A real estate investment company based in Boston has spent over $70 million to add a newly developed apartment complex in Chapel Hill to its regional asset portfolio.

The sale of Alexan Chapel Hill was announced on Monday, with ownership of the 265-unit residential property having been transferred from East West Partners to Berkshire Group.

According to Ben Perry, a project manager at East West Partners, the upscale community was built with outside investors in mind, but a favorable market facilitated its sale.

“We were always going to have to either bring in new investors or refinance it or a combination of that, but the market just got so strong over the year or two that we were building it that it just made sense to go ahead and sell,” he recalled.

Perry also explained that his company sought to maximize the equity of the property by partnering with Trammell Crow Residential and accepting a degree of financial risk.

“We financed that project with shorter-term capital, a construction loan and development equity investors that are looking for the higher-risk, higher-return equity-type yields,” he relayed.

The construction of Alexan Chapel Hill was made possible in part by land development regulations that have since been made less permissive by town officials.

In discussing the attraction that the property had to outside investors, Perry pointed to the availability of a ready-made capital asset that is not likely to be duplicated.

“Berkshire and some of the other markets saw that and thought that Chapel Hill continues to be a high-barrier entry market, so it just […] shows that once you get something built, the lack of supply in the market makes it valuable,” he mused.

Amenities at the complex now known as Berkshire Chapel Hill include a saltwater swimming pool and pet salon as well as 13,560 feet of retail space at ground level.

Michael Krupp, a vice president with Berkshire Group, claimed that the acquisition was part of a strategy to purchase “boutique-style communities” in “prime locations.”

That strategy may bode well for the company, which has four decades of investment experience and over $7 billion in real estate assets under management.

Image by Trammell Crow Residential.

Related Stories

‹

Chapel Hill Approves New Apartment Building on E. Rosemary StreetTwo projects aim to provide more housing on East Rosemary Street – with one recently being approved by the Chapel Hill Town Council.

