Written by GARY D. ROBERTSON

North Carolina’s state government coffers should remain flush with cash at the end of the fiscal year after projections made three months ago by state officials were adjusted only slightly downward Thursday.

Gov. Roy Cooper’s state budget office and General Assembly staff released an updated forecast after the Department of Revenue received key April 15 individual and corporate income tax payments and returns.

The figures play into how Republican legislators in charge of the General Assembly consider spending, saving or cutting taxes while fashioning a new two-year budget over the next several weeks.

The two government branches project the state’s general fund will take in $33.62 billion for the fiscal year ending June 30, which is $136 million less than the total set in the initial consensus forecast from February.

Still, that updated figure equates to overcollections of $3.11 billion, or 10% above the $30.51 billion in revenues that had been anticipated to come in to carry out the current state budget law enacted last summer.

Thursday’s forecast also slightly raised revenue projections for each of the next two fiscal years through June 30, 2025. February’s forecast expected year-over-year revenues during that time period to be essentially flat.

The House passed a budget last month that would spend $29.8 billion during the next fiscal year. That amount is in keeping with spending limits agreed to by House and Senate GOP leaders in March. The Senate is expected to unveil and vote on its budget proposal next week.

The two chambers will then negotiate a final budget measure to present to Gov. Cooper. The Democratic governor’s budget proposal sought to spend nearly $33 billion next year.

April historically has been the most volatile month for tax collections. But this year’s totals were consistent with the February forecast, which anticipated those collections to be below prior-year totals, according to a forecast summary from the Office of State Budget and Management.

Thursday’s slight pullback in projected state revenues this year is predominantly attributed to lower investment income earned on state government’s operating cash and reserves, General Assembly economist Emma Turner told legislative leaders in an email. The upward revision for revenues for the next two fiscal years comes from an improved outlook for sales tax collections and a higher corporate tax base, she added.

Forecast authors said the economic outlook remains unchanged since February, with expectations of a slowdown during the upcoming biennium and the risk of a recession.

The state general fund collected $33.21 billion during the 2021-22 fiscal year. This year’s state budget was enacted based on expectations of significantly lower revenue. But Thursday’s forecast now estimates revenue will be $416 million higher compared to last year, the state budget office said.

