The Chamber for a Greater Chapel Hill-Carrboro held its 18th State of the Community presentation for local leaders on May 7 at the Friday Center in Chapel Hill. Covering the service area for the Chamber — primarily Chapel Hill and Carrboro, but the rest of Orange County and the northeastern part of Chatham County — the report shares some of the latest data and trends in long-term indicators to guide leaders’ strategies and thinking.

Here are some top takeaways from the 2025 report as presented to attendees, and discussed by Chamber President and CEO Aaron Nelson on 97.9 The Hill afterward, that stand out for Orange County.

‘Uncertain Times’ Not Yet Borne Out in Data

Each State of the Community report pulls from trusted sources, but the most critical data about populations and demographics come with a delay. Much of the 2025 report relies on data from 2024 and occasionally even further. With that, the current economic status of the U.S. and upheaval at the federal government being overseen by President Donald Trump’s administration is not reflected in the numbers reviewed by the Chamber.

Nelson prefaced Wednesday’s presentation with this, describing the most current state of the community as facing “uncertain times” and using the metaphor of embarking on an adventure with little idea what to expect because of the federal turmoil.

“We are as a community — together, all of us — going to go on this adventure,” Nelson said to 97.9 The Hill, “and this is an opportunity to take stock. What are our resources? What people do we have in our community? Maybe think of it as…if we’re headed into uncharted waters, this is a conversation about the seaworthiness of our vessel.

“To that end,” he added, “it’s incredibly strong. We have very strong fundamentals. When we face recessions, historically, Orange County is late in and first out. Same with COVID… while very negatively impactful on our health, [it was less so] on our economy, things remained quite strong. This [experience with the Trump administration] a little bit different because the things that have always kept us successful are the university and the hospital. And this one potentially has negative impacts on them.”

Population Growth Is Still Extremely Slow, Old for Orange County

As has been the case for many years, the report begins with an update on the counties’ population and, similarly, the trends remain the same for Orange County: its population change is far slower than its neighbors.

