Written by GARY D. ROBERTSON

North Carolina government tax collections have soared above expectations so far this fiscal year, as the state’s pandemic-rebounding economy has pumped consumer spending and edged the jobless rate close to pre-COVID-19 levels.

Through Jan. 31, state revenues are already almost $1.4 billion ahead of the total anticipated by the executive and legislative branches, the state budget office said Friday.

The revenue surge in state government’s first seven months of the fiscal year is happening in every major tax category, according to a summary provided by the Office of State Budget and Management. Corporate and franchise taxes, along with taxes related to alcoholic beverage and real estate transactions, are among those seeing the highest percentage growth.

The office said Friday that it now estimates overcollections will reach $2.4 billion by June 30, the end of the fiscal year.

The two-year state budget law that Democratic Gov. Roy Cooper signed in November spends $25.9 billion in state dollars this year, but it set aside well over $2 billion above and beyond the latest additional collections that will help cover next year’s budget expenses. And the totals don’t include billions of dollars in federal COVID-19 recovery dollars received.

The budget law, developed largely by Republican lawmakers, included individual income tax reductions that began Jan. 1. Those changes are reflected in the numbers released Friday.

If the projections hold to form, the surplus will mean the Republican-controlled legislature and Cooper will again have more with which to compete on as it relates to priorities for the excess money when budget adjustments are made later this year. That could include more spending, further tax cuts, or both.

The state unemployment rate for December was 3.7%, the lowest since Feb. 2020. More than 138,000 additional people were working as of December compared with 12 months earlier, according to state employment data.

“Our decisive actions and resilient communities have helped us manage the pandemic and power a booming economy across North Carolina,” Cooper said in an emailed statement. “We need to make more investments in our workforce, education and health care that will strengthen our communities and economy for all North Carolinians.”