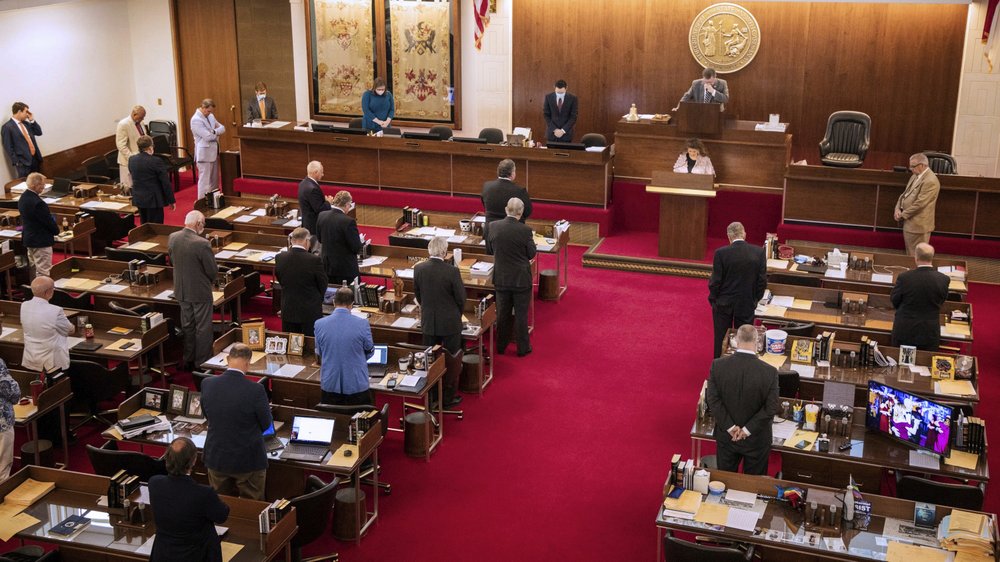

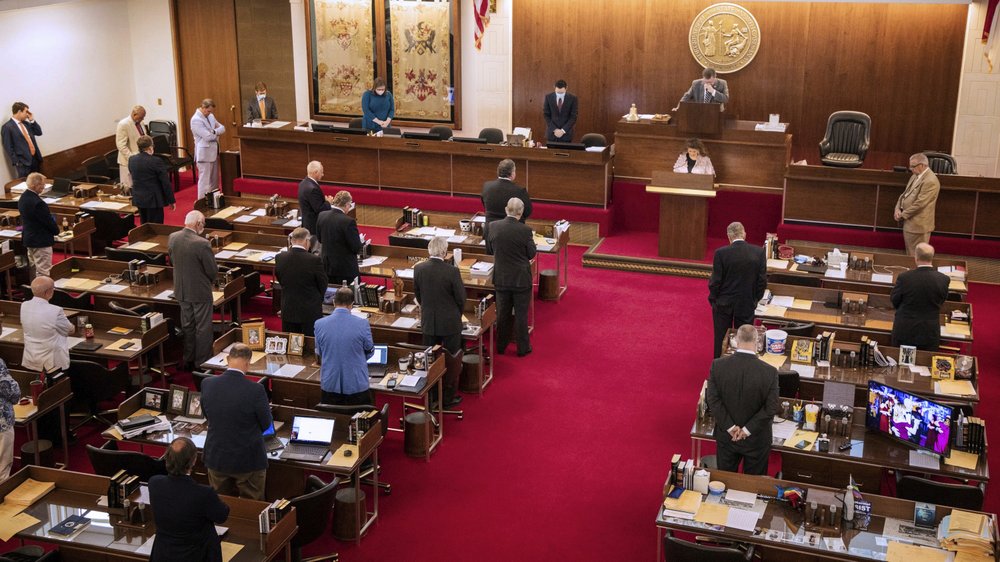

Photo via Mark Stebnicki.

Related Stories

‹

Economists Predict Modest North Carolina Surplus, But Warn More Tax Cuts Will Curb RevenuesNorth Carolina officials project a modest revenue surplus this fiscal year, but warned expected tax cuts mean lower collections are ahead.

North Carolina State Budget Won’t Become Law Until September, House Leader SaysWritten by GARY D. ROBERTSON A final North Carolina state budget won’t be enacted until September, the House’s top leader said Monday. That could scuttle efforts by Gov. Roy Cooper’s administration for Medicaid expansion to begin in early fall. House and Senate Republicans are whittling down dozens of outstanding spending and policy issues within a […]

![]()

Forecast: North Carolina Expects $3B-Plus Surplus This YearWritten by GARY D. ROBERTSON North Carolina state government is on track to see a double-digit percentage increase in revenues by the end of the fiscal year compared to the total that legislators used in fashioning this year’s budget, according to a report released Wednesday. A new revenue forecast agreed upon by General Assembly staff […]

Officials: Expect $4.2B More NC Revenue This Year, $2B NextWritten by GARY D. ROBERTSON North Carolina government tax collections will smash the projections used to help fashion the first year of the current two-year state budget, officials announced Monday as lawmakers return next week to begin figuring out what to do with billions in surplus. Economists at the legislature and Gov. Roy Cooper’s budget […]

N. Carolina Tax Collections Soaring Above Expectations AgainWritten by GARY D. ROBERTSON North Carolina government tax collections have soared above expectations so far this fiscal year, as the state’s pandemic-rebounding economy has pumped consumer spending and edged the jobless rate close to pre-COVID-19 levels. Through Jan. 31, state revenues are already almost $1.4 billion ahead of the total anticipated by the executive […]

Late NC Budget To Take Longer as GOP, Cooper Seek ConsensusWritten by GARY D. ROBERTSON The North Carolina General Assembly is two months late on finalizing a two-year budget, even as the state expects to take in billions of dollars more than it had earlier forecast. Getting the state government’s spending plan enacted depends first on disentangling competing House and Senate proposals. The unexpected billions […]

NC House Budget Spends More on Construction, Pay Than SenateWritten by GARY D. ROBERTSON North Carolina House Republicans would put more money now toward infrastructure projects and pay teachers and state employees more in their two-year budget proposal compared to what the Senate voted for earlier this summer. The House spending plan, the subject of a Monday news conference by GOP leaders, would not go as far on […]

![]()

NC Officials: Gov’t Surplus Became Even Larger Than PlannedNorth Carolina’s tax windfall for the last fiscal year turned out even larger than the bonanza that state government economists predicted would arrive due to the recovering economy. The state ended up collecting $29.7 billion in revenues during the year that ended June 30, according to the Office of State Budget & Management. That’s $190 […]

North Carolina Medicaid Patients Face Care Access Threat as Funding Impasse ContinuesNorth Carolina Medicaid patients face reduced access to services as an legislative impasse over state Medicaid funding extends further.

North Carolina Legislature Passes ‘Iryna’s Law’ After Refugee’s Stabbing DeathIn response to the stabbing death of a Ukrainian refugee on Charlotte’s light rail system, the North Carolina legislature gave final approval Tuesday to a criminal justice package that limits bail and seeks to ensure more defendants undergo mental health evaluations.

›