Written by GARY D. ROBERTSON

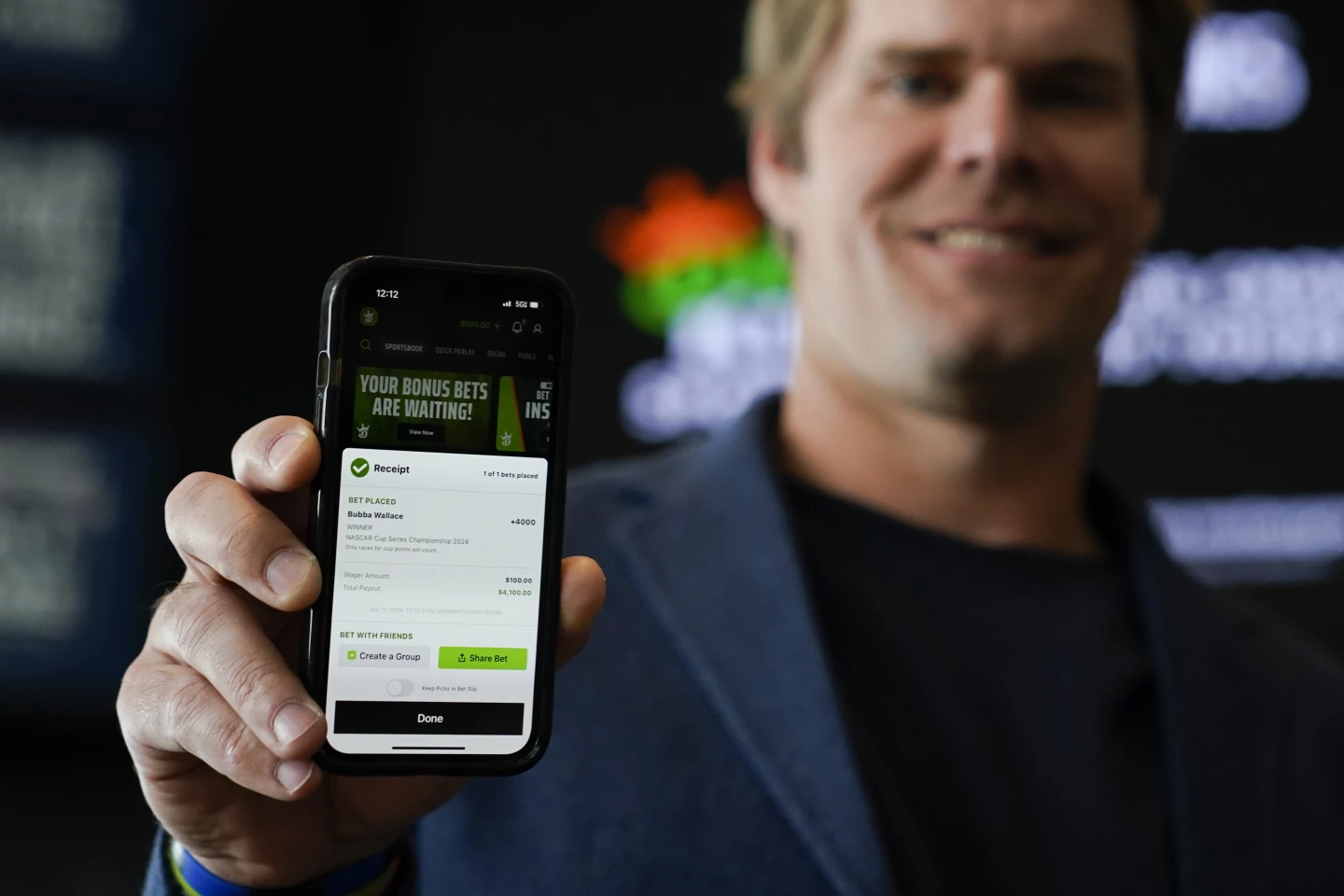

RALEIGH, N.C. (AP) — North Carolina government cashed in early when it came to reaping fiscal benefits from authorized sports wagering in the ninth-largest state.

A report presented Wednesday to the North Carolina State Lottery Commission, which regulates the betting, says the state expects to have collected $131.3 million in taxes from sports betting operations for the first full year of operations through March 10.

That amount goes well beyond estimates of state legislative researchers as the bill worked its way through the General Assembly that enacted it in 2023. They had projected tax revenues could reach $100 million annually within five years. The calculation is based on the law’s 18% rate upon gross wagering revenue, which is essentially betting revenue minus paid winnings.

On March 11, 2024, licensed operators began taking bets on smartphones and computers under the 2023 state law permitting and regulating such gambling. At the time, North Carolina became the 30th state to offer mobile sports better, along with the District of Columbia.

The windfall is connected to big betting. For the first full year of North Carolina operations, over $6.8 billion in bets were made, resulting in $729.3 million in gross wagering revenue for the eight licensees, according to the commission report.

“It was a very successful year in my opinion,” Sterl Carpenter, the lottery’s chief business development officer who helped get sports wagering off the ground, told the commission. “Things went extremely well.”

“I would say that we are very encouraged by the results,” commissioner Cari Boyce said.

With a population of 11 million, North Carolina had been considered an attractive market for interactive wagering companies seeking to open. Before the law was implemented, sports gambling was legal in North Carolina only at three casinos operated by two American Indian tribes.

Under the law, registered customers within the state’s borders can bet on professional, college or Olympic-style sports. The law allows for future in-person wagering through sportsbooks beyond those already located at the tribal casinos.

Close to $500 million in the sports wagering revenues during the past year were considered “promotional wagers” — incentives for new customers offered by the companies once an initial bet is made. With those amounts removed, the complete months with the highest betting totals were November, December and January — a period that features college and professional football playoffs, as well as college basketball and pro hockey and hoops.

The tax revenues collected partly go to athletic departments at most University of North Carolina system schools, amateur sports initiatives and gambling addiction education and treatment.

Featured photo AP Photo/Erik Verduzco.