More than two years after being arrested on securities fraud charges, a octogenarian Chapel Hill businessman and his son pleaded guilty in federal court to a market manipulation scheme.

A release from the U.S. Department of Justice said 82-year-old Peter Coker, Sr. of Chapel Hill and 56-year-old Peter Coker Jr. each admitted to their roles in significantly boosting the trades of two companies to attempt a reverse merger and sell shares at higher values. The stock inflation scheme was brought to light in 2022 after federal authorities arrested Coker Sr. and Winston-Salem businessman James Patten, 65 — who has also since pleaded guilty to his own charges.

The trio of men worked to take over the management and stock of Hometown International, the publicly-traded company that consisted only of Hometown Deli in Paulsboro, N.J., and the shell company E-Waste Corp. Patten helped open Hometown Deli in 2014 with a pair of businesses owners, who are not involved in the scheme, and then conspired with the Cokers years later to artificially trade the stock of the deli’s umbrella company and E-Waste in order to eventually sell with significant profits. Both companies were traded on the OTC Link Alternative Trading System, according to the Department of Justice.

The street view of Hometown Deli in Paulsboro, N.J. in 2019. (Photo via Google Maps.)

For several years, the defendants transferred their shares to family members, friends and associates before accessing those people’s trading accounts, the Department of Justice argued. Using those other accounts, the trio would coordinate trades — called a “match and wash” tactic — to boost outside interest in the stock on the market. Ultimately, the scheme artificially inflated Hometown International’s stock by 939% and E-Waste’s stock by around 19,900%.

Coker Jr. was arrested separately from his father and Patten, having initially evaded authorities while overseas before being caught in Thailand. Coker Sr. — who is known locally for being the managing director of Tryon Capital Ventures, which took ownership of the gifts and gourmet food store Southern Season in 2011 alongside Carrboro Capital Corporation — is registered to a Chapel Hill address in Chatham County.

The securities fraud charges both of the Cokers face carry a maximum penalty of 20 years in prison and a $5 million fine, according to the DOJ’s release. The conspiracy to commit securities fraud crimes carry an additional maximum of five years in prison and a fine of at least a $250,000. Coker Jr.’s sentencing will come first, as the federal judge set it for April 2; Coker Sr. will be sentenced on May 13.

Chapelboro.com does not charge subscription fees, and you can directly support our efforts in local journalism here. Want more of what you see on Chapelboro? Let us bring free local news and community information to you by signing up for our newsletter.

Related Stories

‹

As Markets Implode, US Trading Partners Puzzle Over Whether There’s Room for NegotiationsThe impact of U.S. President Donald Trump’s blast of tariff hikes was reverberating across world markets Monday as America’s trading partners puzzled over whether there is room for negotiating better deals.

![]()

Wall Street See-saws Up and Down as Volatility Retains GripStocks are see-sawing between gains and losses in midday trading on Wall Street Thursday, but the moves are more subdued than the wild jabs that have dominated recent weeks. At least for now. The S&P 500 was up 1.5% after bouncing back from a loss of 3.3%. That would be a notable change in normal […]

![]()

The Mighty Bull Market Falls Victim to a Tiny VirusIn the end, the mighty bull was slayed by a tiny virus. The longest bull market in U.S. history can now be said to have lasted almost 11 years and rewarded investors with a return of 529% based on the performance of the S&P 500, including dividends. The bull officially ran from March 9, 2009, […]

Trump Says He’ll Raise Tariffs to 15 Percent After Supreme Court RulingPresident Donald Trump said Saturday that he wants a global tariff of 15%, up from 10% he had announced a day earlier after the U.S. Supreme Court struck down many of the far-reaching taxes on imports that he had imposed over the last year.

Top Central Bankers Express ‘Full Solidarity’ With Fed Chair Powell in Clash With TrumpCentral bankers from around the world said Tuesday they “stand in full solidarity” with U.S. Federal Reserve Chair Jerome Powell, after President Donald Trump dramatically escalated his confrontation with the Fed.