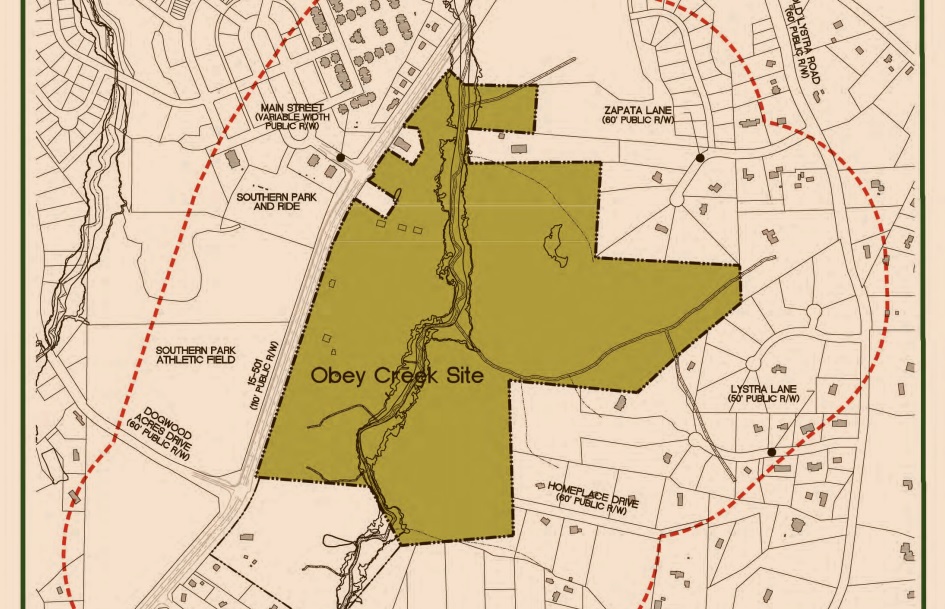

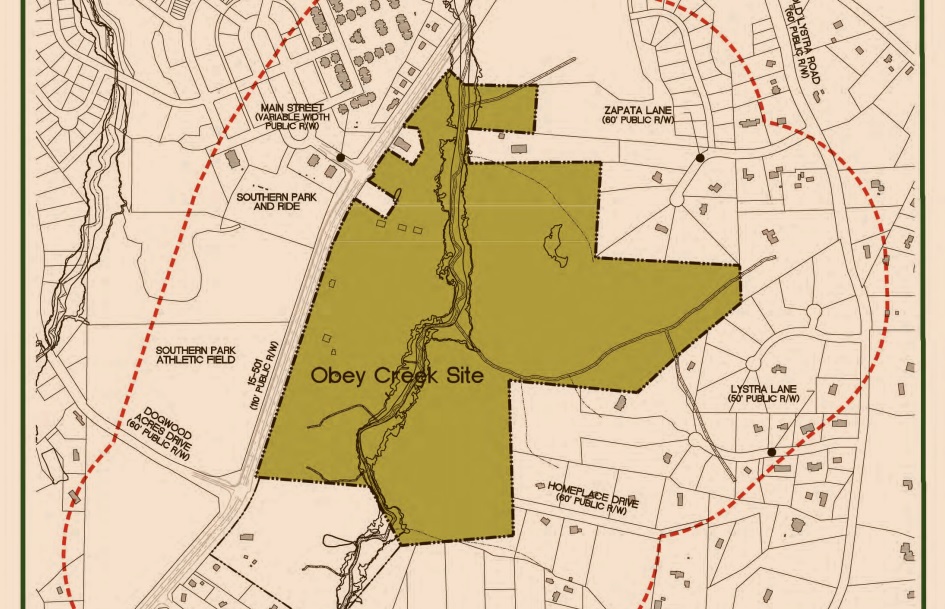

What Happened to Obey Creek? Developer Says Project on Long-Term HoldThe Chapel Hill Town Council gave final approval for the Obey Creek Project in 2015. Since then, however, the project has ground to a halt.

![]()

Chapel Hill Considering Remedy for Fire Station 2 Cost OverrunsThe Chapel Hill Town Council has a packed agenda Wednesday for its final meeting before four new council members are sworn in next week following this month’s election. The council will be considering whether to authorize the sale of a retiring ladder truck from the Chapel Hill Fire Department in an attempt to mitigate costs […]

![]()

East West Partners Sells Environs at East 54 Housing Complex to Private InvestorEast West Partners has sold the Environs at East 54 multi-housing community in Chapel Hill to a private investor, according to a release. Environs at East 54 is a 58-unit complex that was completed by East West Partners in 2015. Officials with Holliday Fenoglio Fowler, L.P., who represented East West Partners in the sale, say […]

![]()

Chapel Hill Moving Forward with Public-Private Partnership for New Fire StationThe Chapel Hill Town Council is moving forward on developing a new fire station and four-story office building on East 54. The new station and office building will replace old Chapel Hill Fire Station 2 on South Hamilton Road. The land is currently owned by the town but part of the business agreement stipulates the […]

![]()

MAYBE A FUTURE PRESIDENT, WITH YOUR HELPWhat do President Bill Clinton, Michael Jordan, Senator George Mitchell, Bill Cosby, Jackie Joyner-Kersee, General Wesley Clark, and Denzel Washington all have in common? As children, they all belonged to Boys & Girls Clubs like the one organizers hope to open at the Pine Knolls Community Center in Chapel Hill next year. www.bgcepnc.org Their first […]

'Together is The Only Path Forward': Orange County's Habitat for Humanity Hosts Affordable Housing SummitAmid a shortage of affordable housing – both locally and nationally – the Orange County chapter of Habitat for Humanity recently held a summit to discuss how leaders can collectively aim to better address the issue.

![]()

Chapel Hill: LUMO Update, Federal Funding for Projects, Financial ReportChapel Hill Mayor Jess Anderson spoke with 97.9 The Hill's Andrew Stuckey on Thursday, February 12, discussing town news and events. She recapped the recent town council meeting, which included a presentation on the town's financial report, and an update in the Land Use Management Ordinance rewrite. She outlined some recent federal funding secured for some major projects for the town, and more.

