This year’s favored tax package for Republicans at the North Carolina General Assembly has received preliminary Senate approval.

The proposal, which advanced in a near party-line 26-19 vote on Thursday, is almost identical to tax provisions contained in the House’s state budget proposal approved two weeks ago. It contains more tax breaks for corporations and individuals, but would also likely collect more sales taxes from North Carolina residents shopping at online shopping sites based out of state.

The entire package, the latest in tax reforms sought this decade by the GOP-controlled legislature, would ultimately result in state tax collections falling by more than $200 million annually compared to what is forecast under current tax laws, according to a memo by legislative staff.

Democrats jumped on this loss of revenues in floor debate. GOP senators argue reductions ultimately will raise collections overall through tax policies that encourage capital investment and job creation. They cite annual robust revenue growth since their tax overhauls began in 2013.

“It will be extremely positive,” said Sen. Paul Newton of Cabarrus County, one of the bill’s chief sponsors, adding that when other tax cuts occurred, “the revenues have outstripped projections in the state.”

A final Senate vote is expected next week. Democratic opposition, however, increases the likelihood that Gov. Roy Cooper would veto legislation containing this package. Since Republicans now lack veto-proof majorities, the odds the full package would be enacted in its current forms are long.

For businesses, the rate on the franchise tax most corporations pay would decrease by one-third over two years, and one method used to calculate the tax based on the company’s property it owns would be eliminated. This and another shift calculating corporate income tax in the bill are designed to favor North Carolina-based companies and discourage them from moving elsewhere, bill supporters said.

On the individual income tax, the standard deduction would increase slightly in 2021 for all filers. For example, the first $20,750 of income of a couple filing jointly would be tax free, compared to $20,000 today. Companies like Amazon and eBay would be told to collect sales taxes from consumers who buy products they offer through third-party retailers.

Tax breaks for airlines on jet fuel, motorsports teams and rehabilitation of historic buildings also would be extended to 2024.

Democratic senators said they could support some elements but not the full package, focusing largely on the franchise tax.

They repeated complaints that corporate taxes keep falling — the corporate income tax rate of 2.5% is the lowest among states with such a tax — while education and health care needs continue to be unmet. And Sen. Floyd McKissick, a Durham County Democrat, said he’s never heard of a company deciding on whether to locate in North Carolina based on the franchise tax.

“The only thing that we are doing at this point right now is decreasing revenues for the state of North Carolina,” McKissick said.

One Democrat, Sen. Paul Lowe voted for the bill, citing a late provision that would eliminate what bill sponsors call some double taxation under the franchise tax. Sen. Ralph Hise, a Mitchell County Republican and bill sponsor, said the change would benefit tobacco giant Reynolds American by about $4 million annually. Reynolds American is based in Winston-Salem, where Lowe lives.

Related Stories

‹

Taxes, Salaries, Vacancy Cuts Make Plain Differences Over Rival North Carolina GOP BudgetsWritten by GARY D. ROBERTSON RALEIGH, N.C. (AP) — The North Carolina House’s reveal of its state government budget proposal makes plain the differences on taxes, salaries and job cuts between Republicans who control both General Assembly chambers. With strong bipartisan support, the House gave preliminary approval late Wednesday to its plan to spend $32.6 […]

North Carolina Budget Plan Advances as Senate Republicans Double Down on Tax CutsNorth Carolina Senate Republicans advanced a two-year budget that doubles down on already enacted income tax cuts.

