Written by THE ASSOCIATED PRESS

Efforts to exempt North Carolina residents from state income tax on the value of student loan forgiveness announced last month by President Joe Biden likely will be unsuccessful given that the state Senate’s most influential member opposes them.

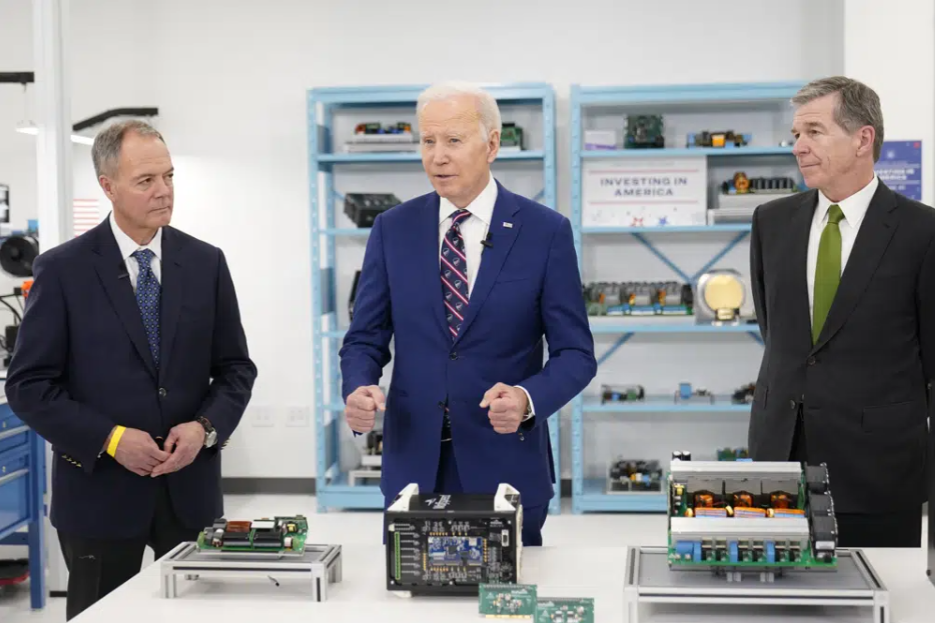

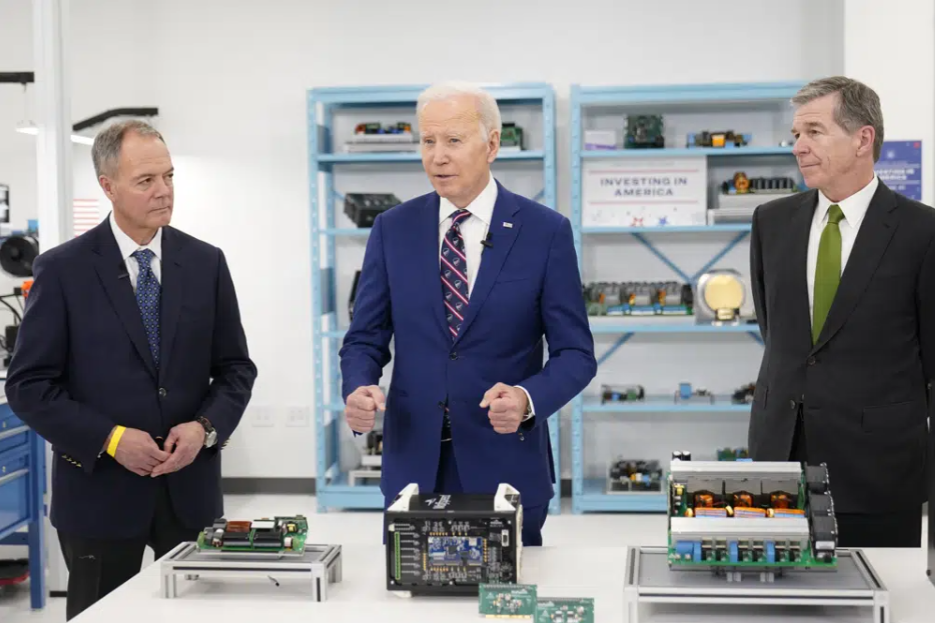

Democratic Gov. Roy Cooper asked legislators last week to change state law to correct what he called an “fundamental unfairness for many hardworking people who will get hit hard” through an income tax payment.

But Senate leader Phil Berger told reporters on Tuesday that he didn’t see a need to take any action. He said such an exemption would be unfair when compared to people who must pay income tax on the monetary value of credit card debt and mortgage loan reductions. And Berger also questioned whether Biden had a basis in federal law to declare the forgiveness.

