Many college students and recent grads are still reacting to the news of the Biden administration’s student debt relief plan. Some UNC students are sharing mixed emotions about the news – excitement about the prospect of some aid, while also hope that more may soon follow.

Earlier this summer, the total student loan debt in the United States hit a record high: $1.75 trillion across approximately 45 million borrowers. According to Forbes, student loans are now second place behind mortgages for total consumer debt amounts in the country.

With his plan shared on August 24, President Joe Biden said he aims to help curb some of that burden for those in debt. Borrowers will receive $20,000 in forgiveness if they went to college with the assistance of Pell Grants – a popular federal grant for undergraduate students in “exceptional financial need.” Those who didn’t will receive $10,000 in relief and the forgiveness only applies to those who are currently earning less than $125,000 a year.

That applies to Gaston Sanders, a UNC medical school student who also graduated from the university in 2019 with a bachelor’s degree. Despite having worked as medical scribe in the past, he says he’s not able to work in addition to his school responsibilities – which provide ample and applicable experience.

Sanders says while he’s grateful for the $10,000 in relief, in his situation, it’s just “a drop in the bucket.”

“It’s a big drop, but it’s still a drop,” he says. “It’s less than a tenth of what I would owe without any of the interest accumulating and certainly less than ten percent of what I will owe [when it does accumulate].”

Sanders says he took out loans for all four years of undergrad and has taken out significantly more for his efforts to be a primary care doctor in rural areas. While the debt hangs over him “like a cloud,” he says he didn’t want to compromise his passion for medicine for the sake of avoiding taking out more student loans.