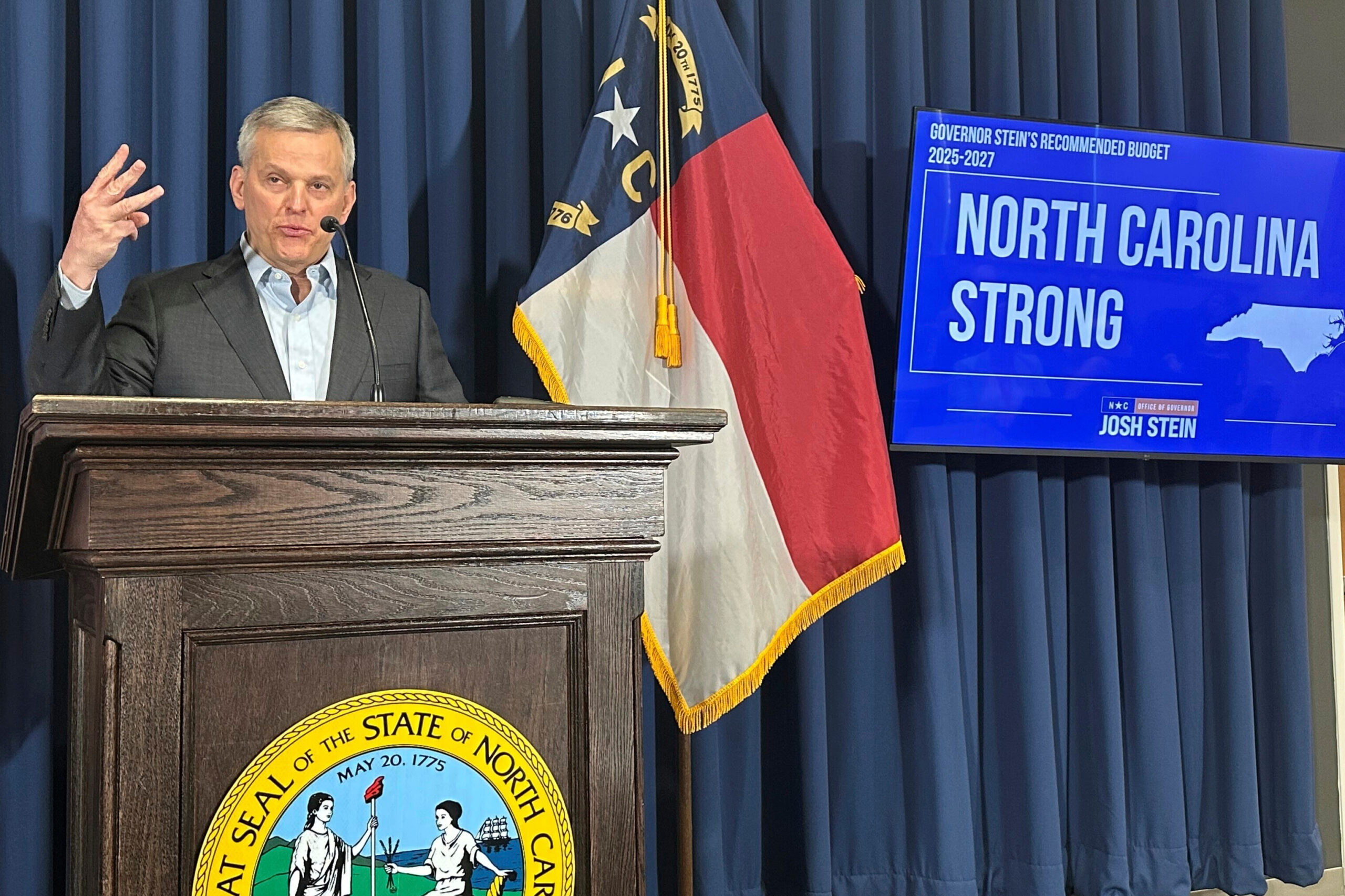

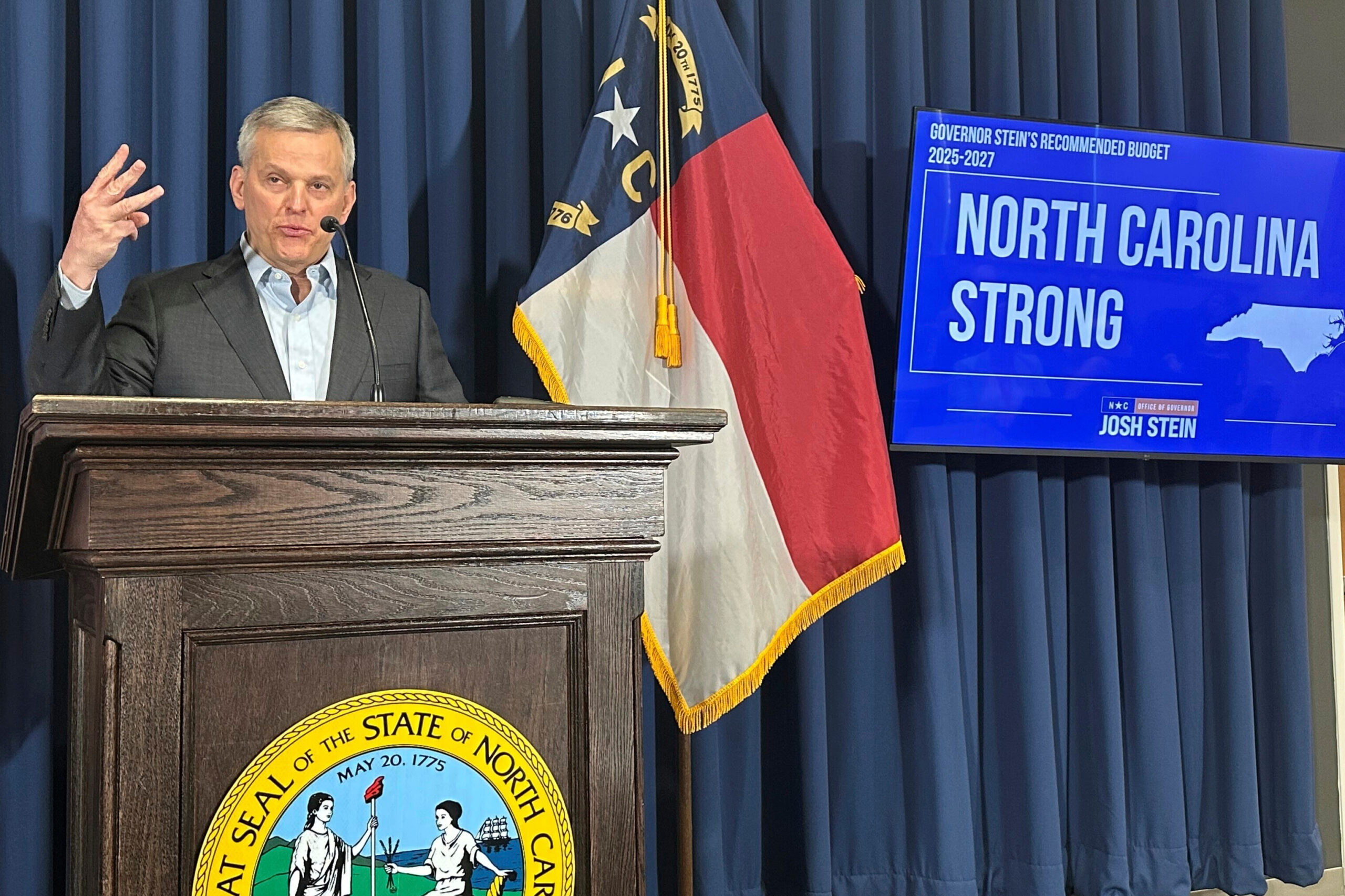

New North Carolina Governor Seeks To Freeze Tax Cuts, Phase Out School Vouchers in BudgetNorth Carolina Democratic Gov. Josh Stein urged Republicans to roll back upcoming income tax rate cuts and private school vouchers.

North Carolina Gov. Cooper Isn’t Sold on Tax-Cut Restrictions by Republicans Still Finalizing BudgetWritten by GARY D. ROBERTSON North Carolina Democratic Gov. Roy Cooper said on Tuesday he’s skeptical that an apparent tax agreement by Republican legislative leaders within a state budget that’s still being negotiated would over time protect revenues to fund pressing needs within government. House Speaker Tim Moore and Senate leader Phil Berger provided on Monday few […]

2 North Carolina State Legislators Lose Leadership Roles Following RemarksWritten by GARY D. ROBERTSON Two North Carolina state House Republicans have lost their caucus leadership positions following recent comments directed at Democratic colleagues questioning their educational attainment and religion. Reps. Keith Kidwell and Jeff McNeely have resigned as deputy majority whips after the GOP leadership team asked them to step down, House Majority Leader […]

State House Budget Proposes More for Infrastructure, RaisesWritten by GARY D. ROBERTSON North Carolina House Republicans unveiled a two-year state government spending proposal Wednesday that would offer sizeable raises for teachers compared to recent years while earmarking billions of dollars for infrastructure and health care. The unveiling of the House budget plan comes two weeks after Democratic Gov. Roy Cooper offered his own proposal, which GOP […]

