North Carolina income tax filers won’t have to pay interest on payments turned in by the new May 17 deadline in a bill signed into law by Gov. Roy Cooper late Tuesday.

The legislation, signed by Cooper after the measure was given final legislative approval earlier Tuesday, addresses a result from an IRS decision to push its traditional April 15 deadline by one month to give people more time to deal with taxes during the pandemic.

State Revenue Secretary Ron Penny extended the North Carolina income tax deadline on his own to the same date because he had the power to do so.

While Penny also was able to waive penalties on payments made after April 15 but by the new date, he couldn’t forgive any interest on those payments without new legislation like what the General Assembly approved.

Cooper also signed a bill last year eliminating the interest mandate when the 2020 state deadline was delayed by three months.

This year’s law also extends the statute of limitations for tax filers from previous years to seek refunds by up to an additional month.

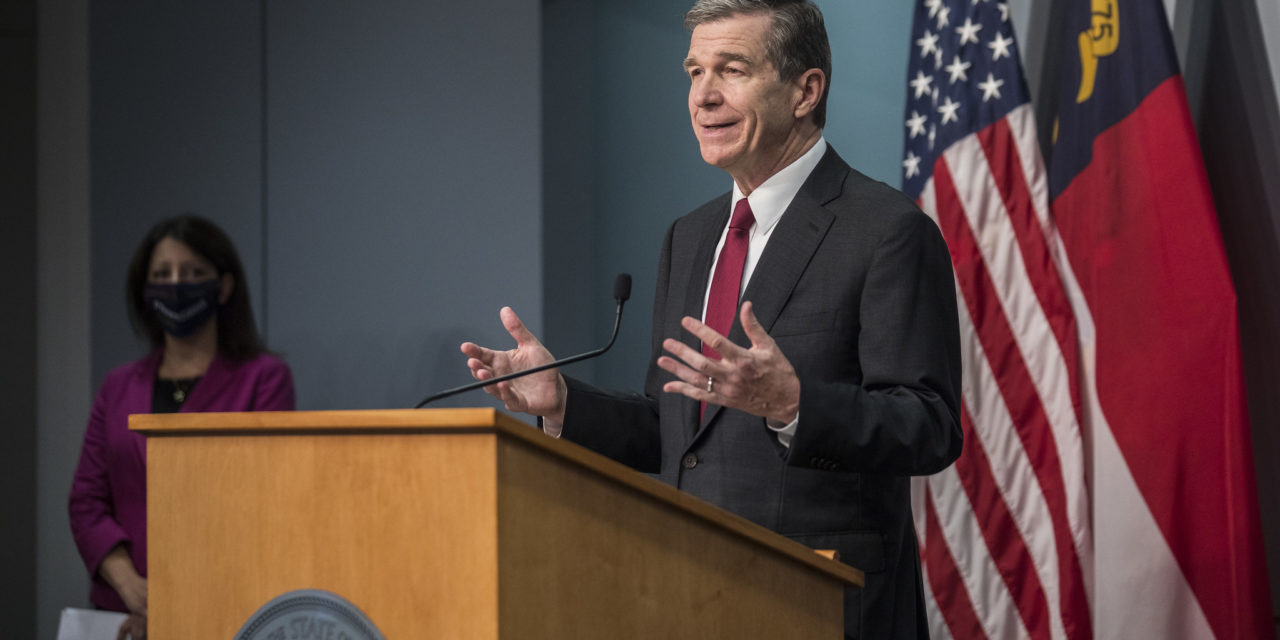

Photo via the North Carolina Department of Public Safety.