By Katie Loovis, Vice President for External Affairs, The Greater Chapel Hill-Carrboro Chamber of Commerce

An area in Chapel Hill is now designated an “Opportunity Zone” and catching the eye of many investors.

This zone, the only one in Orange County, provides tax benefits to investors in order to spur economic development. Investor benefits range from deferring tax on prior gains to sheltering future gains for ten-year investments in the zone.

The word from Chapel Hill Town Economic Development Director, Dwight Bassett, who pursued this designation for the town, is that investors are already considering and purchasing properties and parcels in the zone.

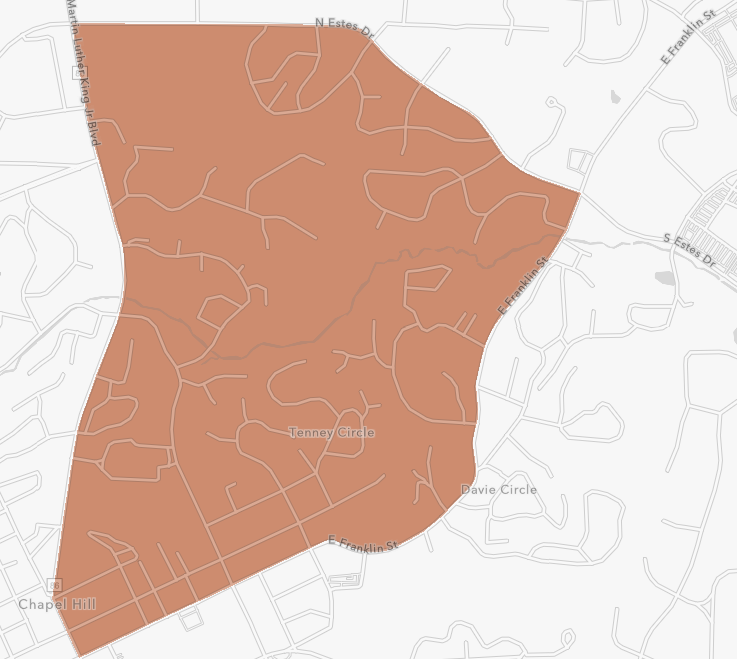

The Opportunity Zone in Chapel Hill

Chapel Hill’s Opportunity Zone

The Opportunity Zone in Chapel Hill includes everything north of Franklin Street, east of MLK Boulevard and south of Estes Drive.

Basically, if you are at the corner of Franklin and Estes (near The Chamber) and drive up the Franklin Street hill towards UNC campus, everything on your right is in the zone (think Fast Med, Caffé Driade, and the entire block that includes Varsity Theatre).

From the corner of Franklin and N. Columbia Street (at Lula’s, formerly Spanky’s), turn right, drive downhill heading north on MLK Boulevard, and everything on your right is in the zone (think PNC Bank building, the open surface lot along Rosemary Street, the shopping center with Fly Leaf Books and Root Cellar at the Hillsborough Street intersection, and then the YMCA as you head up the hill towards Estes Drive).

Finally, turn right from MLK Boulevard onto Estes Drive and everything on your right as you make your way back to the intersection with Franklin at the Chamber is also in the zone.

