The Orange County government recently took its latest steps in trying to update its property tax assessment process, as county commissioners approved the creation of a work group on Aug. 26.

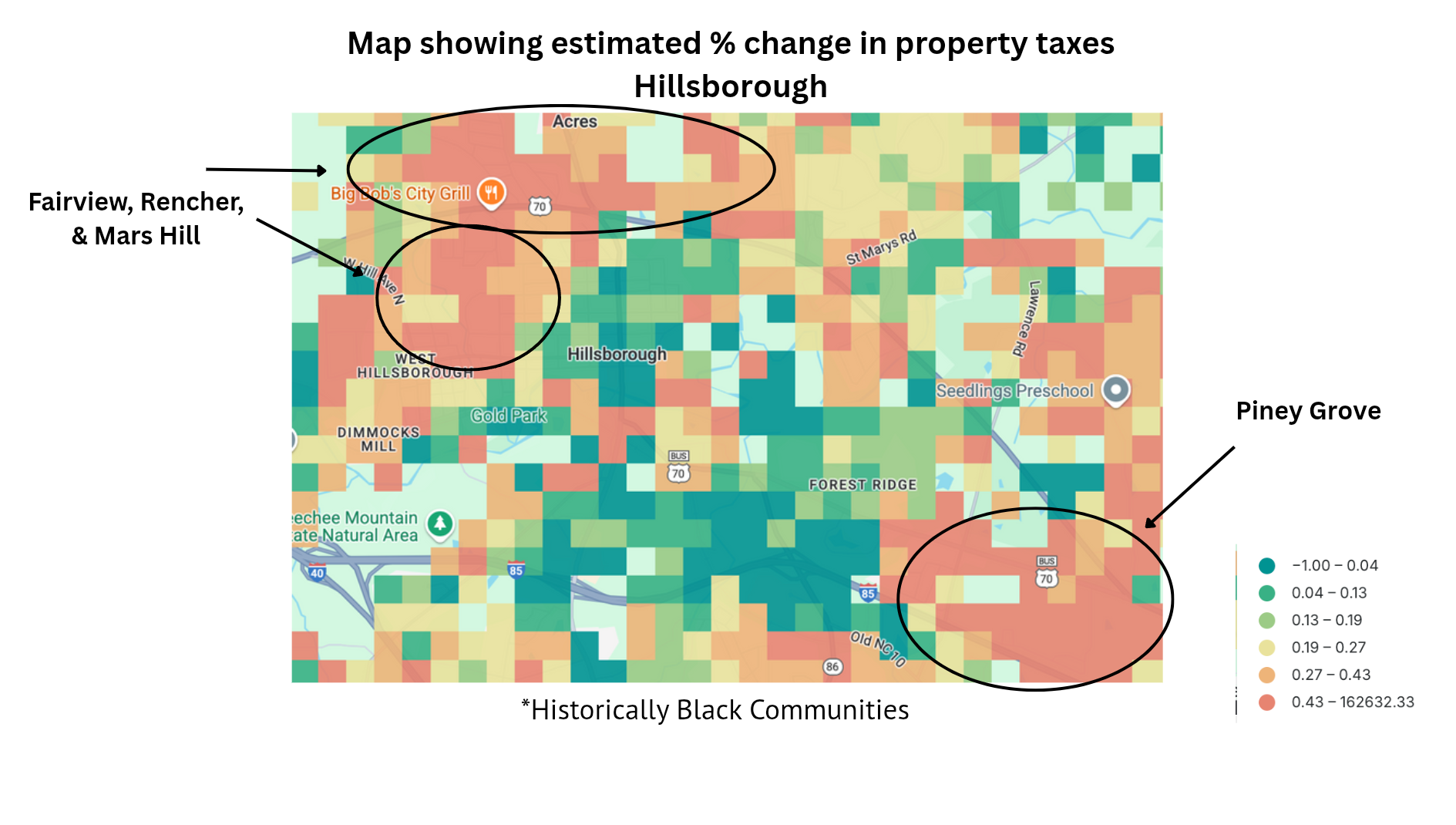

After the latest property tax values were shared in April, a group called the Orange County Property Tax Justice Coalition stepped up to dig into data around historically Black neighborhoods. Members of the coalition noticed several values and tax bills skewed high in the 2021 cycle and helped appeal to lower 140 residences’ values by $7 million collectively. When similar inequities were seen in the 2025’s cycles early data, the coalition formed to sound an alarm and petition the county government to change its assessment process.

