New Comcast-Disney Deal Worth Billions, Creating Much-Needed Windfall for ACC

By David Glenn

It’s not every day that an organization can increase its revenue by hundreds of millions of dollars without spending a single extra penny to do it. Heck, for that matter, it’s not every year, or every decade, or every century, either.

Well, thanks to its good friends at Disney/ESPN, the Atlantic Coast Conference just did something along those lines.

With the recent announcement that the two-year-old ACC Network finally will be carried by the top pay-TV provider in the United States (the cable giant Comcast, a long-time holdout), the league’s financial bottom line improved by a stunning total that gradually could approach $100 million dollars per year.

Divided among the ACC’s 15 member institutions, going forward, that could mean $6 million or so a year (per school) in brand-new money. Even in an era with plenty of $100 million-plus annual athletics budgets, in the ACC and otherwise, that’s not a windfall you see often, especially without raising your expenses in the process.

So, how does it all add up?

Well, get ready to click on your nearest online calculator, or just follow along. Using “ballpark” numbers allows for some pretty simple, yet incredibly eye-opening, financial mathematics.

First, as outlined here almost three months ago, the Comcast-Disney negotiations were between two of the true behemoths of modern corporate America.

While cord-cutting and cord-shaving have been impactful, important trends in the cable television and sports media rights industries over the last decade-plus, it’s easy to forget that — even now, near the end of 2021 — the two largest pay-TV providers in the nation are cable companies.

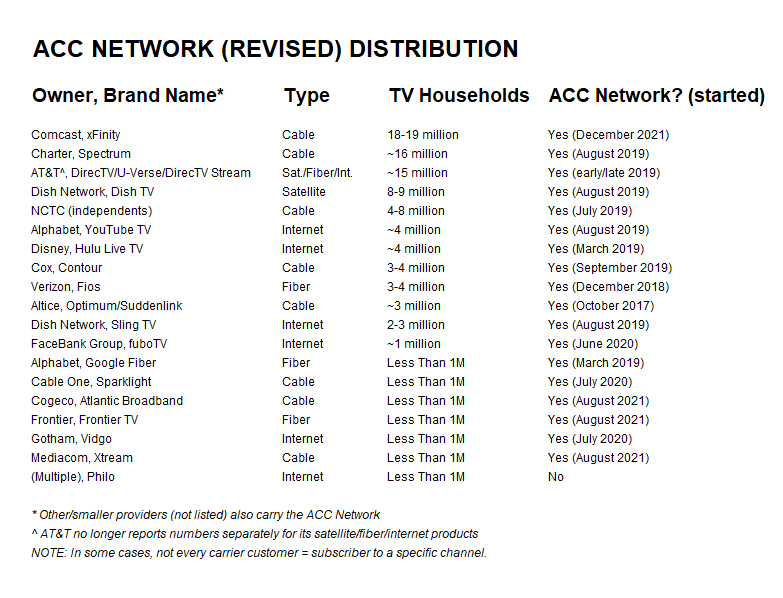

Comcast (brand name xFinity) and Charter (Spectrum) have more than 18.5 million and approximately 16 million pay-TV subscribers, respectively. While new-wave, internet-based offerings such as fuboTV, Hulu With Live TV, Philo, Sling TV, Vidgo and YouTube TV (see revised chart below) continue to grow in popularity, those six companies COMBINED still don’t have nearly as many pay-TV customers as either Comcast or Charter has by itself.

The new Comcast-Disney deal, announced Nov. 30, soon will give the ACC Network access to more than 18.5 million additional/new pay-TV households, bringing the channel’s total to almost 90 million overall. According to Comcast, its customers will begin to have access to the ACC Network by the end of December at the latest.

While the monthly prices that pay-TV providers spend to carry various channels is considered private, proprietary information, and customers don’t have itemized bills (beyond HBO, Showtime, etc.) that reflect what they’re paying for each channel each month, various industry analysts regularly track such details.

