While the appeal period for 2021 property valuations has ended for most Orange County residents, property owners in the Northside Neighborhood and surrounding areas still have the chance to appeal following an unplanned, comprehensive review.

North Carolina counties are required to revalue properties regularly to ensure a fair and equitable distribution of the property tax burden. The Orange County Tax Office completed its 2021 revaluation and mailed notice of new values to all property owners in late March.

Since then, the county has received 2,067 appeals – requesting The Board of Equalization and Review to reassess the determined property value. 196 of those appeals are from the Northside Neighborhood Conservation District.

According to the Marian Cheek Jackson Center, long-term, Black-owned Northside properties are drastically overvalued in comparison to investor-owned rentals and other nearby properties in mostly white, affluent neighborhoods.

The center said, on average, Black residents in local historic neighborhoods saw a 53 percent rise in taxes this year and an overvaluation of roughly $107,000 each.

Following initial reevaluations being sent out to Northside neighbors in March, the Orange County Tax Office began conducting reviews and field visits – for the 196 properties that appealed – from May to July.

Nancy Freeman, the tax administrator for Orange County, said these visits highlighted various discrepancies in how some properties were valued as compared to their neighbors.

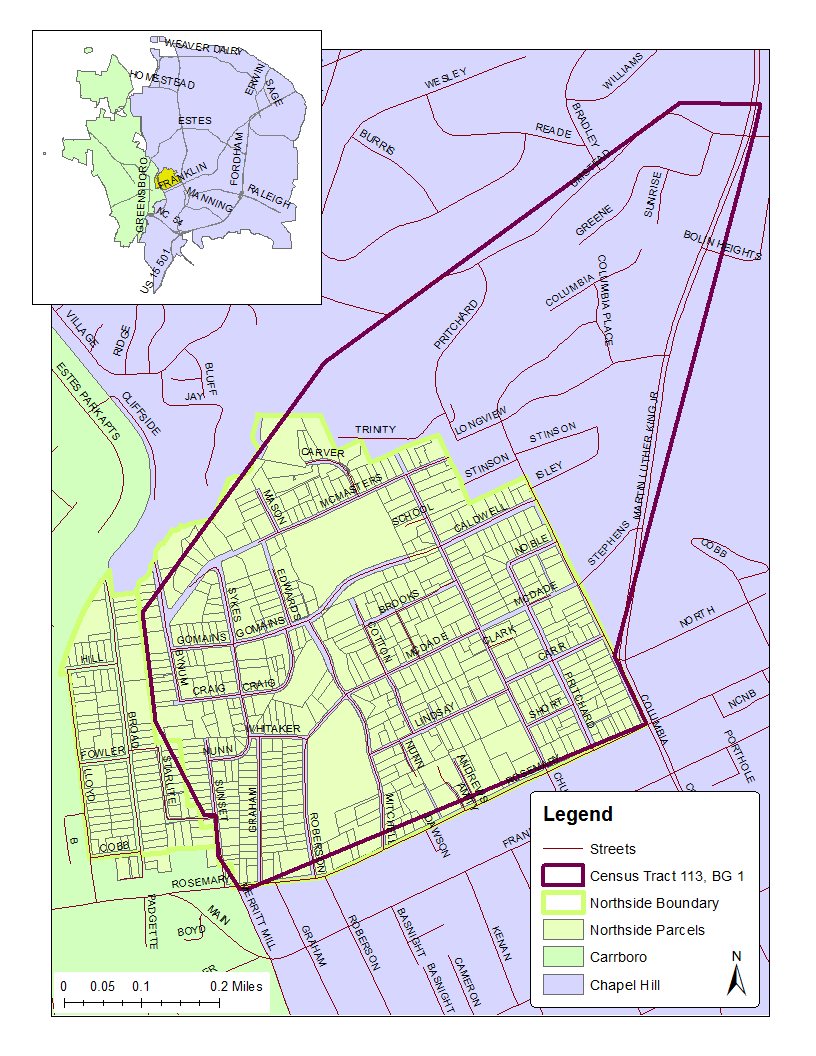

“After the revaluation notices were mailed, the tax office was made aware of inconsistencies in the value of properties within neighborhoods 7102, 7104 and 7110, which includes Chapel Hill’s Northside Neighborhood Conservation District,” said Freeman. “It also includes Carrboro’s Lloyd-Broad Neighborhood preservation district.”

Map of Northside Neighborhood (Photo via Town of Chapel Hill)

To address these inconsistencies, the tax office chose to expand its review of these historic neighborhoods – taking the time to re-evaluate each property even if the owner hadn’t submitted an appeal application.

Freeman said there was a total of 665 properties reviewed in those three affected neighborhoods.

“Of the 347 smaller, conforming properties, the value on 342 of those were lowered,” said Freeman. “Of the 197 larger, legally non-conforming properties, 103 of those increased – their value was increased.”

Property owners in those neighborhoods, including Northside residents, should have received new value notices sent either August 26 or September 7.

Because of the larger-scale review process, the deadline for those residents to further appeal their case to the North Carolina Property Tax Commission has been extended to September 25 and October 7 respectively – up to 30 days after the decision notice was sent out.

The importance of a thorough property valuation process was made more apparent through an additional review done on the East 54 Condominiums in Chapel Hill. According to the tax office, out of those 93 properties, 72 decreased in value, 19 increased in value and 1 no change. On average, that’s a $31,000 reduction.

Freeman said community collaboration and cooperation is critical to help the tax office conduct fair and equitable reevaluations – whether that’s allowing staff members onsite for field visits or raising concerns to local elected officials.

“The continuing work with the community, and being able to get information from the community,” said Freeman, “is very important for us to do accurate work and to avoid having situations like this where we have these disparities.”

On October 5, the Orange County Board of Commissioners plans to look at how to alleviate the burden of Northside Neighbors and address the bigger issue of inequity in the community.

Chapelboro.com does not charge subscription fees. You can support local journalism and our mission to serve the community. Contribute today – every single dollar matters.