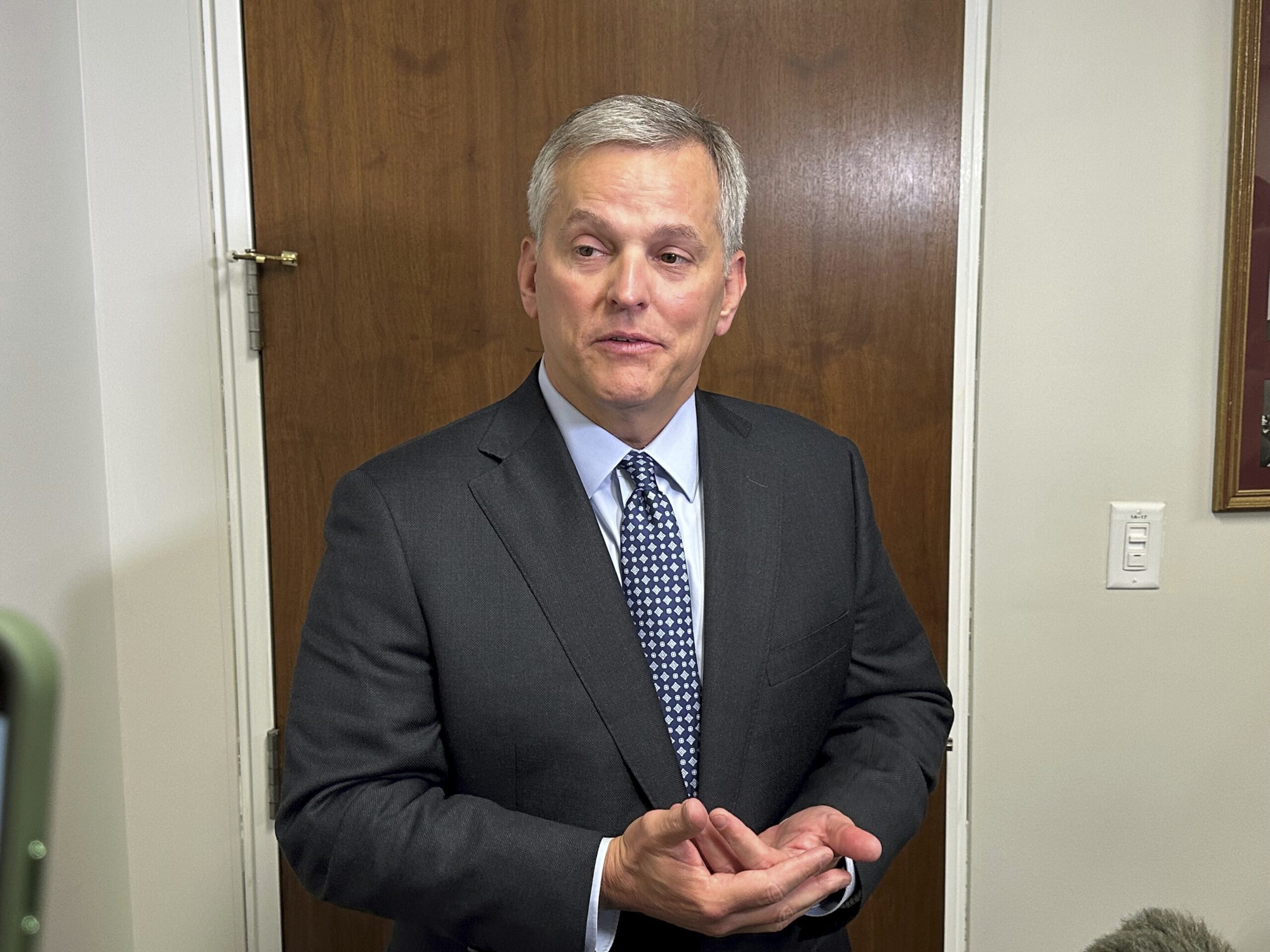

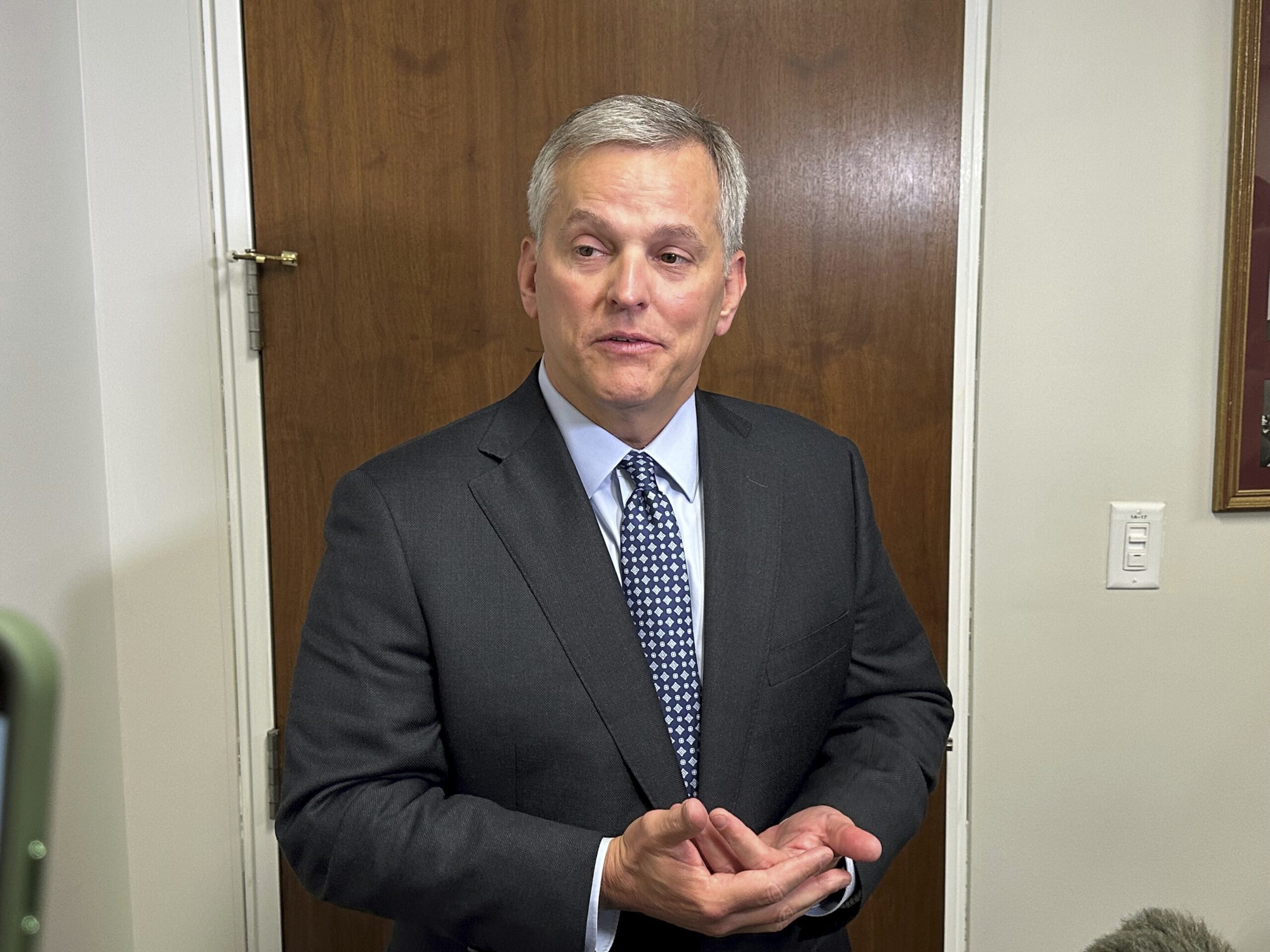

The Office of State Budget and Management and the legislature’s Fiscal Research Division agreed with the year-to-date numbers, state budget director Charlie Perusse said. His office said individual income tax revenues were $766 million above projected figures through January, while sales and use tax collections are $330 million above expectations.

Corporate income and franchise tax collections were 23% higher than expected, while alcoholic beverage taxes were up 20% and real estate taxes up 52%, the budget office said.

The projected $2.4 billion in overcollections remains well below the additional $6.2 billion that the state’s coffers took in during the fiscal year that ended last June 30. But Perusse noted that the previous year’s surplus was supersized in part because of a conservative forecast following shortfalls in the first months of the pandemic in spring 2020.

January’s tax collections create a stronger barometer of the state’s fiscal picture because it includes December holiday sales tax collections and individual and corporate tax payments for the three months ending Dec. 31, according to Perusse.

