As unemployment rates rise and the stock market plummets, some local economists are left comparing the current crisis to the 2008 Great Recession.

Patrick McHugh is the Senior Economic Analyst for the North Carolina Budget and Tax Center, which is part of the North Carolina Justice Center.

McHugh said the coronavirus pandemic has had an incredibly rapid impact on North Carolina.

“We’ve never seen, certainly not in my experience, this fast of an onset of economic downturn,” McHugh said.

He said the number of unemployment filings is unprecedented. Since March 16, there have been over 266,000 unemployment claims due to COVID-19 in North Carolina.

McHugh said the sheer amount of people filing for unemployment is overwhelming the system – and there’s more to come.

“The actual employment numbers lag by a couple of months,” McHugh said. “We’re not going to see the official headline unemployment rate for a little while. Even again with the new unemployment insurance filings, I’m sure there’s a lot of folks out there that intend to file – that need to file – that haven’t been able to get through the system.”

One of the industries that has been hit the hardest during this pandemic are service-based businesses like restaurants, bars and local retailers, but McHugh said this downfall is just the beginning for service workers.

“Unfortunately a lot of this is really in some ways just the tip of the iceberg with the hammer falling on folks in retail and food service and the kind of customer services that are taking the brunt of it at the very beginning of this,” McHugh said.

He said the longer this national crisis drags on, the harder and longer the effects are likely to be felt.

When comparing this financial hit to the 2008 recession, the biggest difference is the pace of the economic downfall.

“That last downturn was slow building and eventually hit a crescendo in mid-2008 but it was a long time in the build-up,” McHugh said. “Whereas this, you look at the projections and two weeks ago they were saying ‘this is going to trim a couple percent off the GDP.’ Two, three weeks ago they weren’t even projecting a recession. Now you’ve got serious economists out there saying this could be worse than the Great Depression.”

McHugh said the rundown of the stock market has been faster than anything previously seen in modern history.

He said this pandemic is showing the country’s economic vulnerability and lack of preparation for an economic disaster. He said this is all made worse as many communities never had the chance to recover after the 2008 recession.

“The wages have been so stagnant and there’s been so little growth of middle-income jobs in the last decade,” McHugh said. “You have a lot of folks out there that we’re just barely scraping by, if that, and so they have no financial or economic cushion to fall back on when something like this drops out of the sky.”

While the pandemic may be hitting the financial markets faster than the Great Recession, McHugh said the magnitude of government response has, thankfully, been much larger.

“The stimulus bill before coming out of the Great Recession was 800-billion dollars,” McHugh said. “This is two-trillion dollars.”

But he still doesn’t think this one bill is going to be enough. He thinks too many of these funds are going towards supporting large corporations when what the general public needs is cash in their pockets – especially when unemployment systems currently in place are, in his words, ‘woefully inadequate.’

“We never really built a system, particularly in states like North Carolina, to really replace wages,” McHugh said. “I mean we have one of the stingiest in terms of maximum amount of benefits and duration of benefits in the country. We’re one of the absolute worst.”

McHugh said our system isn’t set up to help families shoulder financial burden in times of hardship and this is counterproductive. He said unemployment insurance isn’t just a way to support individuals, but also a form of economic stimulus – how we keep the economy moving when a large number of people lose their jobs.

“So you’ve got to keep money flowing into people’s pockets so that they can keep spending it in the economy,” McHugh said.

McHugh said he doesn’t know what the long-term consequences of this pandemic are going to be. What he does know is that it’s going to take a lot of work to dig the country out of this financial hole.

“I think you’re probably going to see a longer tail to this, a longer negative consequence to it, that could hit housing markets that could hit industries well beyond just the consumer services that are the first ones in towns like Chapel Hill to take it in the teeth.”

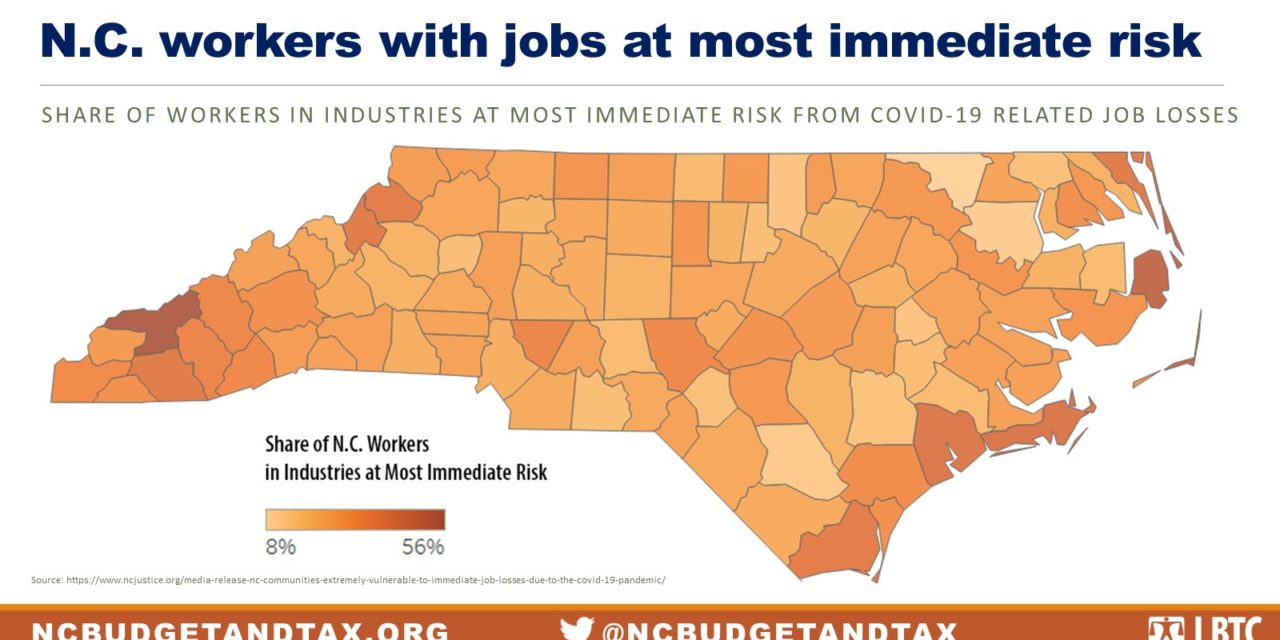

(Photo courtesy of the NC Budget and Tax Center)

Note: 97.9 The Hill has been Chapel Hill and Orange County’s daily source for free local news since 1953. Please consider making a donation to continue supporting important local journalism like this.