As the local governments are beginning to weigh the proposed budgets for the upcoming fiscal year, residents and constituents are finding out how they could be affected. In Chapel Hill and Hillsborough, their need to fund major projects is leading the towns to consider increases in taxes and rates.

The Chapel Hill Town Council has spent the last six months preparing for a different approach to their budget, as it seeks solutions to cut into a backlog of deferred maintenance, staff positions and capital projects built up. The local government is embarking on implementing a five-year spending plan, but the upcoming fiscal year is at the forefront of the discussion – and includes recommended tax increases to start making a difference.

During the council’s meeting on May 10, Interim Town Manager Chris Blue pointed to the town largely passing budgets that “held the line” for spending during the COVID-19 pandemic due to uncertain economic implications. With sales tax revenue staying steady, though, and most other aspects of life returning to normal, he said it is time for the town to address its laundry list of needs by starting with a five-cent increase on property taxes.

“The cost of doing business has gone up and you have some big, bold goals,” said Blue while presenting his budget. “Our tax rate, even with the increase I’m proposing, would place us in the middle of the pack in our region – including lower than our neighbors next door in Carrboro. The proposed budget prioritizes our employees and the core services they provide, [which is] something we’ve talked with you all a lot about these last few months.”

Some of those budget items include a major increase for general parks funding, as well as allocations for building new greenways, buying more electric town vehicles, and hiring 11 new town employees of various positions. In the two prior years, the town government passed a budget with no town-wide property tax increase and another with a 0.8-cent increase dedicated to transit funding.

Council Member Amy Ryan said her perspective on Chapel Hill’s budgeting has been hampered by the pandemic and that the increase does seem big on paper. But she said she was supportive of the proposal, based on the severity of the projects and stagnation in spending over the last few years.

“I know that this is going to feel like a lot to people and we have to make our case for it,” said Ryan. “But I think you’re doing a good job.”

Mayor Pam Hemminger, meanwhile, said she is supportive of starting to tackle the long-term projects but asked for town staff to explore options with just a four-cent increase on taxes. She shared concerns about having a steep increase hit the town’s more low- to middle-income residents at once – especially as there are other increases expected next fiscal year.

“I just want to have that balance with the community,” the mayor added. “Yes, the Town of Chapel Hill’s tax rate is middle of the pack. But when you combine it with the Orange County tax and the school district tax – which is going up – it’s a big chunk for folks. So, I think we have to explore what it looks like for that total combined tax on our businesses and people with fixed incomes.”

The Orange County budget proposal includes a minor increase for property taxes: upping the rate by 0.0046 to better balance the budget, said county manager Bonnie Hammersley during a May 2 county commissioner meeting. The package also suggests raising the special district tax for residents in the Chapel Hill-Carrboro City Schools district for the first time in recent years to improve school funding. Hammersley said she suggests raising it from 0.015 cents every dollar to 0.0198, which would add nearly $2.1 million in continuation funding.

North of Chapel Hill, the Town of Hillsborough is also weighing increases – although a different type. While Town Manager Eric Peterson’s proposed budget would maintain the property tax rate once again, it would increase both water and sewer rates by six percent.