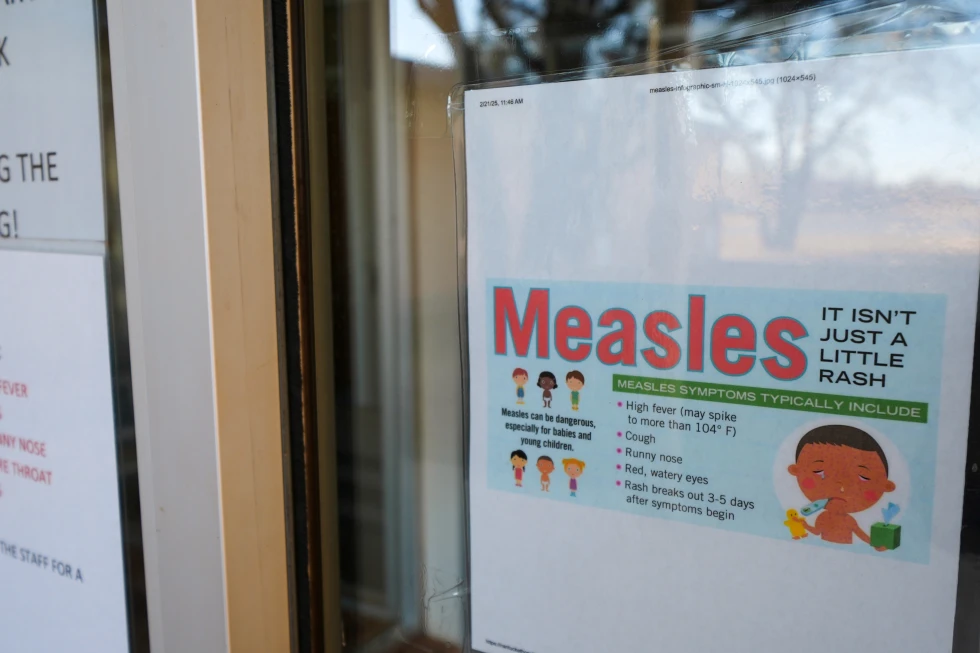

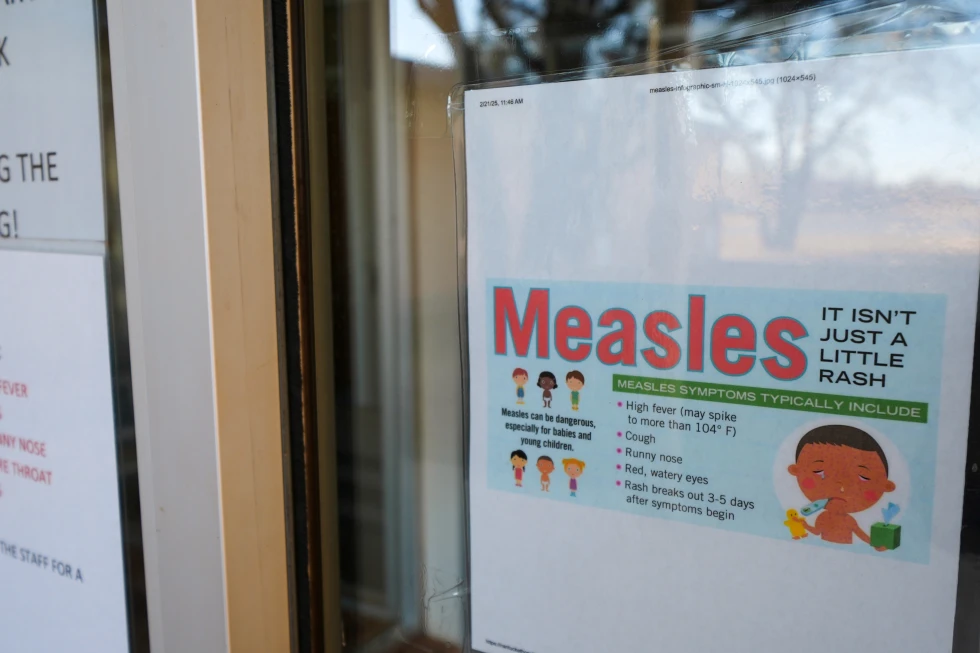

Confirmed Measles Case Reported at Chapel Hill Goodwill StoreThe Orange County Health Department has reported that a person infected with measles recently visited a public place while contagious. According to the department, anyone who visited the Goodwill store at 1115 Weaver Dairy Road in Chapel Hill between 9 a.m. and 12 p.m. on Friday, Feb. 6 may have been exposed. Anyone who thinks […]

Local Government Meetings: February 9-13, 2025This week in local government: residents in Chatham County push back against Flock license-plate cameras and AI data centers.

›