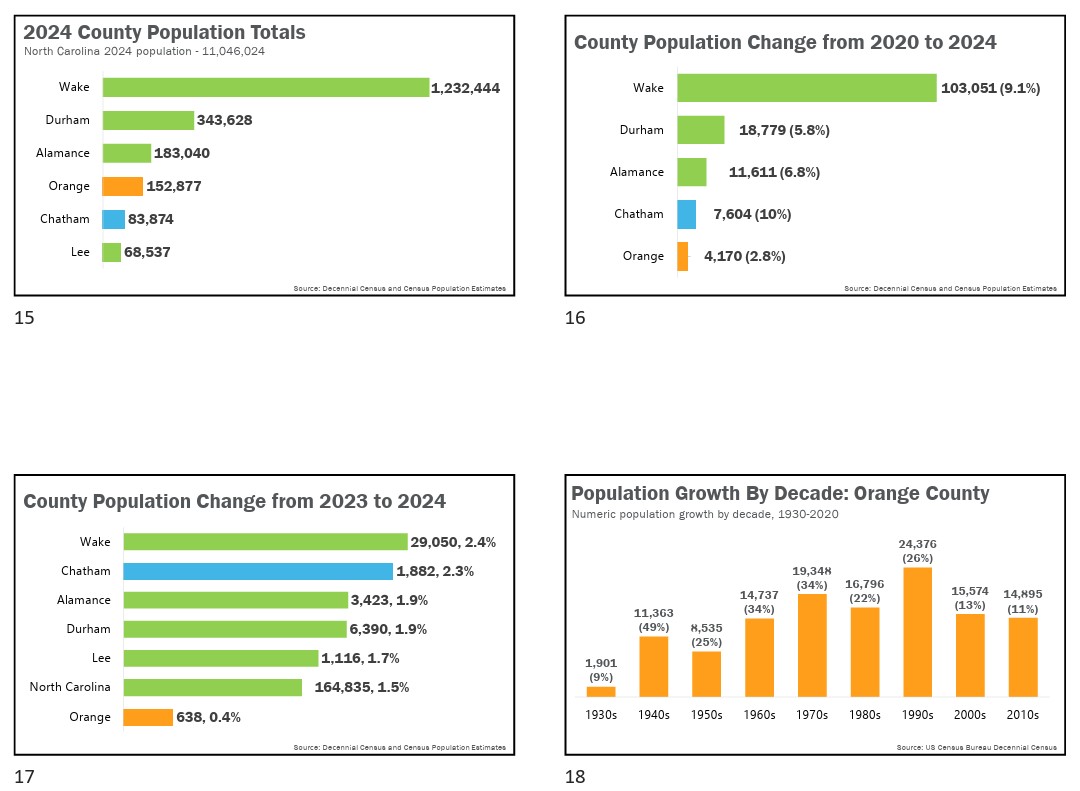

Using decennial census data and census estimates, Orange County’s 2024 population total is nearly 153,000 residents — just less than double of Chatham County’s of nearly 84,000. But Orange County’s growth is minuscule (2.8%) in the last four years compared to Chatham (10%) and its neighbors of Wake (9.1%), Alamance (6.8%) and Durham counties (5.8%). From 2023 to 2024, the county is estimated to have added just 1,638 new residents, which is 0.4% growth. Those numbers indicate that it is already tracking behind its 11% growth across the 2010s, which was already its slowest-growing year since the 1930s.

A quartet of charts presented during the Chamber’s 18th Annual State of the Community Report around population growth in the region. (Photo via the Chamber for a Greater-Chapel Hill Carrboro, data via the U.S. Census Bureau.)

Slow changes of population do not always spell bad things, and Nelson pointed out some positive aspects of the data. There were more births of new Orange County residents than deaths, and its population has more racial diversity than ever (65% white) although still lagging behind the state’s average makeup of minorities.

One “stark” trend Nelson pointed out is how Orange County’s population is rapidly skewing older. Nelson said of the county’s population growth from 2010 to 2023, 73% of the additions were residents 65 years old and up — moving seniors from nearly 11% of Orange County’s overall population to 17%.

“In some communities that’s a real problem, because you don’t have working-age people. In our community, we still do have very a young [percentage of population, as] we’re growing both our college students as well as our upper ages. But we are noticing, it isn’t necessarily folks migrating…it’s folks aging in place. This is a place that people love and they’re staying and getting older here.”

Part of these growth trends can be contributed to housing demand and an expensive market in Orange and Chatham Counties, which is a common theme through many of the chamber’s State of the Community Reports. Older residents looking to migrate to Orange County can afford more expensive homes compared to younger ones and while strides are being made to address housing, the supply is not yet meeting the demand.

Nelson said, though, Orange County’s additional population demographics help shield this from being an immediate, major red flag that this trend could be for other regions.

“I’m not concerned about that as I might be in a manufacturing community,” the chamber president said. “Many of our faculty and university leaders can work well into their 60s and 70s.”

President and CEO of the Chamber for a Greater Chapel Hill-Carrboro Aaron Nelson delivers the presentation on Wednesday, May 7, 2025. (Photo via Maggie Hobson Photography.)

Schools Improve Pandemic-Related Concerns – But Now Face Enrollment Challenges

One area that drew concerned gasps from the conference’s audience in past years was the indicators showing learning loss at Chapel Hill-Carrboro City Schools and Orange County Schools – as COVID-19 significantly affected third grade students’ reading proficiency and math scores. Especially for Black and Hispanic students, a major dip was seen upon students’ return to classrooms in 2022 alongside consistently lower end of grade testing scores.

But, as Nelson pointed out at the 2025 presentation, progress has been made. Both CHCCS and Orange County Schools’ math proficiency scores returned to pre-pandemic levels, while most racial demographics across both schools have seen reading proficiency improve from 2022 levels. For Orange County Schools, its Hispanic and Black third-graders’ reading proficiency has already matched or exceeded 2019 levels (for Black students, 37% reading at grade proficiency in 2019 vs. 38% in 2024; for Hispanic students, 26% reading at grade proficiency in 2019 vs. 33% in 2024). There are still significant gaps between minority races and white students, but Nelson said the rebounds are encouraging.

