Written by THE ASSOCIATED PRESS

North Carolina taxpayers will have to wait a little longer to file.

After the state pushed back the date when it’s able to process tax returns to mid-February, it has now delayed a bit further to the end of the month, The News & Observer reported.

Tax season is starting late because North Carolina’s budget was nearly five months late and included tax changes that impact this year’s filings. The N.C. Department of Revenue announced this week that its new target date to start processing returns is Feb. 28.

The department is encouraging taxpayers to file electronically, noting that they can expect to begin receiving refunds in April. The state is still testing and approving system updates to tax preparation software for businesses and individuals.

Taxpayers can already see their lowered individual income tax rate — dropping from 5.25% to 4.99% — reflected in their paycheck withholdings.

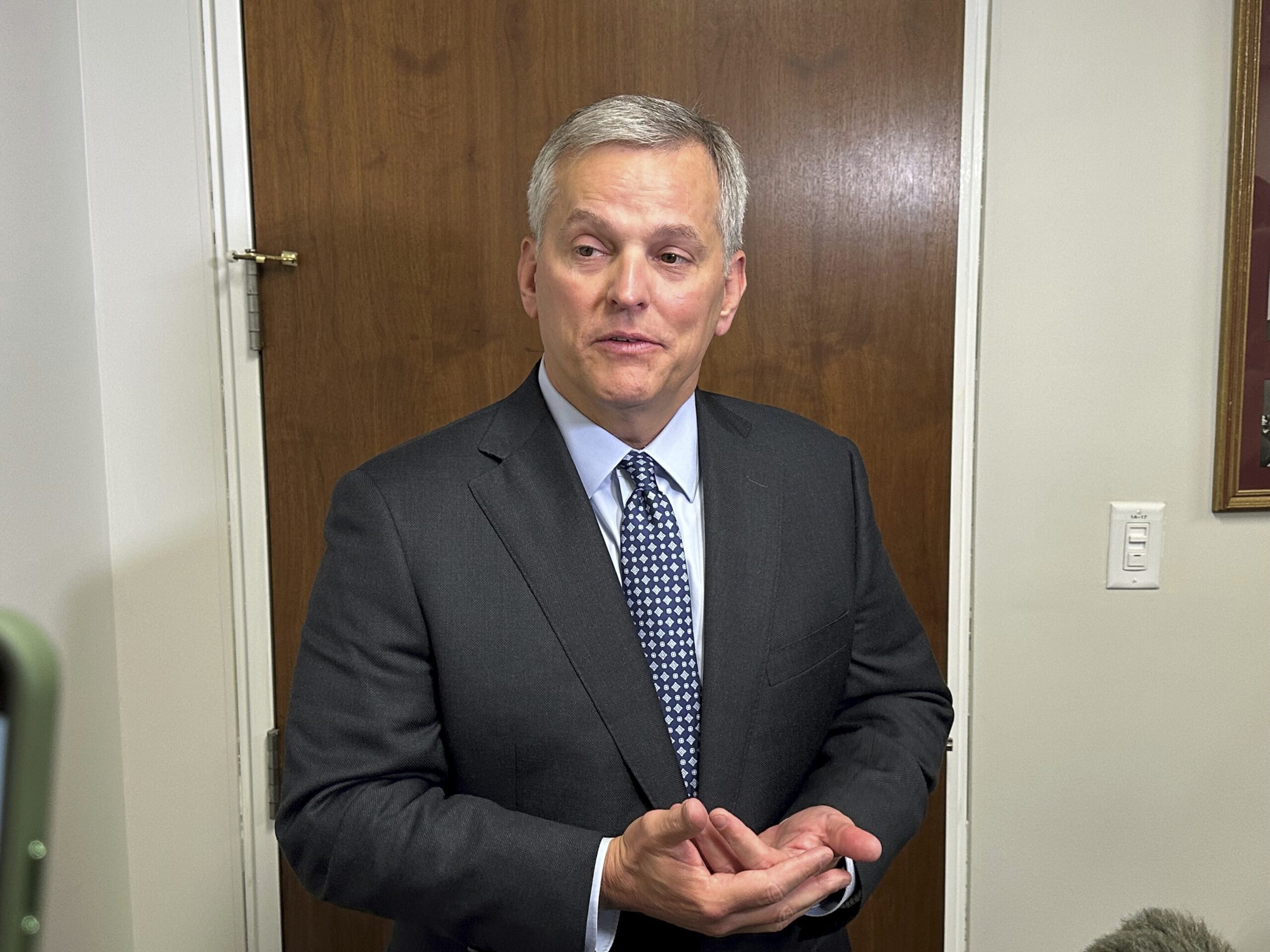

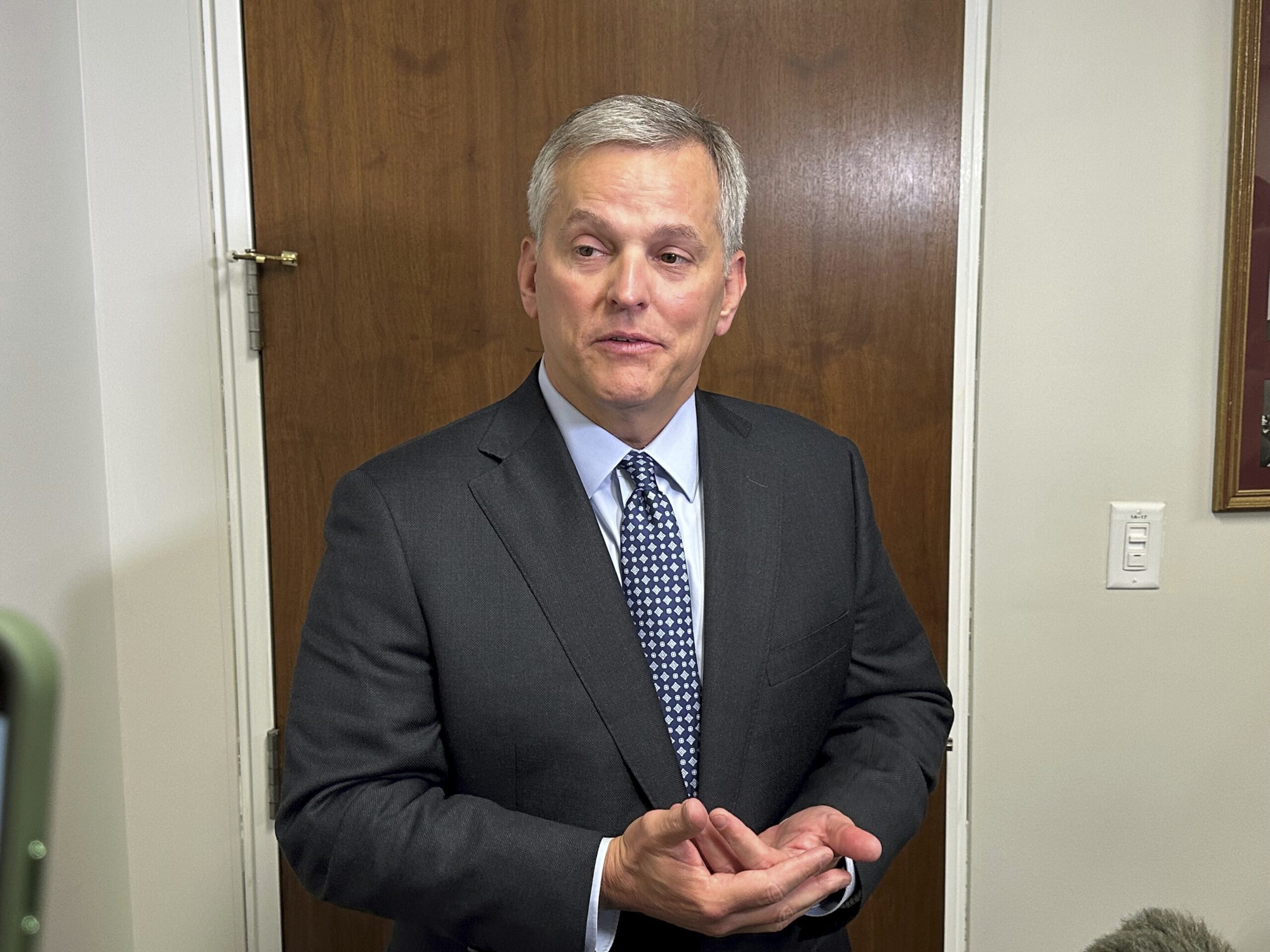

Photo via Mark Stebnicki.

Related Stories

‹

North Carolina Budget Plan Advances as Senate Republicans Double Down on Tax CutsNorth Carolina Senate Republicans advanced a two-year budget that doubles down on already enacted income tax cuts.

North Carolina Medicaid Patients Face Care Access Threat as Funding Impasse ContinuesNorth Carolina Medicaid patients face reduced access to services as an legislative impasse over state Medicaid funding extends further.

North Carolina Legislature Passes ‘Iryna’s Law’ After Refugee’s Stabbing DeathIn response to the stabbing death of a Ukrainian refugee on Charlotte’s light rail system, the North Carolina legislature gave final approval Tuesday to a criminal justice package that limits bail and seeks to ensure more defendants undergo mental health evaluations.

North Carolina Gov. Stein Signs Stopgap Budget Bill and Vetoes Opt-in Bill Helping School ChoiceWritten by GARY D. ROBERTSON RALEIGH, N.C. (AP) — North Carolina Gov. Josh Stein signed into law on Wednesday a stopgap spending measure while lawmakers remain in a state budget impasse. But he vetoed legislation that would direct state participation in a yet-implemented federal tax credit program to boost school-choice options, suggesting state Republicans acted hastily. The […]

North Carolina Lawmakers Approve Stopgap Spending Measure Amid Budget ImpasseNorth Carolina legislators gave final approval Wednesday to a stopgap spending measure while Republican leaders keep building a broad budget.

North Carolina Legislature Leaves After Passing Helene Aid Package, But Still No BudgetThe North Carolina legislature wrapped up the chief portion of its annual session Thursday, passing another Hurricane Helene aid package this week after Republican majorities pushed through divisive bills.