ESPN (like the ACC Network, owned by Disney) is by far the most expensive channel, bringing in an average of almost $8 per month per customer. The next-most expensive channels, TNT (more than $2/month) and the NFL Network (less than $2/month), also carry sports programming. A large majority of channels cost less than $1 per month per customer, and some bring in only 10 cents (in some cases, even less) per month per customer.

According to industry analysts, the SEC Network (also owned by Disney), by far the most popular of the conference-specific channels, brings in an average of more than 90 cents per month per subscriber. The numbers for regionally sensitive channels, including the ACC Network, Big Ten Network, Pac-12 Network and SEC Network, are complicated by the fact that in-market customers are charged a much higher price than out-of-market customers. Nevertheless, the average price per month takes both of those groups into account.

Could the ACC Network, with fewer viewers than the SEC Network but the largest in-market footprint (in terms of geography and population/households) of any conference channel, bring in an average of 80 cents per month per customer in 2022?

Earlier this year, industry analysts estimated the ACC Network’s average at 70 cents per month, but it’s important to remember that an enormous number of out-of-market customers (think of those located in any of the 40 states that do not include an ACC school) have been depressing that average.

Among the states where Comcast has a huge number of customers are the “ACC states” of Florida, Georgia, Indiana, Massachusetts, Pennsylvania and Virginia, where its customers will be paying the much higher (in-market) rate for the ACC Network, likely bringing up the channel’s overall average in the process.

So, finally, let’s have some fun with the numbers.

If the ACC gets to the 80 cents per month mark, that means $9.60 per customer per year. To keep the math simple, let’s round that up to $10 per customer per year.

The new Comcast deal is bringing in more than 18.5 million new ACC Network subscribers.

Go ahead, now. Punch in the numbers: 18.5 million times $10/year = $185 million per year.

Importantly, Disney/ESPN has had the ACC Network up and running for more than two years now. The company’s expenses for broadcast personnel, facilities, production costs, right fees, etc., do NOT go up significantly just because they have more customers, not even 18.5 million new customers. The content production for the channel doesn’t have to change at all; that content just will be much, much more widely distributed moving forward.

Instead, this is truly the classic definition of a windfall, perhaps in the neighborhood of $185 million per year, for at least as many years (undisclosed in the recent announcement) as the new Comcast contract remains in place. The last time Disney and Comcast struck a wide-ranging deal, it was for a 10-year term.

Even after ESPN takes its half of the new profits in its ACC Network partnership with the ACC, that still leaves more than $90 million per year in new money for the league, which is an average of around $6 million per school per year.

Given how UNC and its fellow ACC members desperately have needed to find ways to increase their individual and collective revenue sources, and especially how they’ve fallen way behind the Big Ten and SEC on money matters (https://chapelboro.com/town-square/columns/holding-court-with-david-glenn-understanding-the-alliance), this Comcast/xFinity contract is a significant step in the right direction, regardless of its exact financial details.

David Glenn (DavidGlennShow.com, @DavidGlennShow) is an award-winning author, broadcaster, editor, entrepreneur, publisher, speaker, writer and university lecturer (now at UNC Wilmington) who has covered sports in North Carolina since 1987.

David Glenn (DavidGlennShow.com, @DavidGlennShow) is an award-winning author, broadcaster, editor, entrepreneur, publisher, speaker, writer and university lecturer (now at UNC Wilmington) who has covered sports in North Carolina since 1987.

The founding editor and long-time owner of the ACC Sports Journal and ACCSports.com, he also has contributed to the Durham Herald-Sun, ESPN Radio, the New York Times, the Washington Post, Raycom Sports, SiriusXM and most recently The Athletic. From 1999-2020, he also hosted the David Glenn Show, which became the largest sports radio program in the history of the Carolinas, syndicated in more than 300 North Carolina cities and towns, plus parts of South Carolina and Virginia.