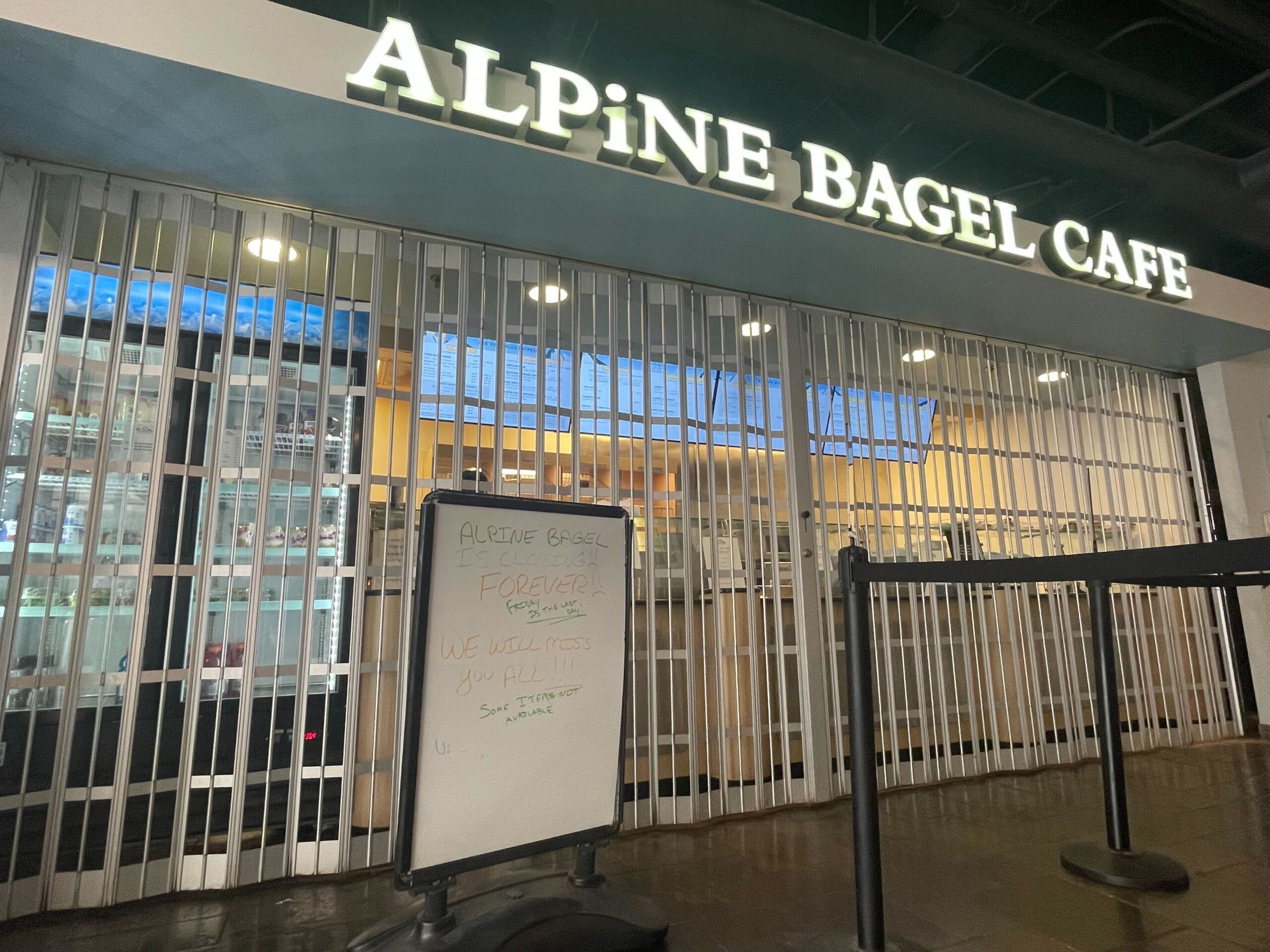

Gaston Sanders (left), a medical student at UNC, stands with Dr. Crister Brady at the Prospect Hill Community Health Center. (Photo via Gaston Sanders.)

For his peers, however, Sanders says debt can affect more of their professional decisions.

“Just in the medical community,” he describes, “you see tons of people on Twitter or just in-person talking about ‘Well, because it’s so expensive and there’s so much upfront cost, it in some ways forces people into high-paying specialties to keep going down a path that maybe they aren’t as satisfied with as they would be in some other way.

“People aren’t just making choices [over whether] doing this makes you happy,” Sanders adds. “It’s ‘can I now pay for the debt I’ve taken on?’”

The potential for long-standing and high-interest debt caused by student loans also works as a deterrent for some considering any higher education.

Turner Medlicott, a UNC Class of 2020 graduate, recently worked with the Carolina College Advising Corps. The nonprofit helps students in low-income communities or first-generation families get connected to resources and consider the most affordable options. Medlicott says while working at Lumberton High School in Roberson County, he heard from many students who indicated debt as a “huge factor” in their deicisions.

“A lot of times when I’d ask students who weren’t considering college,” he says, “one of the first things they brought up wasn’t necessarily that they didn’t feel smart, capable or interested enough. It was often, ‘well, there’s just no way that my family’s going to be able to afford that. I can’t afford college.’

“It was kind of heartbreaking to hear,” says Medlicott, “but then luckily, a great part of my position was connecting them to the resources that were there.”

