All too often business owners do not know what it costs to deliver a product or service. I have many sad owners that thought they were making money when they landed a big deal but discounted it to the point of losing money in the process. The illusion was a quick improvement in cash flow before realizing it would have been better to not have “won” that business and focused on more profitable opportunities – or just “business as usual”.

Three expense categories:

1) Overhead / fixed costs – In this category any cost that is core to the business that does not change with volume. Rent, utilities, insurance, and anything that does not vary greatly should be placed in this category. Accounts may have different standards but let’s keep it simple for a small business. These are all the costs that occur even if you did not have any sales. Also know as “keeping the lights on. We should include any salaried employees and core / minimal staff to keep the business operating and remember to account for owner pay. Don’t forget about annual taxes, licenses, and insurances (average the annual costs per month).

2) Product or service costs “Variable” – Anything that can be reduced or increased as business fluctuates. This includes inventory and staffing costs that can vary above keeping the lights on. If you have a manufacturing business that uses higher utilities in production – that portion should be accounted for as variable.

3) Investment / run the business – As a rule of thumb, setting aside 10-20% is the minimum in most cases. This is for breakage and repairs, marketing, and other unexpected costs.

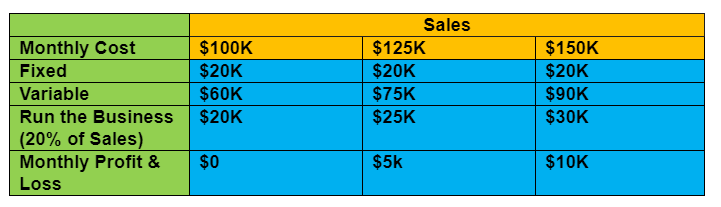

Example of Monthly breakdown:

For this business, the normal fixed cost is $20k / month, and for sales between $80K- $175K its incremental cost is 60 cents per dollar. We are setting aside 20% for “investment” back into the business for repairs, marketing, etc.

This business has normally been averaging ~ $100K / month in sales. They have able to keep up with expenses but not growing cash. They have an opportunity to close a $65K sale for next month and believe they have enough staff and will obtain product in time to deliver. But – to close the deal – need to offer ~ 15% discount. That would result in $50K to the top line vs $65K. Let’s look at what that does to the bottom line.

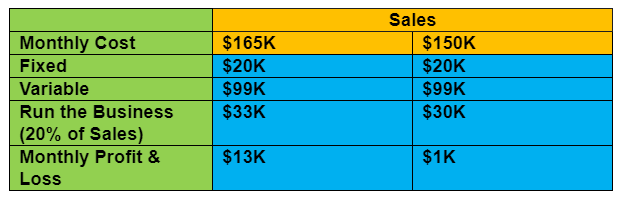

The cost to deliver is the same at the discounted price increasing the top line to $150K vs $165K. Thus the bulk of the costs are identical to the $165K undiscounted sales.

The reduction in price of 15% resulted in a .6% increase to the variable cost to an average of 66%. If the product / service is not delivered to standard – any additional discount or refund will quickly turn the bottom-line negative and is essentially indistinguishable from a $100K sales P&L standpoint than had they not “won” the business.

Think through

Understanding your “true” cost to deliver a product or service is essential to longevity. All too many business owners do not look at the incremental cost. A “big sales” along with a big discount without understanding if you can do that profitably will close your doors faster than a mad teenager!

I have had to negotiate many deals and walk away from a few. Most people are reasonable and want you to stay in business. One memorable one we walked away from was a large financial institution that wanted full services catering for $3 / head for 500 people. Their pitch was a great marketing opportunity to “sample” food to their employees. Knowing our costs made it easy to walk away. A competitor “won” the business. Not sure what they negotiated but were closed ~6 months later. They most likely didn’t know their numbers. Would like to hear from you on what business you are glad you walked away from or maybe a hard lesson you learned thinking you “won”. Business, Big Lessons™ – Know your numbers!

Small Business

About the Author:

Gregory Woloszczuk is an entrepreneur and experienced tech executive that helps small business owners grow their top and bottom line. Gregory believes in straight talk and helping others see things they need to see but may not want to with a focus on taking responsibly for one’s own business. He and his wife, Maureen, started GMW Carolina in 2006.

Gregory Woloszczuk is an entrepreneur and experienced tech executive that helps small business owners grow their top and bottom line. Gregory believes in straight talk and helping others see things they need to see but may not want to with a focus on taking responsibly for one’s own business. He and his wife, Maureen, started GMW Carolina in 2006.