The county tax office conducts the subjective process with appraisers, following the state law to determine the market values based on sales ratios and other metrics. But after reviewing the coalition’s early data, Orange County’s elected officials collectively agreed to request further studies and an outside expert to review how a more equitable assessment can be made for all residents.

“We have, as a group, identified this as our key priority for this year – even more so than the comprehensive plan update,” said Chair of the Orange County Commissioners Jamezetta Bedford during the Aug. 26 meeting.

The Tax Assessment Work Group, which was approved as part of the board’s business, will have more than a dozen members that include: Orange County elected officials, staff, housing representatives and four residents. The group’s charge is to serve as an advisory body to a consultant yet to be hired by the country, who will develop recommendations to “improve and strengthen the accuracy and transparency of Orange County’s property tax assessment process.”

Since the spring, the county government conducted both countywide and neighborhood-level equity studies and offered tech support to residents to help file appeals of their property values. Ten of the 19 historically Black neighborhoods flagged by the OCPTJC were also identified by the tax office in the equity study as needing closer review – as well as several other areas scattered throughout the county where sales ratios appeared to drastically skew the value of homes.

A slide from a May presentation made by the Orange County Property Tax Justice Coalition, depicting the percentage of change in total property value by plots in Hillsborough. The historically Black neighborhoods are circled. (Photo via the Orange County Property Tax Justice Coalition.)