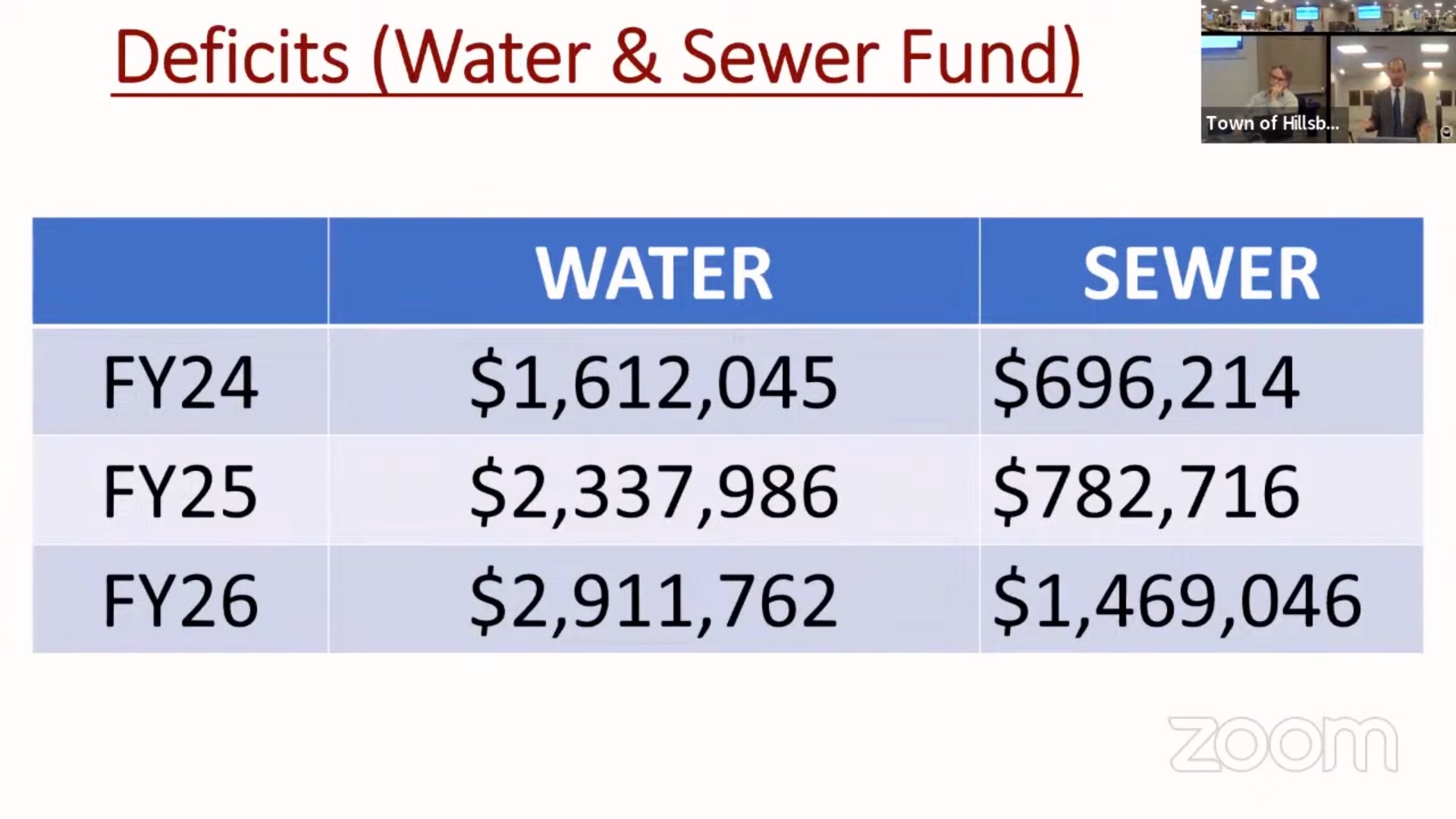

During a budget preview on May 8, Peterson pointed to significant financial deficits in the town’s water and sewer operations due to increased operational costs and the rate of inflation. He said even with these changes, Hillsborough’s wastewater system will need major upgrades that will cost more than the town can bring in. Pederson said, to him, the rate increase represents a “modest proposal for this year.”

Hillsborough Town Manager Eric Peterson presents to the town’s Board of Commissioners on his proposed FY 2023-24 budget. In this slide, he shows projections of the town’s operating deficits for the two systems if there’s no increase in rates to residents. (Photo via the Town of Hillsborough)

“I think last year when [town staff] gave you the update, we had $40 million of capital improvements on wastewater collection alone,” said the town manager. “Now, this is reality coming: it’s one thing to read about it, but we’re going to see how this is going to impact us.”

“We can’t do nothing,” Pederson later said, “because as you can see, we’re going to fall further and further behind with significant deficits.”

In Chapel Hill, the town council will hold a work session on Wednesday before hosting its budget public hearing on May 24. The Town of Hillsborough will hold its budget public hearing on May 22, while Orange County will hold its public hearing on June 1. The Town of Carrboro has yet to release its budget recommendation to its town council.

Photo via the Town of Chapel Hill.

Chapelboro.com does not charge subscription fees, and you can directly support our efforts in local journalism here. Want more of what you see on Chapelboro? Let us bring free local news and community information to you by signing up for our biweekly newsletter.