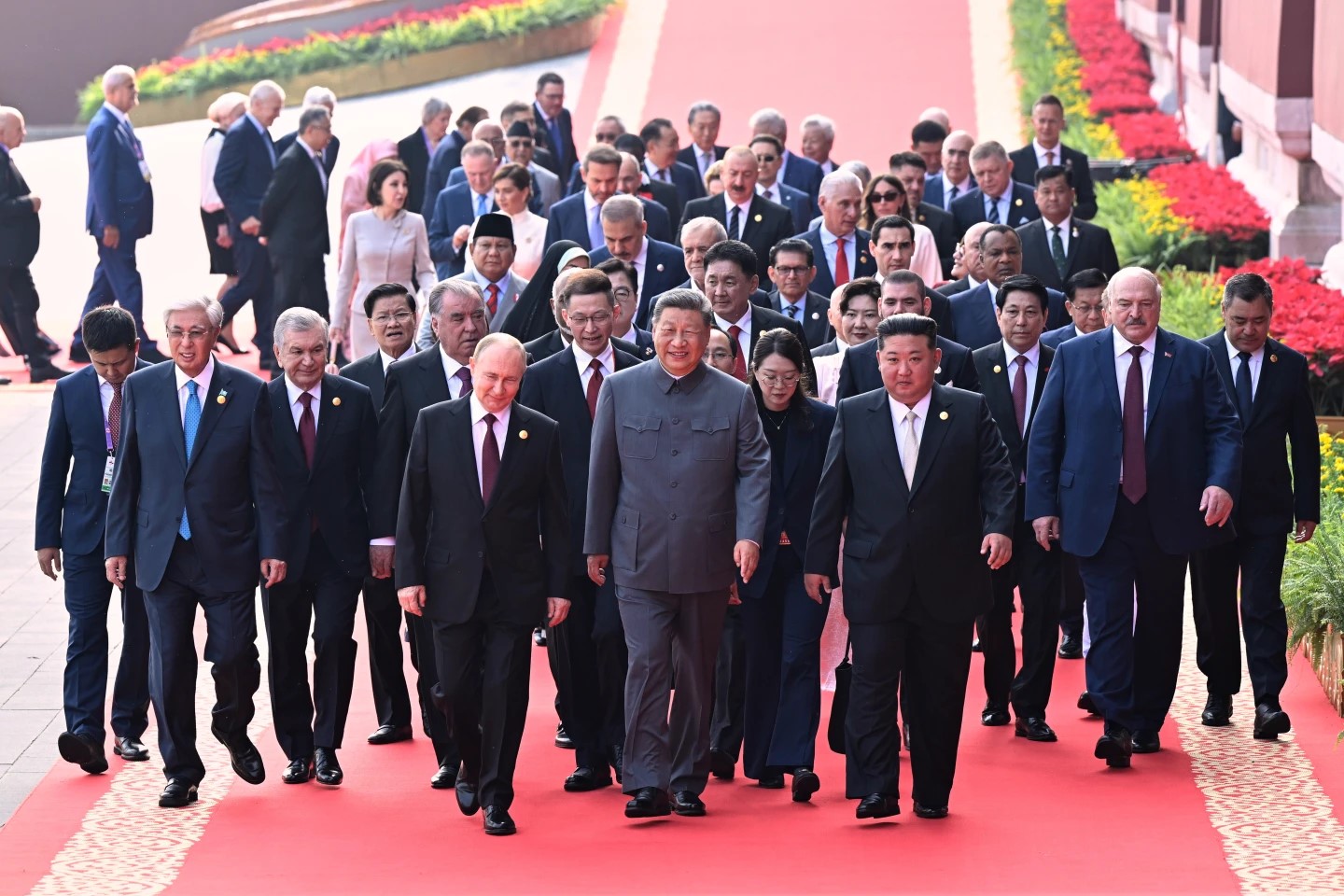

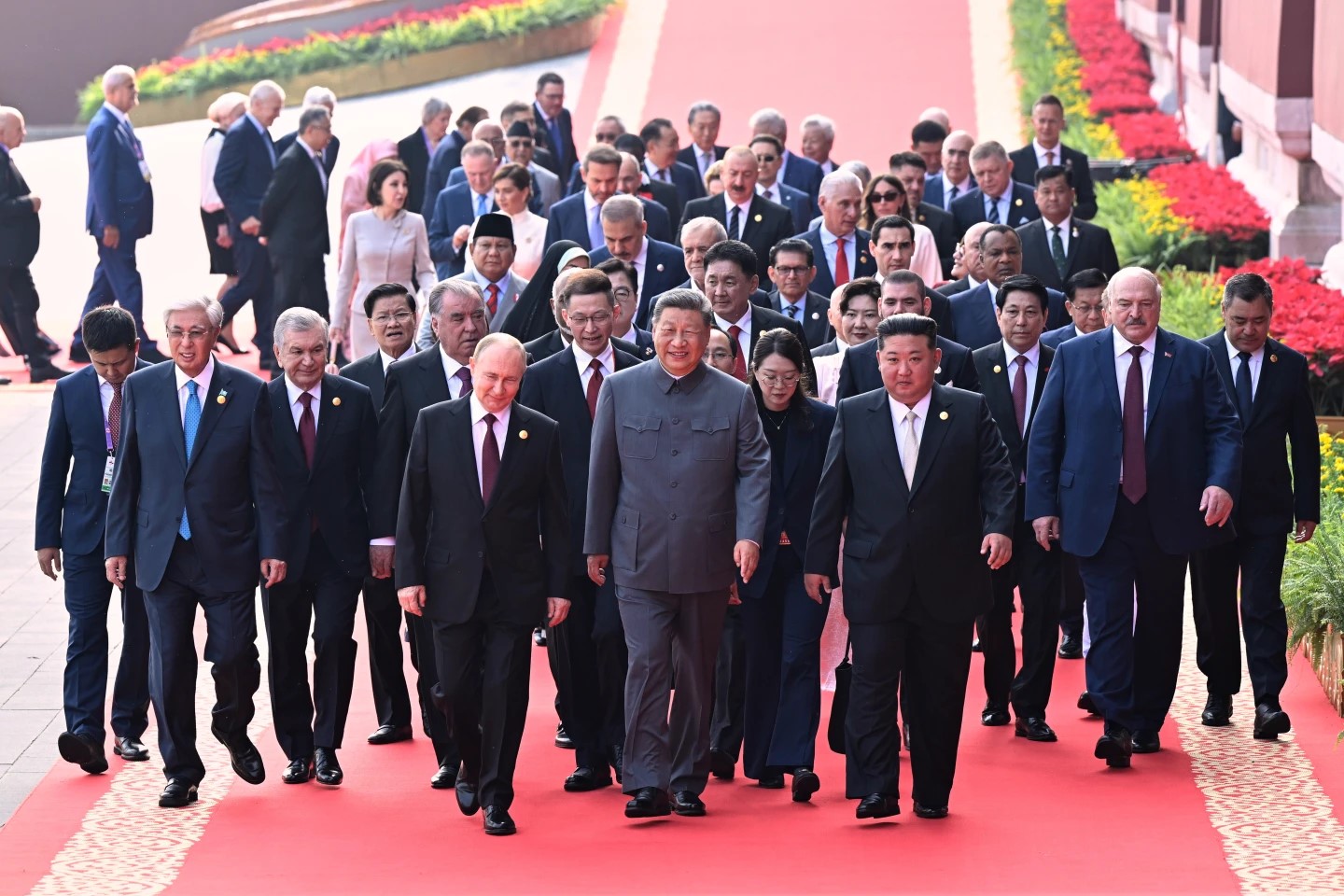

A Summit and Parade in China May Signal a Geopolitical Shift. They Might Also Be Political JockeyingThe leaders of China, North Korea and Russia stood shoulder to shoulder Wednesday as high-tech military hardware and thousands of marching soldiers filled the streets of Beijing.

On the Porch: April News Roundup with Dr. Jim CrawfordThis Week:

Born into a blue collar and agricultural clan in rural Pennsylvania, Jim Crawford was the first in his family to graduate from college. Earning his PhD from UNC, he taught US and World History at several universities in piedmont North Carolina for several decades. He served as chairman of the Chatham County board of commissioners, and currently serves as trustee for Central Carolina Community College. He is a firm believer in American democracy and trusts that the constitution will hold firm now as it has in past crises despite the broken, distempered electorate.

Sweeping Trump Tariffs Draw Dismay and Calls for Talks From Countries Around the GlobeSweeping new tariffs announced by U.S. President Donald Trump provoked dismay, threats of countermeasures and urgent calls around the globe.

On the Porch: A Conversation with Dr. Jim CrawfordThis Week:

Born into a blue collar and agricultural clan in rural Pennsylvania, Jim Crawford was the first in his family to graduate from college. Earning his PhD from UNC, he taught US and World History at several universities in piedmont North Carolina for several decades. He served as chairman of the Chatham County board of commissioners, and currently serves as trustee for Central Carolina Community College. He is a firm believer in American democracy and trusts that the constitution will hold firm now as it has in past crises despite the broken, distempered electorate.

Chapel Hill Businessman and Son Plead Guilty in 2022 Stock Fraud CaseMore than two years after being arrested, a Chapel Hill businessman and his son plead guilty to a market manipulation scheme.

›