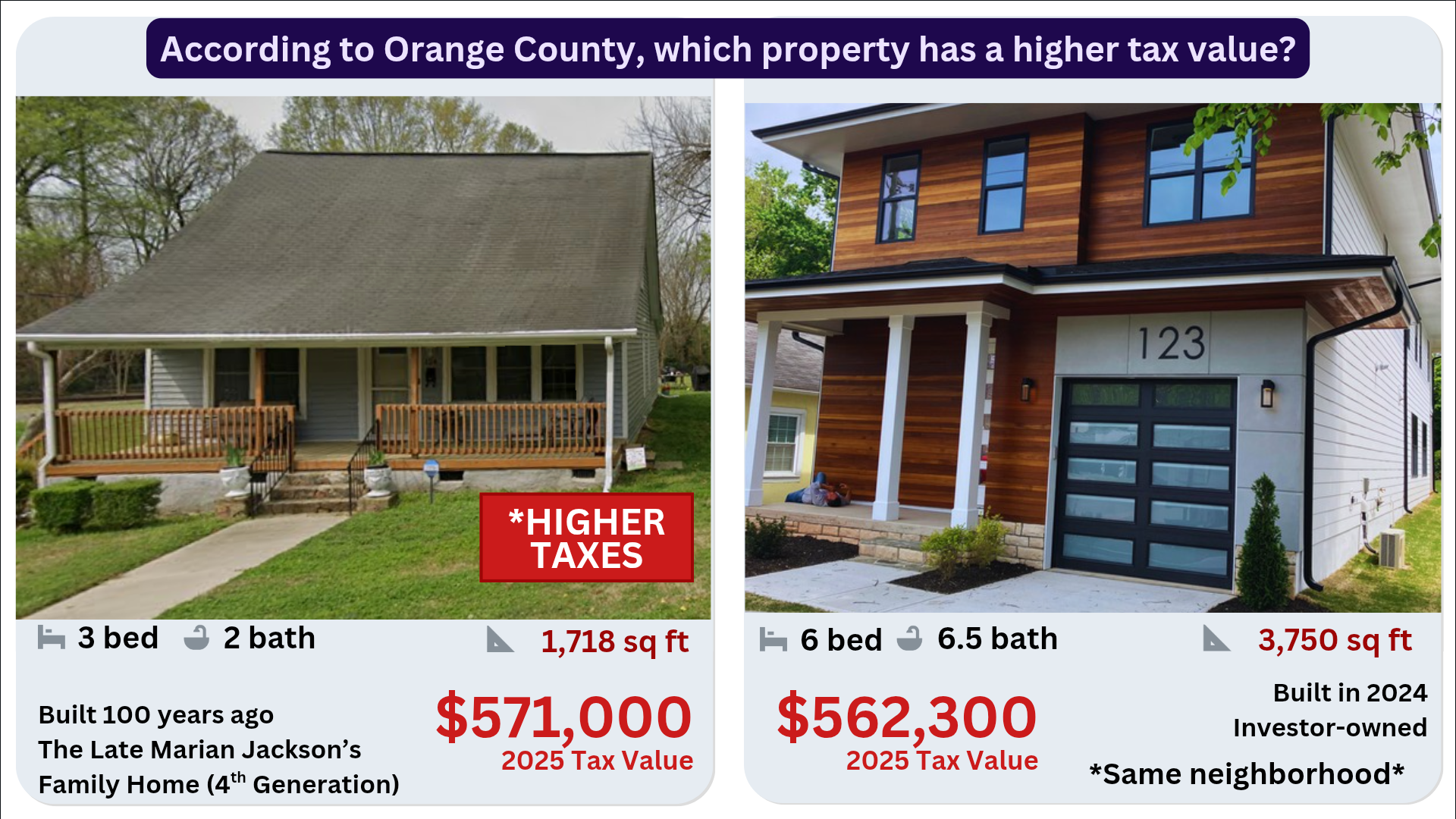

An example of two Chapel Hill residences in a historically Black neighborhood and the differences between their features and property taxes following the 2025 revaluation. (Photo via the Orange County Property Tax Justice Coalition.)

County Manager Travis Myren presented to the county commissioners how those efforts are gradually leading to more appeals. The 2025 cycle has led to 4,256 total appeals – nearly 2,200 more than in the 2021 revaluation cycle – and led to a median residential decrease of $25,990 of value so far. Several appeal decisions are still pending (944), with all projected to be completed by mid-December before the tax bills are due in January 2026.

While those efforts help some residents in the short-term, Bedford said the goal is to find a more democratic and transparent assessment process going forward. She described the creation of the work group as a mid-term step in updating the Orange County tax office’s approaches before the next revaluation cycle in 2029.

“To have 171 neighborhoods that need to be reviewed at this time in this process,” Bedford said, “I’m hopeful that there’s a way to improve [the tax office’s approach.] I don’t mean to fault – they have been working night and day on this – but [could we] be able to find us better software, or starting from the very beginning [determine] what should the design be?

“Now that we’ve seen some of the data – and it does seem so random on the map – is there a better way to design a reval process,” the board chair asked. “Is there a better way to…design the neighborhoods? Do they need redrawing [within a system?]”

During the meeting, many commissioners admitted that the current process and methods used to determine homes’ market values are very complicated and out of their expertise. Commissioner Earl McKee volunteered this as the case for himself, and said he believes it is important to direct both the working group and consultant toward answering challenging questions.

“How are we going to define what we’re looking for,” McKee asked his colleagues. “What I’m looking for is very simple: how do we get the [anomaly] with the higher-wealth homes with 30 to 50% increases [in property taxes], and the lower-wealth communities with 70, 80, 90, 150% increases?

“I don’t know how to reconcile what is partially gentrification, partially natural growth and the disparities I see that are driving people out of their homes,” the longest-tenured commissioner added.

Commissioner Jean Hamilton responded by saying she believes having an outside expert evaluate Orange County’s situation will be informative – as long as the right company is found.

“What I want to see is a consultant who can tell us about the way we do our assessments, the difference between what’s coming from gentrification, demand from outside and what comes from our own process,” she said.

As part of the work group’s approval, the county commissioners debated whether to have the collection develop the request for proposal (RFP) for a consultant or to have Orange County staff do it. Bedford suggested letting the invested community members craft that document, while Hamilton and others shared concerns that would drag the response out.

“I just think we owe it to the community sooner rather than later,” Hamilton said, “to understand what happened with this last reval and what we’re going to do differently.”

While some of the Tax Assessment Work Group’s positions are already filled or identified with volunteer candidates, the county is taking applications for residents willing to serve as District 1 and District 2 representatives in the collective. Interested community members can apply until Sep. 30 and the working group’s membership will be approved during the Board of County Commissioners’ Oct. 7 meeting.

More details on Orange County’s 2025 revaluation can be found on the county government’s website. Public property value assessments in the county can be found here.

Chapelboro.com does not charge subscription fees, and you can directly support our efforts in local journalism here. Want more of what you see on Chapelboro? Let us bring free local news and community information to you by signing up for our newsletter.