NC Senate Budget Gets Final OK; House Makes Own Plan NextA two-year North Carolina government budget that spends, saves and cuts taxes thanks to a state revenue boon and billions more federal COVID-19 relief funds cleared the Senate on Friday. Four Democrats joined all Republicans in voting for the spending proposal — just like Thursday when the chamber completed the first of two required votes […]

North Carolina Senate Gives Final OK to $2B Tax-Cut PlanLegislation that includes more than $2 billion in tax reductions over the next two years and the phaseout of North Carolina’s corporate income tax by 2028 received bipartisan approval again in the Senate on Thursday. The Republican-authored measure, which also would send up to $1 billion in federal COVID-19 recovery aid to hundreds of thousands […]

NC Senate Tax Cut Plan Includes Virus Aid for BusinessesWritten by GARY D. ROBERTSON A broad tax cut proposal from North Carolina Senate Republicans that began its advance in the chamber on Tuesday also contains federal COVID-19 relief money to give more aid to businesses that previously received federal or state pandemic assistance. GOP finance leaders unveiled an amended version of its tax plan, some of which […]

Bill to Reopen NC Gyms, Bars Sent to Skeptical Governor After Passing HouseThe North Carolina legislature passed another bill on Wednesday overturning parts of Gov. Roy Cooper’s executive order that keep certain businesses closed to discourage the spread of COVID-19. As with previous legislation sent to him seeking to reopen bars, Cooper is also likely to veto the latest measure, which also ends the shuttering of gyms […]

›