In the end, the mighty bull was slayed by a tiny virus.

The longest bull market in U.S. history can now be said to have lasted almost 11 years and rewarded investors with a return of 529% based on the performance of the S&P 500, including dividends.

The bull officially ran from March 9, 2009, until Feb. 19, 2020, when it began the 26.7% dive that as of Thursday has taken it into bear market territory.

The record run for stocks appeared fairly smooth but there were some hiccups. The bull survived a downgrade to the U.S. credit rating and the European debt crisis in 2011, two slowdowns in China (2015, 2016) and a market freakout over higher interest rates in late 2018, after investors had been spoiled by ultra-low rates for a decade.

But the coronavirus scare flooded the market with too much uncertainty. Investors hate uncertainty more than anything, as the Wall Street saying goes, and the first reaction for many to it is to sell. And this new virus has certainly been uncertain.

The coronavirus has infected around 128,000 people worldwide and killed over 4,700. The death toll in the U.S. climbed to 39, with over 1,300 infections. For most people, the virus causes only mild or moderate symptoms, such as fever and cough. For some, especially older adults and people with existing health problems, it can cause more severe illnesses, including pneumonia. The vast majority of people recover from the virus in a matter of weeks..

Corporate profits are the lifeblood of the stock market, and they are getting hit on two ends. On one side, the virus has snarled supply chains around the world, with factories shut due to workers out on quarantine. That gives companies less things to sell. On the other side, the virus is causing the cancellation of events from professional basketball games to concerts. Two presidential candidates will hold a debate this weekend without a live audience. And worried consumers are staying away from stores, public gathering spaces and flights, wiping away demand.

On Thursday, the S&P 500 fell 260 points, or 9.5%. It was the index’s biggest percentage drop since Black Monday in 1987.

The amazing rally for stocks altered the make-up of the market, elevating technology stocks to a dominating position and lessening the weight of industrial and energy companies.

Back in March 2009, the biggest companies were familiar names with long histories in traditional industries like oil (Exxon Mobil) and makers of detergent and other household products (Procter & Gamble).

There is, however, one company that’s among the most valuable today that was also among the Big Five back then: Microsoft.

These days, technology companies dominate the top five, as they do the market overall. After Microsoft, there’s Apple, Amazon, Google’s parent company Alphabet, and Facebook. At the beginning of the bull market, Apple’s iPhone was just two years old and Google had just released its Android operating system for smartphones.

Related Stories

‹

![]()

Wall Street See-saws Up and Down as Volatility Retains GripStocks are see-sawing between gains and losses in midday trading on Wall Street Thursday, but the moves are more subdued than the wild jabs that have dominated recent weeks. At least for now. The S&P 500 was up 1.5% after bouncing back from a loss of 3.3%. That would be a notable change in normal […]

![]()

Oil Market in Turmoil as Price Falls Below ZeroThe market for U.S. crude was in turmoil Tuesday, with one contract trading below zero, as investors worried about full storage facilities and a collapse in demand as the pandemic leaves factories, automobiles and airplanes idled. The extreme volatility in energy markets highlighted investors’ broad concerns about the duration of the coronavirus outbreak and its […]

FBI Reaches Out to Sen. Burr Over Stock Sales Tied to VirusThe FBI has reached out to Sen. Richard Burr about his sale of stocks before the coronavirus caused markets to plummet, a person familiar with the matter said Monday. The outreach suggests federal law enforcement officials may be looking to determine whether the North Carolina Republican exploited advance information when he dumped as much as […]

Global Stocks Turn Lower after Rise in Virus-related DeathsStronger than anticipated Chinese economic data briefly shored up stocks on Tuesday, but a worrying increase in the number of Spanish deaths linked to the COVID-19 disease saw market sentiment sink back again. The mood in markets seems tightly linked to evidence about the spread of the new coronavirus pandemic. That was evident with the […]

![]()

Stocks, Oil Plunge Over Global Fight for Crude ProductionGlobal stock markets and oil prices plunged Monday after a fight among major crude-producing nations jolted investors who already were on edge about the surging costs of a virus outbreak. The main stock indexes in Britain and Germany were down by almost 7%. Japan’s benchmark closed down 5.1% while Australia’s lost 7.3% and the Shanghai […]

5 Things We Know and Still Don’t Know About COVID, 5 Years After It AppearedCOVID-19 is less deadly than it was in the pandemic’s early days. But the virus is evolving, meaning scientists must track it closely.

Wall Street Opens Higher as Some Calm Returns After the Market’s Worse Loss in Almost 2 YearsWall Street appears poised to return to less chaotic trading Tuesday after a huge sell-off to start the week.