Other Opportunity Zones

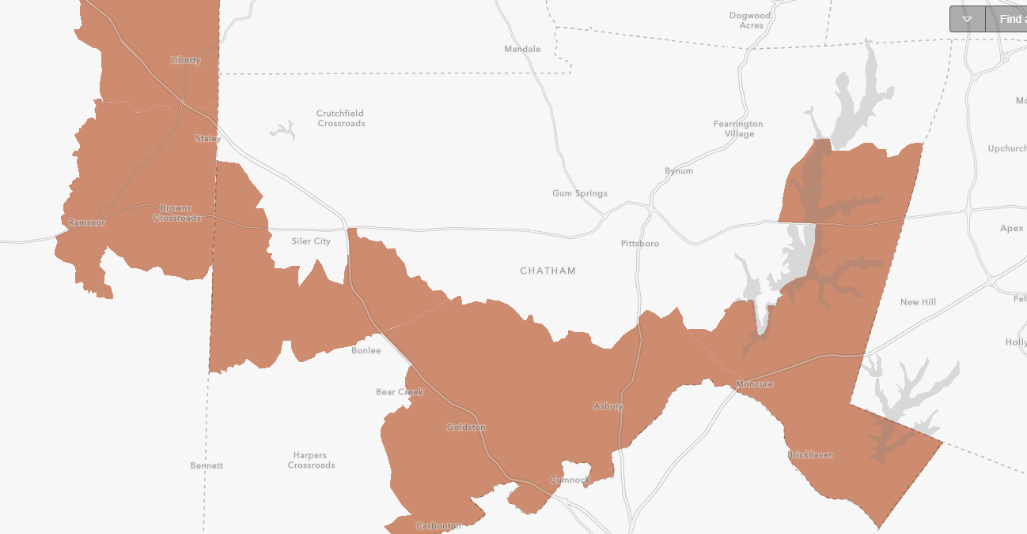

Chatham’s Opportunity Zone

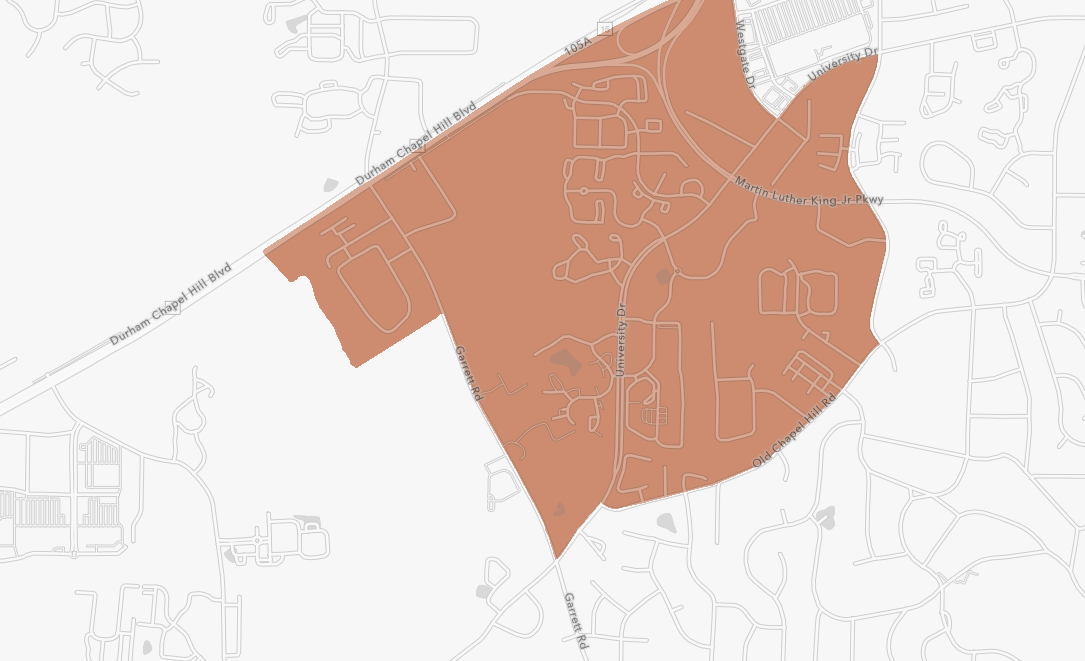

There are other Opportunity Zones in our region, including a huge swath across Chatham County(includes three census tracts – 203, 206 and 207.02 and the Moncure Megasite) and several areas in Durham County, the closest being in the southwest Durham (the area between Durham-Chapel Hill Boulevard, Garret Road, Old Chapel Hill Road, and MLK Jr. Boulevard).

Durham’s Opportunity Zone

National Framing

The Opportunity Zones Program is an economic development and tax incentive as part of the recent federal tax legislation known as The Tax Cuts and Jobs Act (H.R.1).

Through the federal program, the state of North Carolina established 252 zones with at least one zone in every county. All certified zones “offer qualified investors certain tax benefits when they invest unrealized capital gains in these areas.”

Summary

The bottom line is that Opportunity Zones are low-income census tracts where tax incentives are designed to draw long-term investment to help revitalize urban, rural and distressed parts of the state. In exchange for the investment, investors receive a temporary capital gains deferral and other tax benefits.

Final details of this program are still being worked out, including the timeline for when funds need to be invested to realize the full benefit of the incentive, which could be by the end of 2019.

Resources

A few additional resources to make the most of this possible win for investors and our community:

The Town of Chapel Hill Opportunity Zone Information

The State of North Carolina Opportunity Zone Program (and map of zones)

The Federal Reserve Bank of Richmond’s Guide

The Chamber President and CEO, Aaron Nelson, is also available to answer questions.