Written by CHRISTOPHER RUGABER

An inflation gauge that is closely monitored by the Federal Reserve jumped 6.4% in February compared with a year ago, with sharply higher prices for food, gasoline and other necessities squeezing Americans’ finances.

The figure reported Thursday by the Commerce Department was the largest year-over-year rise since January 1982. Excluding volatile prices for food and energy, so-called core inflation increased 5.4% in February from 12 months earlier.

Robust consumer demand has combined with shortages of many goods to fuel the sharpest price jumps in four decades. Escalating the inflation pressures, Russia’s invasion of Ukraine has disrupted global oil markets and accelerated prices for wheat, nickel and other key commodities.

The inflation spike took a toll on consumers, whose spending in February rose just 0.2%, down from a much larger 2.7% gain in January. Adjusted for inflation, spending actually fell 0.4% last month.

Yet Americans’ overall incomes rose 0.5% in February, the highest gain since November and up from just 0.1% in January. Wages and salaries jumped 0.8%, the most in four months.

Businesses have been raising pay to attract and keep employees — a trend that is benefiting workers but also giving employers cause to raise prices to offset their higher labor costs. That cycle is helping fuel inflation.

Last month, food costs climbed 1.4%, the most in nearly two years. Energy costs spiked 3.7%, the biggest such increase since October.

The Federal Reserve responded this month to the inflation surge by raising its benchmark short-term interest rate by a quarter-point from near zero, and it’s likely to keep raising it well into next year. Because its rate affects many consumer and business loans, the Fed’s rate hikes will make borrowing more expensive and could weaken the economy over time.

Michael Feroli of JPMorgan is among economists who now think the Fed will raise its key rate by an aggressive half-point in both May and June. The central bank hasn’t raised its benchmark rate by a half-point in two decades, a sign of how concerned it has become about the persistent surge in inflation.

On a monthly basis, prices rose 0.6% from January to February, up slightly from the previous month’s increase of 0.5% and matching the highest monthly figure since 2008. Core prices rose 0.4%, down from a 0.5% increase in January.

Gas prices have soared in the past month in the aftermath of Russia’s invasion, which led the United Kingdom and the Biden administration to ban Russia’s oil exports. The cost of a gallon of gas shot up to a national average of $4.24 a gallon Wednesday, according to AAA. That’s up 63 cents from a month ago, when it was $3.61.

On Thursday, President Joe Biden is expected to order the release of up to 1 million barrels of oil a day from the nation’s strategic petroleum reserve in an effort to reduce gas prices.

Thursday’s report follows a more widely monitored inflation gauge, the consumer price index, that was issued earlier this month. The CPI jumped to 7.9% in February from a year ago, the sharpest such increase in four decades.

Many economists still expect inflation to peak in the coming months. In part, that’s because price spikes that occurred last year, when the economy widely reopened, will begin to make the year-over-year price increases appear smaller. Yet Fed officials project that inflation, as measured by its preferred gauge, will still be a comparatively high 4.3% by the end of this year.

Related Stories

‹

Will Europe’s Ban on Russian Diesel Hike Global Fuel Prices?Written by DAVID McHUGH Europe is taking another big step toward cutting its energy ties with Russia, banning imports of diesel fuel and other products made from crude oil in Russian refineries. The European Union ban takes effect Feb. 5 following its embargo on coal and most oil from Russia. The 27-nation bloc is trying to sever […]

US Consumer Inflation Eased to 7.7% Over Past 12 MonthsWritten by PAUL WISEMAN Price increases moderated in the United States last month in the latest sign that the inflation pressures that have gripped the nation might be easing as the economy slows and consumers grow more cautious. Consumer inflation reached 7.7% in October from a year earlier and 0.4% from September, the Labor Department […]

![]()

As the Causes of US Inflation Grow, so Do the DangersWritten by CHRISTOPHER RUGABER What keeps driving inflation so high? The answer, it seems, is nearly everything. Supply chain snarls and parts shortages inflated the cost of factory goods when the economy rocketed out of the pandemic recession two years ago. Then it was a surge in consumer spending fueled by federal stimulus checks. Then Russia’s invasion […]

![]()

US Inflation Slows for 2nd Month but Remains Stubbornly HighWritten by CHRISTOPHER RUGABER U.S. inflation slowed for a second straight month on a sharp fall in gas prices, yet excluding energy most other items got more expensive in August, a sign that inflation remains a heavy burden for American households. Consumer prices surged 8.3% in August compared with a year earlier, the government said Tuesday, down […]

![]()