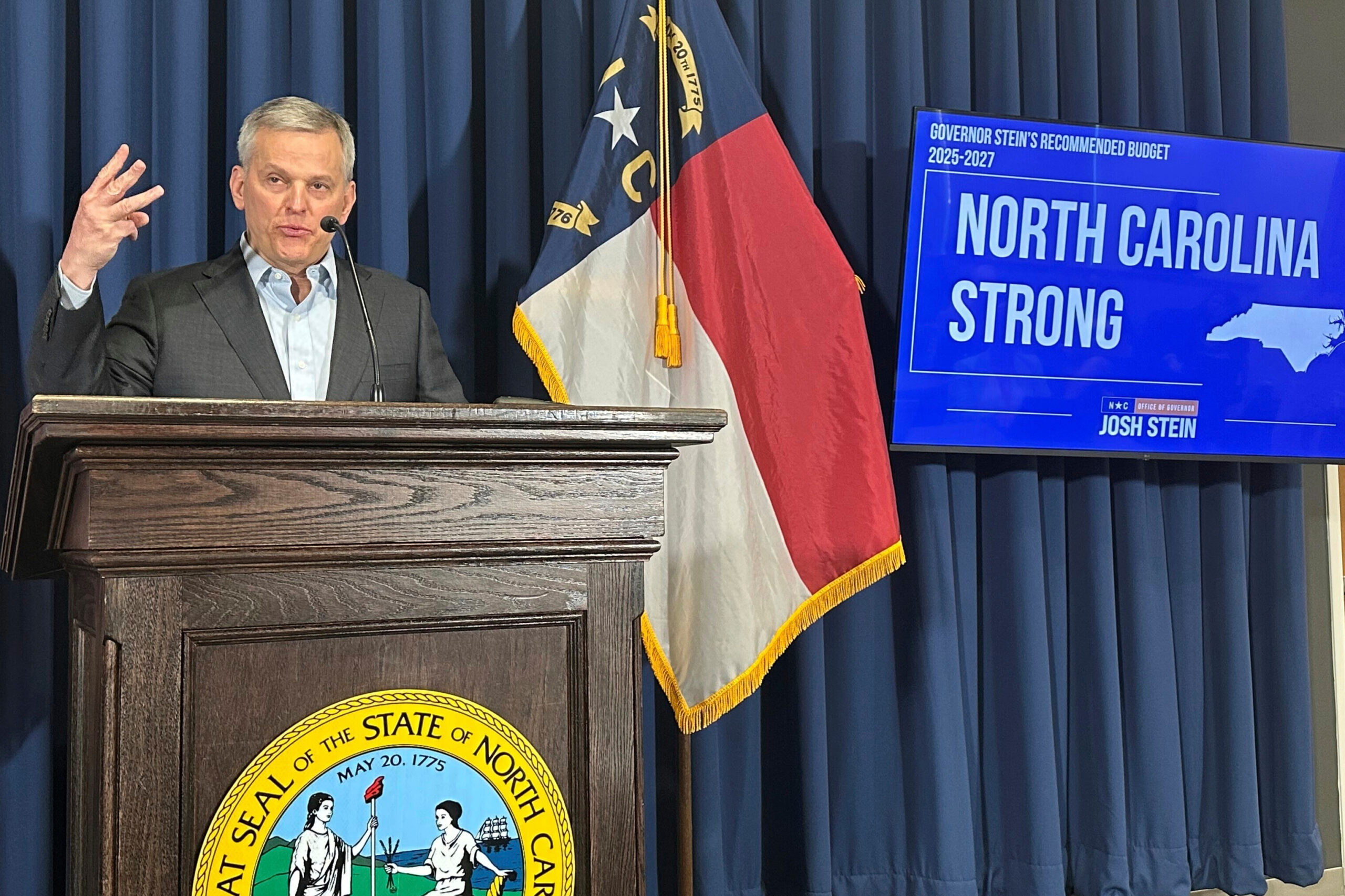

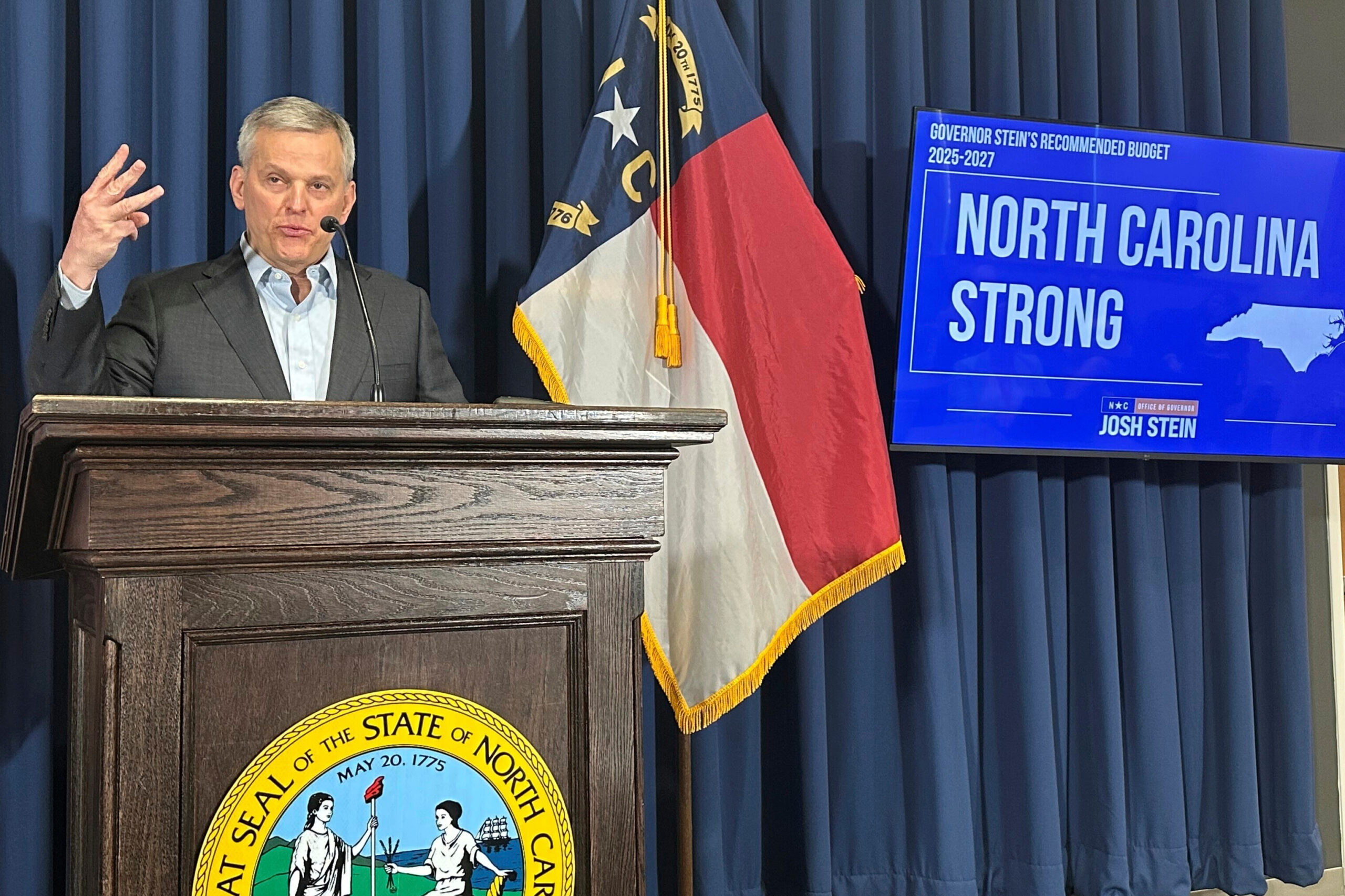

New North Carolina Governor Seeks To Freeze Tax Cuts, Phase Out School Vouchers in BudgetNorth Carolina Democratic Gov. Josh Stein urged Republicans to roll back upcoming income tax rate cuts and private school vouchers.

North Carolina’s New Governor Seeks More Helene Aid, Help for Families in Legislative AddressWritten by GARY D. ROBERTSON RALEIGH, N.C. (AP) — New North Carolina Democratic Gov. Josh Stein gave his first address to a joint General Assembly session Wednesday night, hitting on familiar campaign and early-term themes of helping Hurricane Helene victims, making living expenses affordable and focusing on bipartisan accomplishments. Stein delivered the biennial State of the State […]

North Carolina Republicans Seek to Force Top Democrats to Fall in Line with Trump AgendaNorth Carolina Republicans seek to compel the new Democratic governor and attorney general to aid President Donald Trump's agenda.

Economists Predict Modest North Carolina Surplus, But Warn More Tax Cuts Will Curb RevenuesNorth Carolina officials project a modest revenue surplus this fiscal year, but warned expected tax cuts mean lower collections are ahead.

›