The White House has said the value of that forgiveness — up to $10,000 for some and to $20,000 for others — is exempt from federal income tax. North Carolina appears to be one of half-dozen states where amounts would be subject to state tax without a change.

Cooper compared the legislature’s decision last year to exempt loans from the Paycheck Protection Program during the pandemic for businesses from state income tax to the student loan forgiveness. But Berger, a Rockingham County Republican, called PPP a “completely different situation.”

“The PPP loans were taken out as a result of the federal government and state government shutting down the economy. And those loans were provided for by federal law … passed by Congress,” Berger said. The student loans, he added, “were not taken out in any kind of emergency situation.”

The White House said on Tuesday that an estimated 1.19 million people in North Carolina would be eligible for student debt relief under the Biden administration plan. It’s unclear exactly how much state income tax revenue would be collected. North Carolina’s individual income tax rate of 4.99% falls to 4.75% in 2023.

Photo via AP Photo/Bryan Anderson.

Related Stories

‹

NC Governor Wants Loan Forgiveness Exempt from State TaxWritten by THE ASSOCIATED PRESS North Carolina Gov. Roy Cooper wants the General Assembly to pass legislation exempting individuals from state income tax on the student loan forgiveness announced by President Joe Biden last month. The White House has said the value of that forgiveness — up to $20,000 for some — is exempt from […]

North Carolina Adopts New Trump-Backed US House Districts Aimed at Gaining a Republican SeatWritten by GARY D. ROBERTSON RALEIGH, N.C. (AP) — North Carolina Republican legislative leaders completed their remapping of the state’s U.S. House districts on Wednesday, intent on picking up one more seat to help President Donald Trump’s efforts to retain GOP control of Congress in next year’s midterm elections. The new boundaries approved by the […]

North Carolina GOP Announce Plans to Vote on New House Map Amid Nationwide Redistricting BattleNorth Carolina Republican legislative leaders announced plans to vote on redrawing the state's U.S. House district map for 2026 elections.

Trump’s Words of Opposition Stop a Bipartisan Budget Deal in Its Tracks With Musk’s HelpPresident-elect Donald Trump delivered a likely death blow to bipartisan congressional budget negotiations, rejecting the measure as full of giveaways to Democrats.

Biden: GOP Policies Would Surrender Tech Economy to ChinaWritten by AAMER MADHANI President Joe Biden said Tuesday that Republicans’ ideas for cutting the budget could undermine U.S. manufacturing and help China dominate the world economy. Speaking at a semiconductor maker in North Carolina to highlight his own policies, Biden is trying to shape public sentiment as he faces off with House Speaker Kevin […]

Supreme Court Weighs Biden Student Loan Plan Worth BillionsWritten by MARK SHERMAN The Supreme Court is taking up a partisan legal fight over President Joe Biden’s plan to wipe away or reduce student loans held by millions of Americans. The high court, with its 6-3 conservative majority, is hearing arguments on Tuesday in two challenges to the plan, which has so far been blocked by Republican-appointed judges on lower courts. […]

NC Democrats’ Parity in Congress Delegation May Be FleetingWritten by GARY D. ROBERTSON and HANNAH SCHOENBAUM Democrats celebrated winning what was billed as North Carolina’s lone toss-up race for the U.S. House this month, as state Sen. Wiley Nickel’s narrow victory over Republican Bo Hines in the 13th Congressional District helped weaken any national GOP midterm wave. Nickel’s win creates a 7-7 split in the […]

Student Loan Forgiveness: Here’s How to ApplyWritten by THE ASSOCIATED PRESS President Joe Biden on Monday officially kicked off the application process for his student debt cancellation program, opening the door for millions of Americans to apply for up to $20,000 in forgiveness. The Biden administration touts it as a simple, straightforward application that should only take about five minutes. Here’s how to […]

Big Student Loan Forgiveness Plan Announced by BidenWritten by SEUNG MIN KIM, CHRIS MEGERIAN, COLLIN BINKLEY and ZEKE MILLER President Joe Biden on Wednesday announced his long-awaited plan to deliver on a campaign promise to provide $10,000 in student debt cancellation for millions of Americans — and up to $10,000 more for those with the greatest financial need — along with new measures to […]

NC Senate Tax Cut Plan Includes Virus Aid for BusinessesWritten by GARY D. ROBERTSON A broad tax cut proposal from North Carolina Senate Republicans that began its advance in the chamber on Tuesday also contains federal COVID-19 relief money to give more aid to businesses that previously received federal or state pandemic assistance. GOP finance leaders unveiled an amended version of its tax plan, some of which […]

›