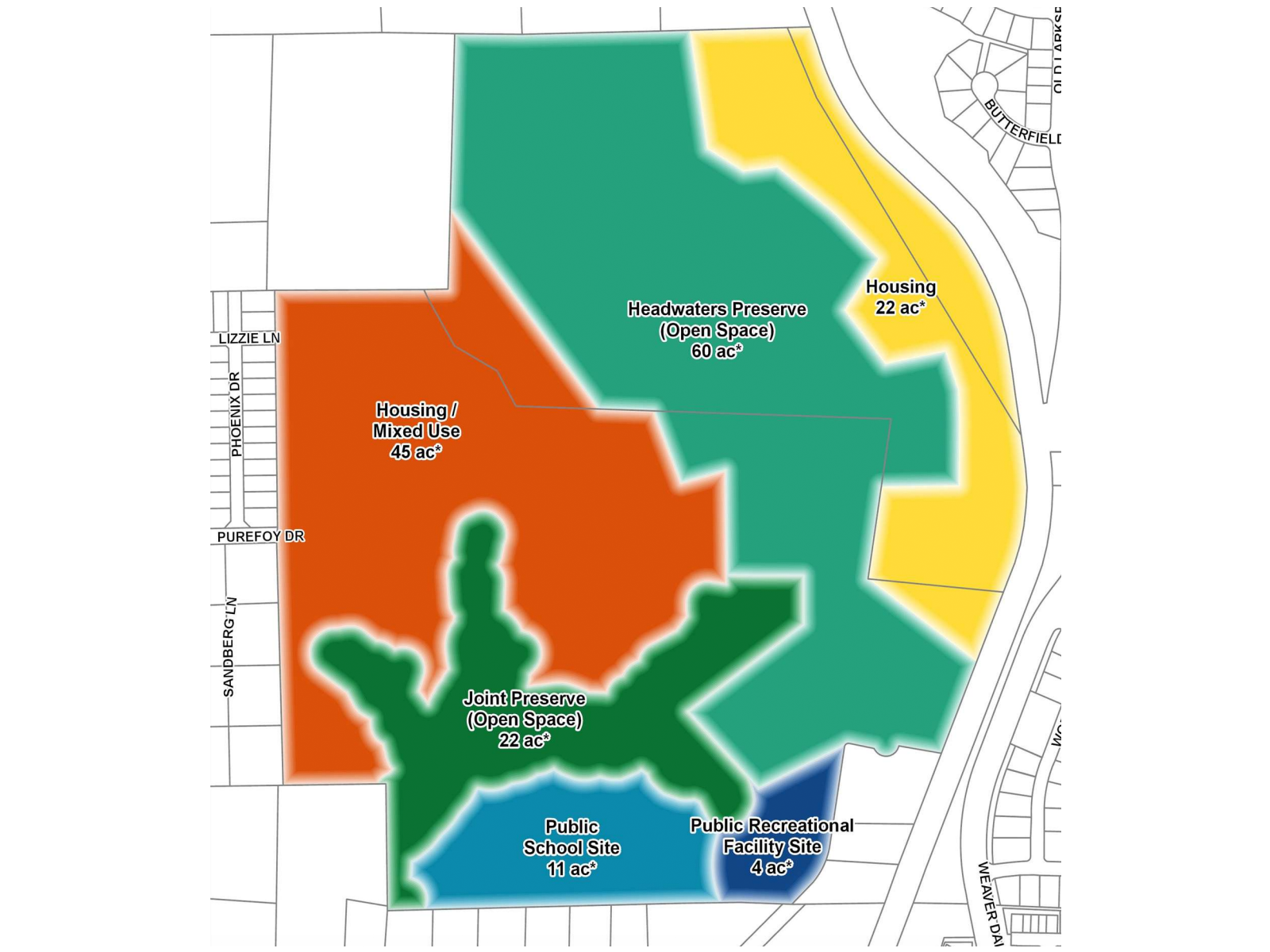

Viewpoints: Regarding the Greene Tract ForestThe Rushed Vote on Summer Development in Greene Tract Forest A perspective from Abel Hastings Chapel Hill Town Council Rushes Summer Development Vote on Greene Tract Forest In the usually slow days of summer, the Chapel Hill Town Council has decided to hold a special session to consider a new plan to develop the […]

On the Porch: Bobbie Morel - Food for the PeopleThis Week:

Service is a part of living for Bobbie Morel and food is her love language. Helping to lead the Chatham Alliance allows Bobbie to provide for her community while addressing food insecurity and do what she loves. Bobbie is married with 5 stepchildren and 8+ grandchildren. Her professional career was in the medical field and she later transitioned to electrical before retiring and moving from New England to North Carolina. Bobbie's faith is the cornerstone of her life. She is a dedicated member of Pittsboro Presbyterian Church.

On the Porch: Mayor Kyle Shipp and Tami Schwerin - Sculpture Celebration at The PlantThis Week:

Tami Schwerin is a re-developer of The Plant, taking a cold-war industrial plant and creating a community hub of food, beverage and experiences. Her past experience includes founding a local food, renewable energy and cultural non-profit; Abundance NC. Before that she helped build Chatham Marketplace, a local co-op grocery store. She has served on art and environmental boards of directors. She traveled the world selling software in her younger years and renovated several old broken-down houses. Tami loves a challenge and creating a world that she wants to live in. She grew up in Raleigh, North Carolina and loves the south and Pittsboro.

Kyle Shipp serves as the Mayor of Pittsboro, North Carolina, where he focuses on responsible growth, infrastructure, and transparent governance. He previously served as a Town Commissioner and Planning Board member. In his full-time role, Kyle works as an engineer in the data center industry, specializing in industrial control systems. He also serves as Board Chair of the Boys & Girls Clubs of Central Carolina, supporting youth development across the region. With a background in engineering and a passion for community service, Kyle works to ensure Pittsboro grows in a way that reflects its values and long-term vision.

On the Porch: Nicole Villano and Kirsha Dudenhausen on Your Local Co-op Grocery StoreThis Week:

Kirsha Dudenhausen is the General Manager of Chatham Marketplace, a food co-op in Pittsboro, NC where she's worked since 2021. Working at The Chatham Marketplace means Kirsha can make a difference in her community by helping to provide access to fresh, local goods while supporting regional farmers and other producers. Kirsha celebrates working in a place where she shares common values with employees and customers. Kirsha and her family have lived in Pittsboro since 2018.

Nicole Villano is a Strategy and Development Manager for the National Cooperative of Grocers, a business service cooperative for retail food co-ops in the US. Prior to that she was the General Manager at Deep Roots Market in Greensboro, NC, where she still lives and works remotely. She earned an Anthropology degree from Appalachian State and is working on a Master’s in Sustainability at UNCG. Nicole also serves as Board President for Carolina Common Enterprise, a non-profit cooperative development agency. Nicole believes that food systems are unsustainable without cooperation and that local food economies are critical to our future.

'This is My Home': Med Deli Owner Shares Plans to Rebuild, Target OpeningA fire destroyed the Mediterranean Deli and Catering on Franklin Street, all employees got out of the building safely.

PORCH Chapel Hill-Carrboro Appoints New Executive DirectorPORCH, a Chapel Hill-Carrboro non-profit, named a new executive director last week.

›