By Zachary Horner, Chatham News + Record Staff

The Chatham County Board of Commissioners has instructed county staff to put together a fiscal year 2020-2021 budget with no property tax increase.

The board made the vote last week during its mid-year budget retreat. In the midst of discussions on requests from county departments and commissioner goals, County Manager Dan LaMontagne said the staff was already working off that assumption, but the vote confirmed it.

LaMontagne added that the county did not “have any specific thing” that would make it believe a tax rate increase was necessary.

“That doesn’t change the fact that if something changes between now and the approval of the budget, we can come back to the board and say, ‘Oh my goodness, this happened,’” he said. “It means we’re going to work towards that goal to bring you a recommended budget that meets that.”

The county government increased the property tax rate by 4.19 cents to 67 cents per $100 in last year’s budget, meaning that taxes on property worth $100,000 would be $670. That was the 10th change in the county’s tax rate in 20 years and seventh change in the last 12 years. The last two times the rate decreased came in years of property revaluations, 2010 and 2018. The county’s next property revaluation takes effect next year.

At last week’s meetings, budget analyst Darrell Butts told the commissioners that the county was expecting two percent growth in overall revenue, but that the county was going to be taking on at least one major additional expense — $1.4 million in operating costs for the new Chatham Grove Elementary School. In last year’s budget, one cent of the property tax rate accounted for $1,140,623 in revenue. Final numbers are not available yet, but a two percent increase in revenue would cover those expenses and still have more than $1 million left over without a tax rate increase. That math is not a final and official accounting, but a projection taking last year’s General Fund budget into account.

Board Chairman Karen Howard and last year’s chairman, Mike Dasher — both of whom are up for re-election this year — stressed their desire for no tax rate increase.

“I say that without knowing how tight that means the belt is going to be,” Howard said. “But I do think that, as a citizen, it would be hard to swallow these hits.”

LaMontagne said there were still some budget requests coming in, particularly from Chatham County Schools. The school district did not finalize its budget until a March vote by the Chatham County Board of Education.

“We’ll see if they come back with a request,” LaMontagne said. “There’s plenty of time to look at their budget still.”

LaMontagne did not present a completed budget draft to the commissioners until May last year, so if the pattern holds, there are still four months reamining until the plan is put together for the board’s consideration and public comment. But as of now, it looks as though the property tax rate will remain the same.

“If we can’t, then we’ll tell you we can’t, or we’re sacrificing x, y or z if we do not do a tax increase,” the county manager said. “Right now, we do not foresee that.”

Chapelboro.com has partnered with the Chatham News + Record in order to bring more Chatham-focused stories to our audience.

TheChatham News + Record is Chatham County’s source for local news and journalism. The Chatham News, established in 1924, and the Chatham Record, founded in 1878, have come together to better serve the Chatham community as the Chatham News + Record. Covering news, business, sports and more, the News + Record is working to strengthen community ties through compelling coverage of life in Chatham County.

Related Stories

‹

Local Historian: Chatham County Was a Big Player in America’s IndependenceBy Bob Wachs, Chatham News + Record Staff The Fourth of July holiday has come and gone on the calendar but memories — of long ago and present day — are still with us. And, says one local historian, had it not been for a turn of events, Chatham County could have played an even bigger […]

Daughters of the Confederacy File Notice to Appeal Removal of MonumentBy Casey Mann, Chatham News + Record Staff The Winnie Davis Chapter #259 of the United Daughters of the Confederacy have filed a notice to appeal the Dec. 4 dismissal of the case it filed against the Chatham County Board of Commissioners, Chatham for All and the West Chatham Branch 5378 of the NAACP in […]

Pittsboro’s Town Hall Project Moves ForwardBy Casey Mann, Chatham News + Record Staff Pittsboro’s proposed $18 million town hall project received the green light to move into the “construction document” phase Monday night from the Pittsboro Board of Commissioners. The board approved the initial designs, budget and proposed timeline presented by Hobbs Architects of Pittsboro, the firm hired to design […]

Jordan Lake Bald Eagle Count Set for January 12By David Bradley, Chatham News + Record Staff Bald eagle populations are soaring across the United States — but four times a year, the New Hope National Audubon Society works with the North Carolina Parks Service to count the local numbers at Jordan Lake. The next count is Sunday, January 12. Eagles, whose main diet […]