Tracking the Number of Coronavirus Cases in North Carolina

COVID-19 Cluster Reported at UNC's Avery Residence HallUNC has identified a cluster of COVID-19 cases at Avery Residence Hall on campus. This is the second COVID-19 cluster identified at UNC in 2021 and the first since the spring semester began on January 19. Earlier this month, a cluster was identified at Carmichael Residence Hall between students who lived on campus during winter […]

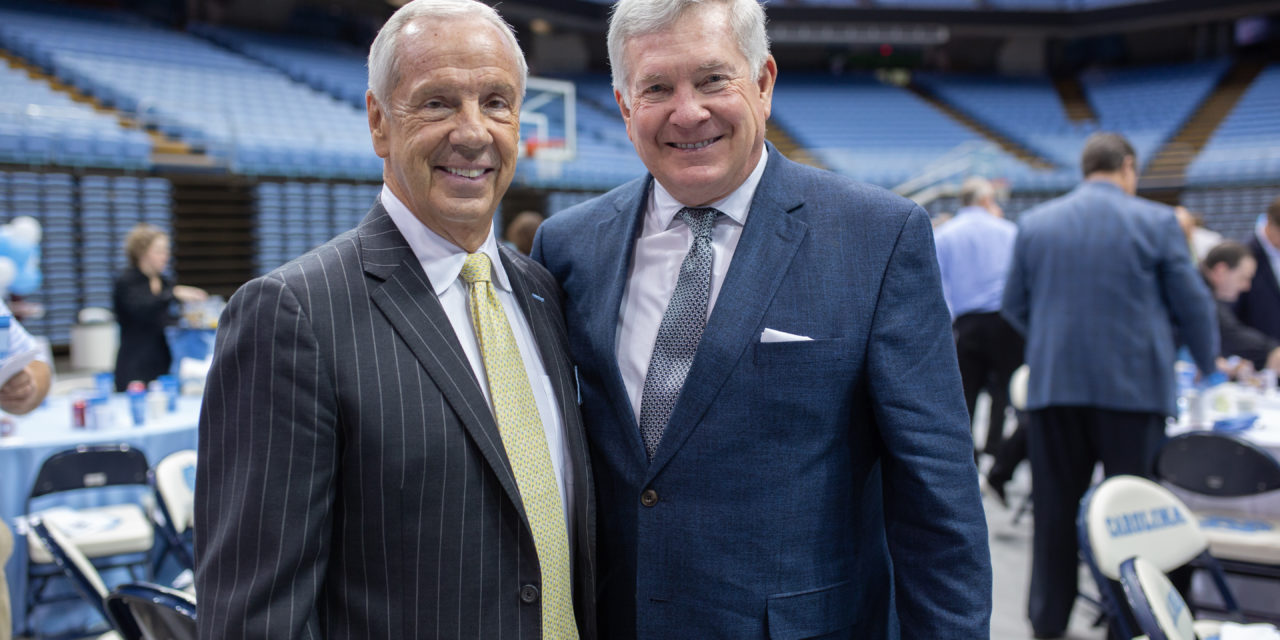

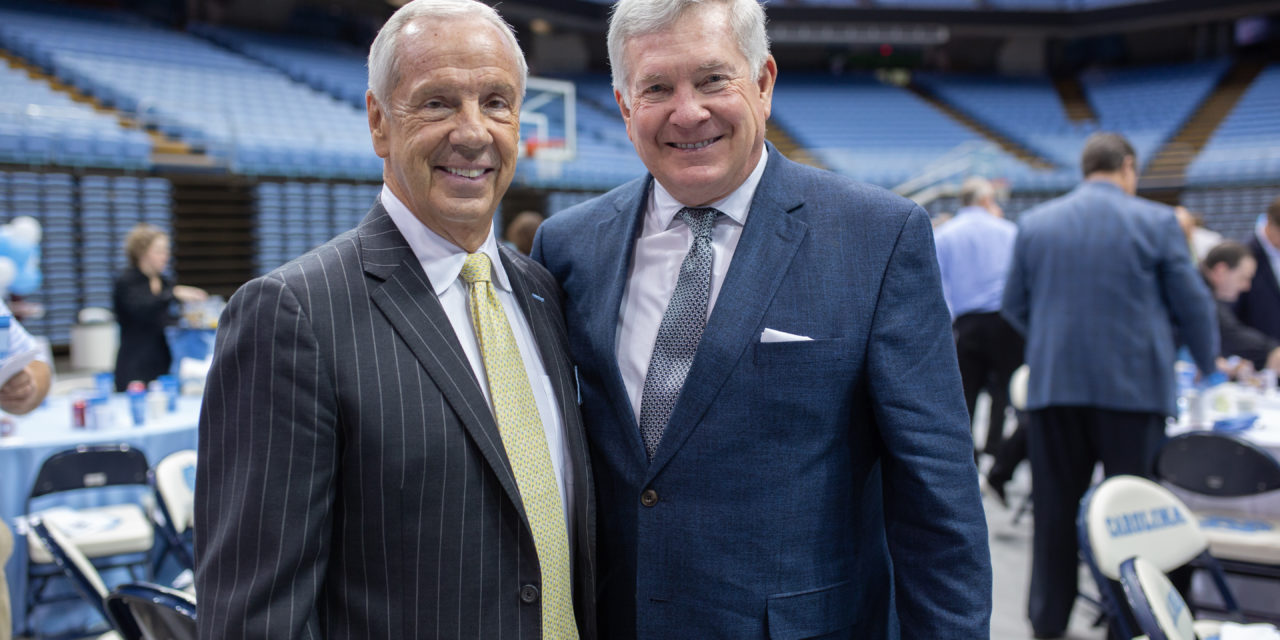

Mack Brown, Roy Williams Receive First Doses of the COVID-19 VaccineUNC coaches Mack Brown and Roy Williams have received their first dose of the COVID-19 vaccine, the university confirmed on Friday. “I think that everyone who has the opportunity to take the vaccination should,” Williams said in a Zoom call with reporters. Brown, 69, and Williams, 70, are eligible to receive the vaccine thanks to […]

›