Perhaps the next challenge for the districts, though, affects all students. Enrollment for both CHCCS and Orange County is down across the last five school years, with CHCCS having 1,205 fewer students (-9.8%) and Orange County having 450 fewer (-6.1%). The losses are particularly seen in each districts’ elementary schools — which Nelson said is partially related to the housing trends in Orange County.

“There are just fewer humans ages 6 to 18 in our community,” he said, “and that’s a factor of the type and kind of housing we’re building here. It’s also a factor of folks not moving after their children leave [school]. You used to move — you’d move out of Southern Village once your kids got old enough, but now you don’t want to give up the [favorable] interest rate. So, you stay because you like it here and you don’t make way for someone with a six-year-old behind you.”

Long-term, enrollment totals are key for districts’ funding since they earn allocations on a per-pupil basis from both the county and state governments. District leaders are already grappling with how to adjust their operations on thinner budgets, and continued decreases in enrollment mean that would become the new norm.

“If you have 1,000 fewer children,” said Nelson, “and you get about $14,000 per pupil per year, that’s a $14 million problem…with the same amount of schools, the same amount of principals and the same amount of teachers. There’s not a lot of savings that happen — but the revenue is down.”

Retail Sales Don’t Rise, But Remain Strong

Since the COVID-19 pandemic, the overarching theme when discussing the retailer experience is that sales have not gotten back to normal or other factors have played a part in hampering recovery. Nelson said while the Chamber still fields many questions about what is causing this and what can be done.

“Coming out of the pandemic,” he said, “what was uncertain was whether, ‘My business is not doing great [because I’m not] offering the right product at the right price, or is it a hangover from COVID?’ Some of retailers we have talked to [say] it is tough business.

“But some of them,” Nelson added, “are [doing good sales], and our restaurant community — which had a very rough January and February — has been saying things are getting better.”