![]()

A Big Year for Development in Chatham CountyBy Zachary Horner, Chatham News + Record Staff In his annual budget message from last May, Chatham County Manager Dan LaMontagne wrote that fiscal 2018-2019 was a bit of a downer when it came to development. “Chatham County tax values continue to grow, but we are experiencing slower growth from development services, due in large […]

Pittsboro Businesses Push Forward to End 2019By Zachary Horner, Chatham News + Record Staff This past Monday was a fairly normal one for downtown Pittsboro. Along with the normal hustle and bustle of any weekday, there were two individuals sitting in front of the Chatham County Historic Courthouse in the traffic circle holding Confederate flags. Whereas most cities and towns might […]

Organization Shines Spotlight on Chatham’s Grand TreesBy Randall Rigsbee, Chatham News + Record Staff There was nothing noteworthy, as far as Judy Lessler could tell, about the old redbud tree growing near her home on her farm outside of Pittsboro. A big tree, it’s true, and with some age on it, the redbud had been on the property as long as Lessler […]

Chatham County Hemp Farmers in the CrosshairsBy Casey Mann, Chatham News + Record Staff Chatham N+R editor’s note: Four years after North Carolina legalized the production and sale of industrial hemp, actions by legislators in the N.C. House Agriculture Committee may strike a blow to one of the state’s fastest-growing industries. The uncertainty has local hemp farmers, and others in […]

Pittsboro Revisits Two Additional Elements, Passes OneBy Casey Mann, Chatham News + Record Staff The Pittsboro Board of Commissioners revisited two different Chatham Park Additional Elements at its meeting on Monday — the Tree Protection Element and the Open Space Element. As part of the Chatham Park Planned Development District Master Plan passed in 2015, the town and Chatham Park agreed […]

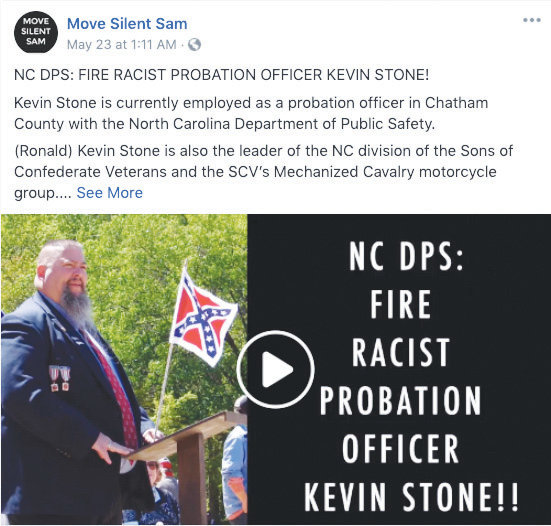

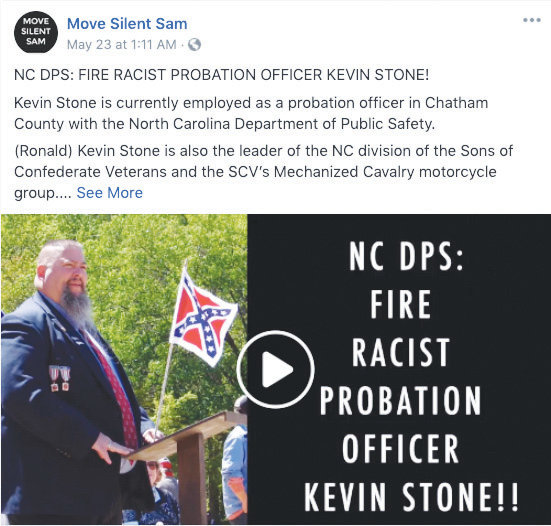

Chatham Probation Officer Reacts to Recent News Reports, Claims of BiasBy Zachary Horner, Chatham News + Record Staff Kevin Stone said he knew the news reports were coming. So he prepared his family and friends “as best I could,” he said. Stone, a Chatham County probation officer and owner of a country store in Moncure, was recently the focus of two news reports on Raleigh […]

›

![]()