In its boldest effort to protect the U.S. economy from the coronavirus, the Federal Reserve says it will buy as much government debt as it deems necessary and will also begin lending to small and large businesses and local governments to help them weather the crisis.

The Fed’s announcement Monday removes any dollar limits from its plans to support the flow of credit through an economy that has been ravaged by the viral outbreak. The central bank’s all-out effort has now gone beyond even the extraordinary drive it made to rescue the economy from the 2008 financial crisis.

“The coronavirus pandemic is causing tremendous hardship across the United States and around the world,” the Fed said in a statement. “Our nation’s first priority is to care for those afflicted and to limit the further spread of the virus. While great uncertainty remains, it has become clear that our economy will face severe disruptions. Aggressive efforts must be taken across the public and private sectors to limit the losses to jobs and incomes and to promote a swift recovery once the disruptions abate.”

Financial markets sharply reversed themselves after the announcement. Dow Jones futures swung more than 1,000 points from about 500 down to a rise of roughly 500. The yield on the 10-year Treasury bond also fell, a sign that more investors are willing to purchase the securities.

In its announcement, the Fed said it will establish three new lending facilities that will provide up to $300 billion by purchasing corporate bonds, a wider range of municipal bonds and securities tied to such debt as auto and real estate loans. It will also buy an unlimited amount of Treasury bonds and mortgage-backed securities to try to hold down borrowing rates and ensure those markets function smoothly.

The Fed’s new go-for-broke approach is an acknowledgment that its previous plans to keep credit flowing smoothly, which included dollar limits, wouldn’t be enough in the face of the viral outbreak, which has brought the U.S. economy to a near-standstill as workers and consumers stay home. Last week, it said it would buy $500 billion of Treasuries and $200 billion of mortgage-backed securities, then quickly ran through roughly half those amounts by the end of the week.

And on Monday, the New York Federal Reserve said it would purchase $75 billion of Treasuries and $50 billion of mortgage-backed securities each day this week.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, said it is clear that the Fed is now doing “whatever it takes.”

“This is an all-out effort to ensure that the business sector can continue to exist even as economic activity temporarily collapses,” Shepherdson said.

Related Stories

‹

5 Things We Know and Still Don’t Know About COVID, 5 Years After It AppearedCOVID-19 is less deadly than it was in the pandemic’s early days. But the virus is evolving, meaning scientists must track it closely.

Tracking the Number of Coronavirus Cases in North Carolina

COVID-19 Cluster Reported at UNC's Avery Residence HallUNC has identified a cluster of COVID-19 cases at Avery Residence Hall on campus. This is the second COVID-19 cluster identified at UNC in 2021 and the first since the spring semester began on January 19. Earlier this month, a cluster was identified at Carmichael Residence Hall between students who lived on campus during winter […]