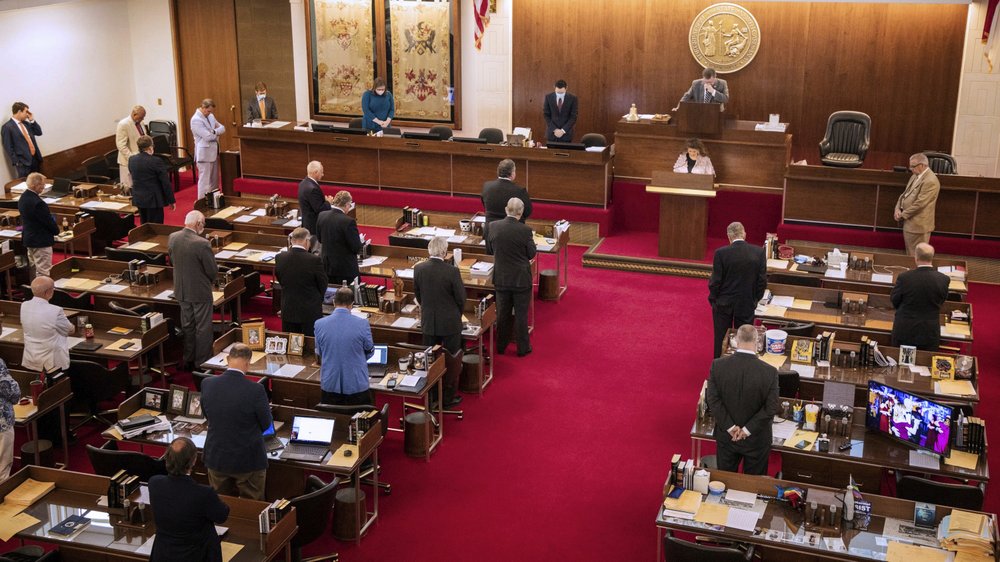

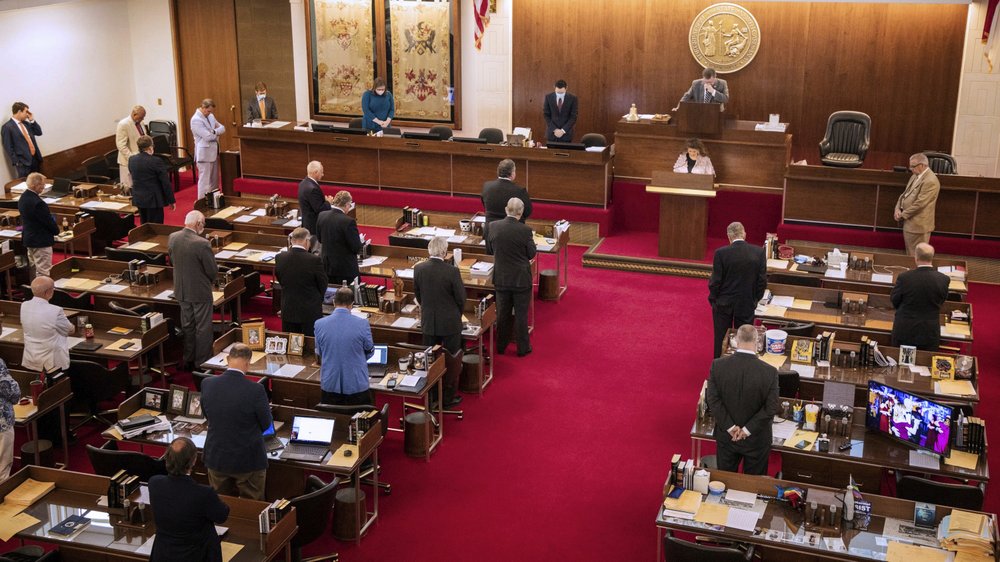

Photo via the North Carolina Department of Public Safety.

Related Stories

‹

North Carolina State Budget Won’t Become Law Until September, House Leader SaysWritten by GARY D. ROBERTSON A final North Carolina state budget won’t be enacted until September, the House’s top leader said Monday. That could scuttle efforts by Gov. Roy Cooper’s administration for Medicaid expansion to begin in early fall. House and Senate Republicans are whittling down dozens of outstanding spending and policy issues within a […]

North Carolina Coffers To Remain Flush Even With Updated Forecast That’s Slightly DownwardWritten by GARY D. ROBERTSON North Carolina’s state government coffers should remain flush with cash at the end of the fiscal year after projections made three months ago by state officials were adjusted only slightly downward Thursday. Gov. Roy Cooper’s state budget office and General Assembly staff released an updated forecast after the Department of […]

![]()

Forecast: North Carolina Expects $3B-Plus Surplus This YearWritten by GARY D. ROBERTSON North Carolina state government is on track to see a double-digit percentage increase in revenues by the end of the fiscal year compared to the total that legislators used in fashioning this year’s budget, according to a report released Wednesday. A new revenue forecast agreed upon by General Assembly staff […]

Officials: Expect $4.2B More NC Revenue This Year, $2B NextWritten by GARY D. ROBERTSON North Carolina government tax collections will smash the projections used to help fashion the first year of the current two-year state budget, officials announced Monday as lawmakers return next week to begin figuring out what to do with billions in surplus. Economists at the legislature and Gov. Roy Cooper’s budget […]

Late NC Budget To Take Longer as GOP, Cooper Seek ConsensusWritten by GARY D. ROBERTSON The North Carolina General Assembly is two months late on finalizing a two-year budget, even as the state expects to take in billions of dollars more than it had earlier forecast. Getting the state government’s spending plan enacted depends first on disentangling competing House and Senate proposals. The unexpected billions […]

NC House Budget Spends More on Construction, Pay Than SenateWritten by GARY D. ROBERTSON North Carolina House Republicans would put more money now toward infrastructure projects and pay teachers and state employees more in their two-year budget proposal compared to what the Senate voted for earlier this summer. The House spending plan, the subject of a Monday news conference by GOP leaders, would not go as far on […]

![]()

NC Officials: Gov’t Surplus Became Even Larger Than PlannedNorth Carolina’s tax windfall for the last fiscal year turned out even larger than the bonanza that state government economists predicted would arrive due to the recovering economy. The state ended up collecting $29.7 billion in revenues during the year that ended June 30, according to the Office of State Budget & Management. That’s $190 […]

North Carolina Medicaid Patients Face Care Access Threat as Funding Impasse ContinuesNorth Carolina Medicaid patients face reduced access to services as an legislative impasse over state Medicaid funding extends further.

North Carolina Legislature Passes ‘Iryna’s Law’ After Refugee’s Stabbing DeathIn response to the stabbing death of a Ukrainian refugee on Charlotte’s light rail system, the North Carolina legislature gave final approval Tuesday to a criminal justice package that limits bail and seeks to ensure more defendants undergo mental health evaluations.

North Carolina Gov. Stein Signs Stopgap Budget Bill and Vetoes Opt-in Bill Helping School ChoiceWritten by GARY D. ROBERTSON RALEIGH, N.C. (AP) — North Carolina Gov. Josh Stein signed into law on Wednesday a stopgap spending measure while lawmakers remain in a state budget impasse. But he vetoed legislation that would direct state participation in a yet-implemented federal tax credit program to boost school-choice options, suggesting state Republicans acted hastily. The […]

›