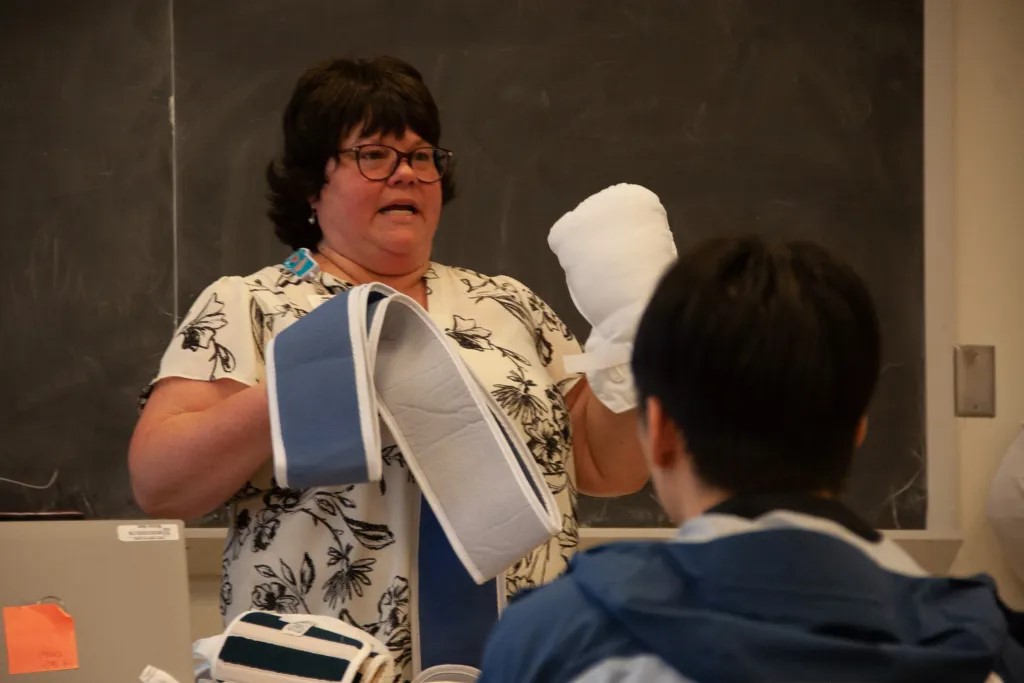

Turner Medlicott (center) stands with staff of Lumberton High School, where he was stationed as part of the Carolina College Advising Corps. (Photo via Turner Medlicott.)

The class of advisors for the 2021-2022 school year from the Carolina College Advising Corps. (Photo via the Carolina College Advising Corps.)

Medlicott is among those facing student debt, although the Biden administration’s plan may significantly help. After taking out loans through his undergraduate career, his master’s program in social work at UNC Charlotte helps cover tuition and fees. Medlicott says the federal forgiveness paired with some Americorps education awards from being an advisor, the loan debt from his four years at Carolina will be nearly wiped away.

“That’s going to be such a trajectory difference when I look at my five-year and ten-year plan personally now,” said Medlicott. “It’s completely changed. Initially, it was, ‘Okay, I’ll graduate from my master’s [program] and I’ll work to pay off these student loans. It’ll take a few years, but I can maybe handle them and then I can start thinking about buying a home, building assets, traveling’ – or any of the other things that you want to be able to do once you’re done with your education. And now I can start to think about doing them now.”

Medlicott says he’s excited his new program includes mentoring first-year or first-generation college students and Pell Grant recipients. As he continues to see students face concerns about paying for school – and suffering the debt afterward – he hopes that the federal government can continue to help them. Medlicott sees increasing the Pell Grant totals to better reflect the true cost of university tuition, housing and additional fees as an option.

“I’m most hopeful that what [this relief plan] signifies as a first step,” he says. “It was rolled out as a ‘this is what we’re doing now, but we have to continue to battle this’ and not a ‘alright, we’ve fixed the problem.’ Because we certainly haven’t.”

Medlicott said, however, that the debt relief being treated as taxable income in North Carolina “puts a damper” on the federal plan. The state Department of Revenue issued a release on Wednesday reminding residents the North Carolina General Assembly did not adopt part of the country’s Internal Revenue Code, specifically Section 108(f)(5). While the state legislature could eventually adopt this measure, the affected students will have to pay taxes on the relief money.

Sanders agrees that the state law is antithetical to the nationwide plan. He says he hopes the Biden administration and other federal officials who campaigned on the promise of student debt relief continue enacting change. Sanders says, from personal experience, that more needs to be done to address the vast discrepancy for those facing years of interest payments – let alone payment on the initial loans.

“Everyone is happy to have the $10,000 that needs it,” says Sanders. “But the people who are in some really bad situations, it’s not going to make [a difference.] [It’s like], ‘Oh, now I only owe 65 thousand instead of 75 thousand. And when I got out of school it was only 45, but because of interest, it’s never gone down.’ Because people have never been able to make headway on loans.”

Editor’s Note: A previous version of this story incorrectly stated Medlicott was a recipient of a Pell Grant. It has since been corrected.

Chapelboro.com does not charge subscription fees, and you can directly support our efforts in local journalism here. Want more of what you see on Chapelboro? Let us bring free local news and community information to you by signing up for our biweekly newsletter.