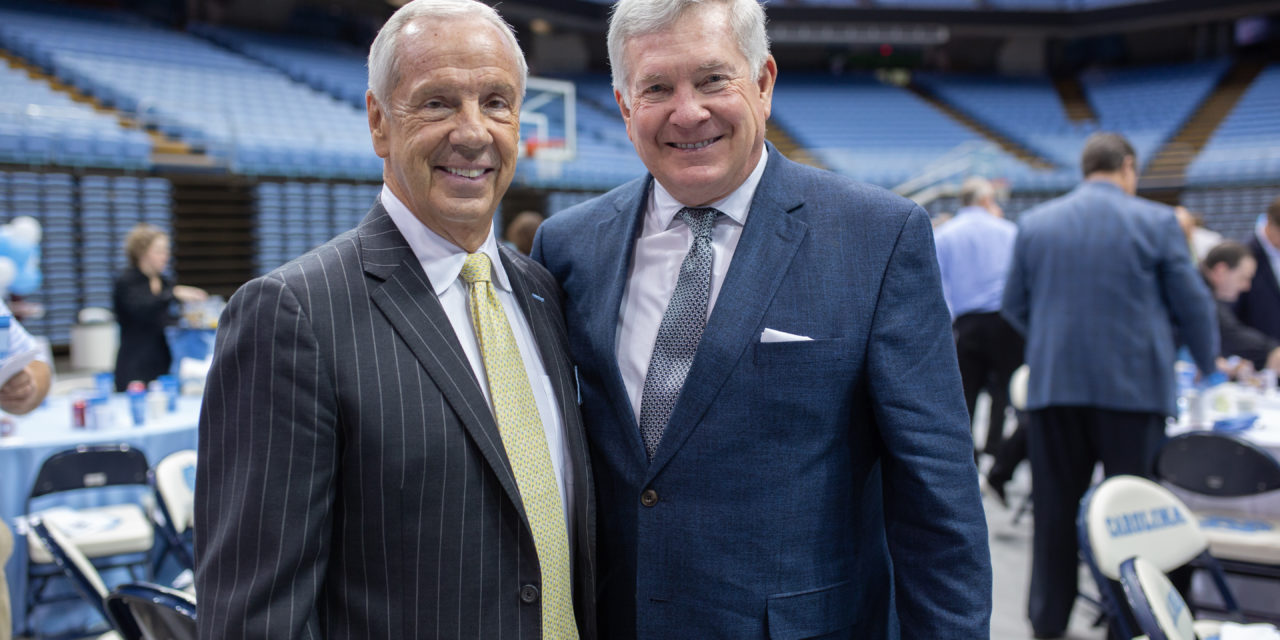

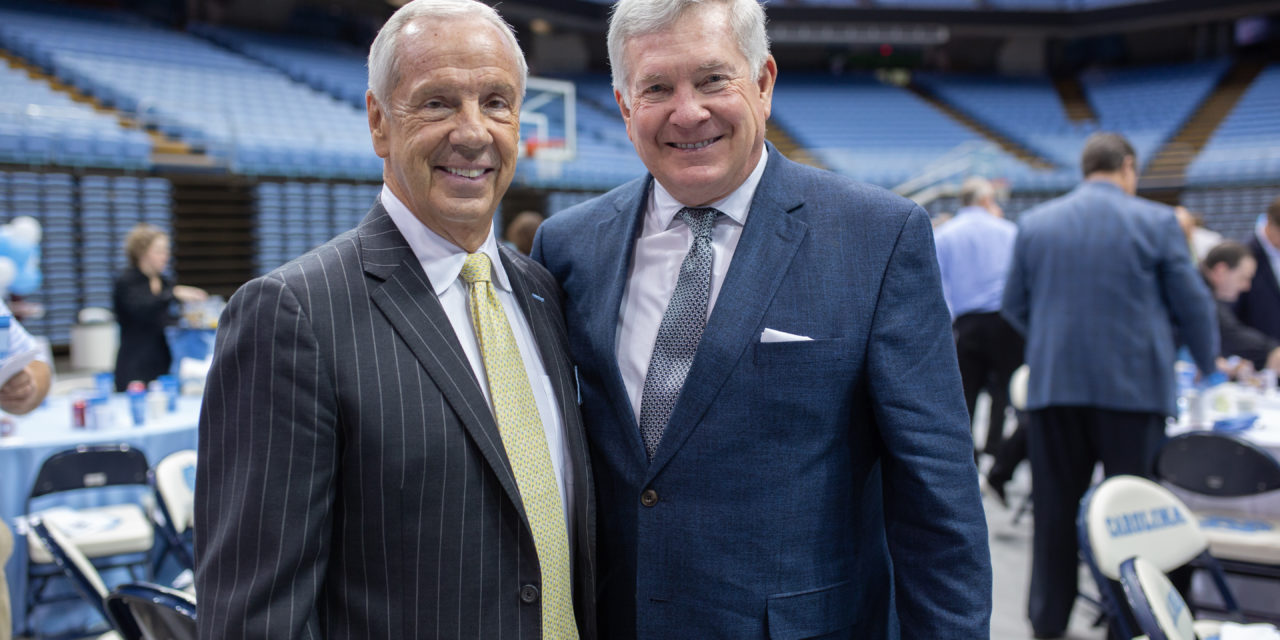

Mack Brown, Roy Williams Receive First Doses of the COVID-19 VaccineUNC coaches Mack Brown and Roy Williams have received their first dose of the COVID-19 vaccine, the university confirmed on Friday. “I think that everyone who has the opportunity to take the vaccination should,” Williams said in a Zoom call with reporters. Brown, 69, and Williams, 70, are eligible to receive the vaccine thanks to […]

North Carolina Shatters Single-Day Record With 10,000 New COVID-19 CasesNorth Carolina reported 10,398 new coronavirus cases on Thursday, shattering the single-day record for new cases as the state continues to see a significant spread of the virus. North Carolina’s Department of Health and Human Services reports a total of 592,746 coronavirus cases since the beginning of the pandemic. In addition, the state reported 137 […]

NC Introduces COVID-19 County Alert System Amid Record HospitalizationsGovernor Cooper announced that North Carolina is introducing a county alert system to identify counties with the highest levels of COVID-19 community spread.

New Weekday COVID-19 Testing Available in Chapel HillA new no-cost COVID-19 testing option will now be available for Chapel Hill and Orange County residents. The Orange County Health Department announced that a new testing site will be available through OptumServe and will operate on Monday through Fridays in Chapel Hill. The testing site will be located at the R7 Parking Lot (725 Martin […]

Orange County Not Hosting COVID-19 Testing on Election DayThe Orange County Health Department will not host its daily COVID-19 testing event on Election Day. The county has begun its free daily testing event — held Monday through Friday at the Whitted Building in Hillsborough from 9 a.m. to 5 p.m. However, no testing will be available on Tuesday during Election Day. WEEKDAY TESTING […]

Orange County Health Department to Offer Free Daily COVID-19 TestsBeginning next week, the Orange County Health Department will offer free COVID-19 tests to all residents who need one. Tests will be available at the Whitted Human Services Building (300 West Tryon Street, Hillsborough) from 9 a.m. to 5 p.m. each day beginning on Monday, October 26. The only day when tests will not be […]

North Carolina Reports Highest Single-Day Increase in COVID-19 CasesNorth Carolina reported 2,532 new coronavirus cases on Thursday — the highest single-day increase in cases since the pandemic began. Data from North Carolina Health and Human Services revealed the increase, marking a new high as North Carolina has seen recent steep increases in positive COVID-19 cases. The department reports the state has experienced an increase […]

›