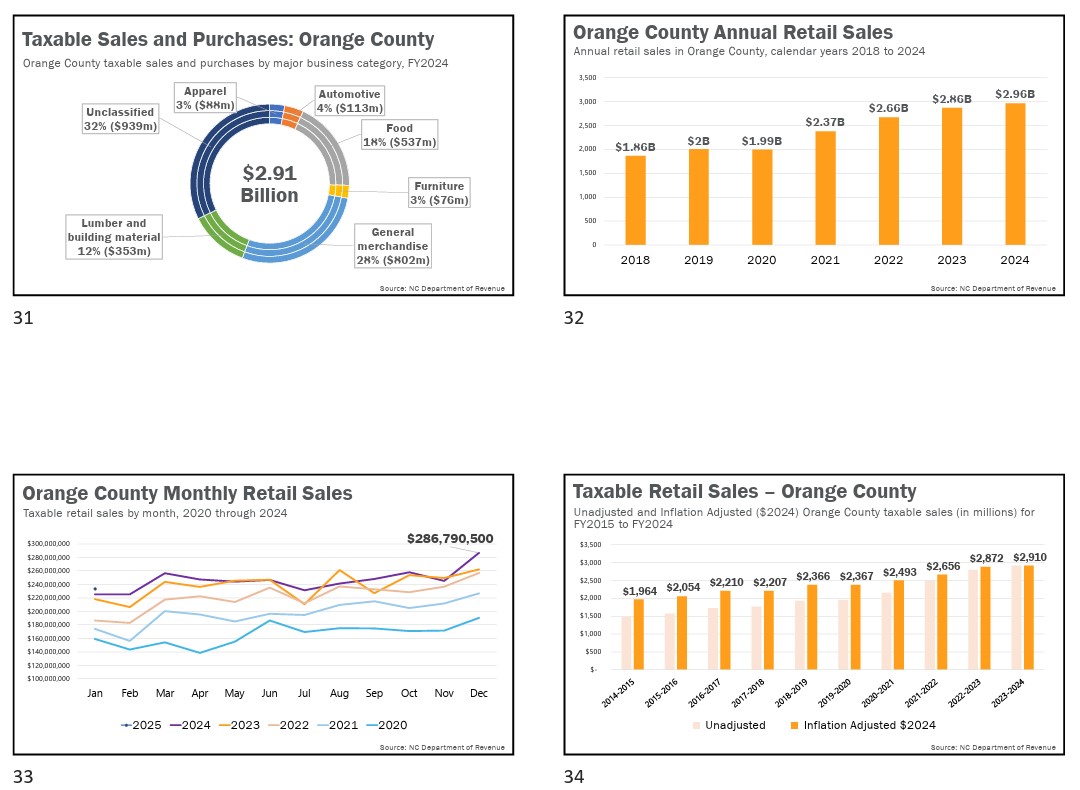

Despite it perhaps being a varied experience for retailers, the overall retail sales for Orange County are very healthy for the community in part because online purchases count toward the total. The county saw $2.91 billion in taxable sales and purchases during fiscal year 2024, netting the county government $138.6 million in sales tax collections. Even though it was the flattest growth since the boom from 2020 to 2021, especially once adjusted for inflation, Nelson said that is a remarkable level to reach.

“Every year, year over year, has been better than the previous year,” he said. “Retail sales are growing and December was the best December that there’d ever been in retail sales in this market, and this January was the best January ever. Now, retailers will tell us there’s a challenge, but retail sales are through the roof. Some of that is because of groceries…all of the construction materials when we build an apartment complex or new home, that gets paid to the county delivery of sales and Orange County benefits. We have strong wages here, which means we have strong retail sales here.”

Worth noting: while Orange County’s taxable sales growth is very healthy, neighboring Chatham County is absolutely booming as the region becomes more developed for housing and businesses. From 2019 to 2024, Chatham’s taxable sales grew 84% and reached $70.4 million in fiscal year 2024. Based on its population changes, those numbers are expected to push even higher.

A quartet of charts presented during the Chamber’s 18th Annual State of the Community Report about the retail sales in Orange County. (Photo via the Chamber for a Greater-Chapel Hill Carrboro, data via the North Carolina Department of Revenue.)

Childcare Struggles

As a precursor to a longer discussion set to be held later this year, the Chamber also highlighted the challenges facing the childcare industry within the broader Orange County community. Robin Pulver of the Orange County Partnership for Young Children and Anna Mercer-McLean of the Community School for People under Six took part in a mini-panel discussing how despite the prevalence of childcare options available in the community (roughly 12 centers per 1,000 children under the age of 5), both families and centers are struggling. Pulver cited how even with anecdotes about high demand, roughly 50% of spaces are available at local childcare centers — but the centers may not be in areas of the community where that need is greatest or offer infant care. Another prohibitive barrier can be the cost of childcare.

According to data from the 2024 rankings by the Robert Wood Johnson Foundation, childcare costs for a two-child household making the median household income would take up 32% of that income. Consider that against 55% of Orange County’s households are cost-burdened — paying more than 30% of their household income on gross rent — and childcare could suddenly become a luxury some cannot afford. Parents staying home to take care of children adds to a tricky cycle of removing them from the workforce, which adds up. The U.S. Chamber of Commerce Foundation, NC Chamber Foundation and NC Child published a report in 2024 detailing how North Carolina is losing an estimated $5.65 billion in economic activity each year because of the lack of childcare resources available to families.

But as Pulver and Mercer-McLean pointed out, running childcare business is also expensive as they contend with the same rising prices as the rest of the country has in recent years. The search to find qualified staff may be more difficult than ever, said Mercer-McLean, who detailed the importance of finding “experienced teachers” for children in these centers compared to simple “babysitters.” Increasing pay to attract more staff might mean cuts somewhere else in operating budgets or raising prices even further for families, which contributes to an unaffordable cycle.

To close out the discussion, Mercer-McLean recommended local leaders and business owners visit some local childcare centers to see their atmospheres and learn more about their situations first-hand. Pulver, meanwhile, urged them to consider providing a childcare stipend to employees as part of a benefits package to help reduce the cost for families and help all parties involved.

The full 18th Annual State of the Community Report presentation and data book can be accessed on the Chamber for a Greater Chapel Hill-Carrboro’s website.

Featured photo via Maggie Hobson Photography.

Chapelboro.com does not charge subscription fees, and you can directly support our efforts in local journalism here. Want more of what you see on Chapelboro? Let us bring free local news and community information to you by signing up for our newsletter.