Biden Aims To Do What Presidents Often Can’t: Beat InflationWritten by PAUL WISEMAN, CATHY BUSSEWITZ and CHRISTOPHER RUGABER LBJ tried jawboning. Richard Nixon issued a presidential edict. The Ford administration printed buttons exhorting Americans to “Whip Inflation Now.” Over the years, American presidents have tried, and mostly floundered, in their efforts to quell the economic and political menace of consumer inflation. Now, President Joe […]

![]()

US to Release 50 Million Barrels of Oil To Ease Energy CostsWritten by JOSH BOAK and COLLEEN LONG President Joe Biden on Tuesday ordered 50 million barrels of oil released from the nation’s strategic reserve to help bring down energy costs, in coordination with other major energy consuming nations, including China, India and the United Kingdom. The move is aimed at global energy markets, but also […]

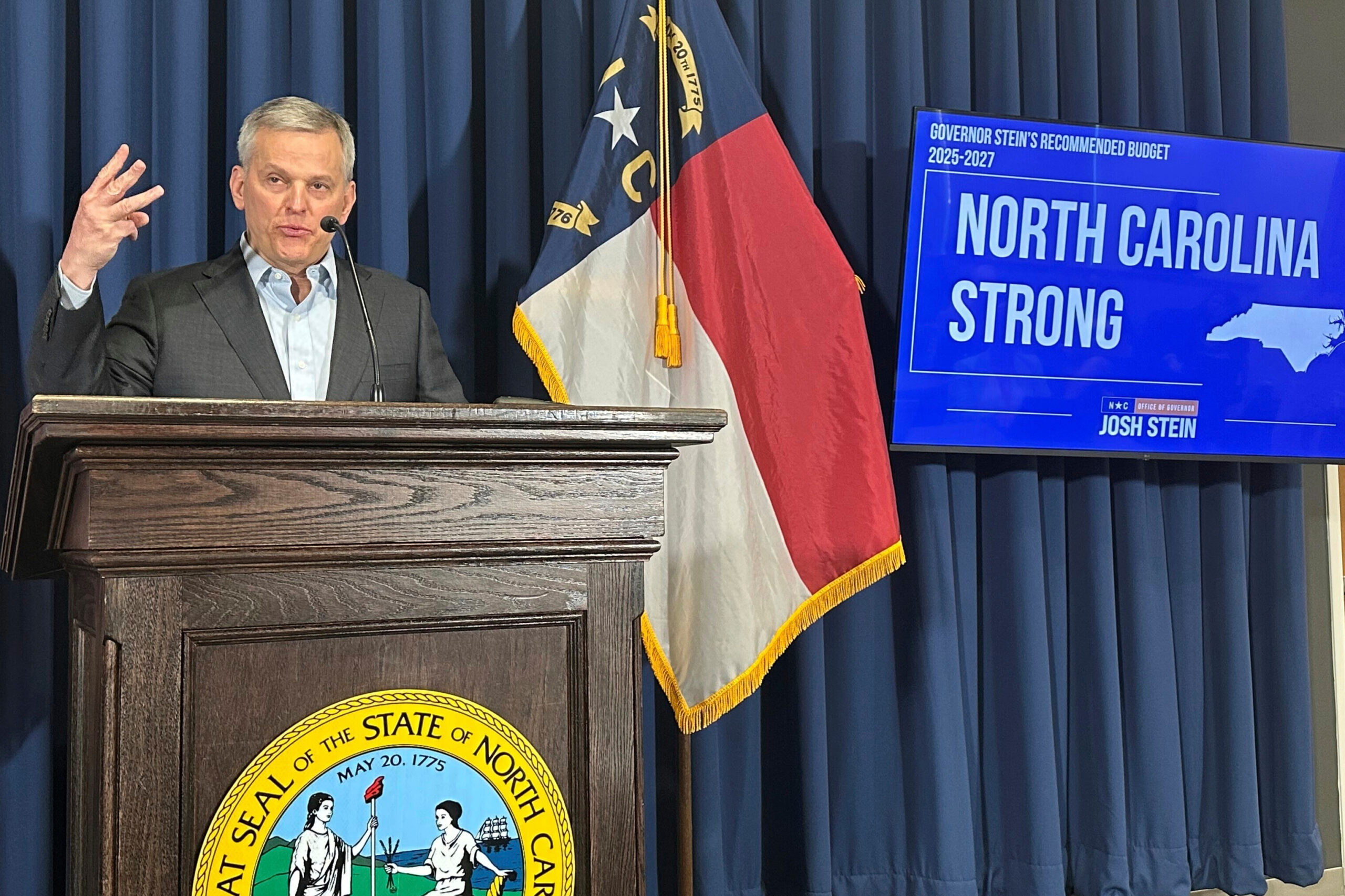

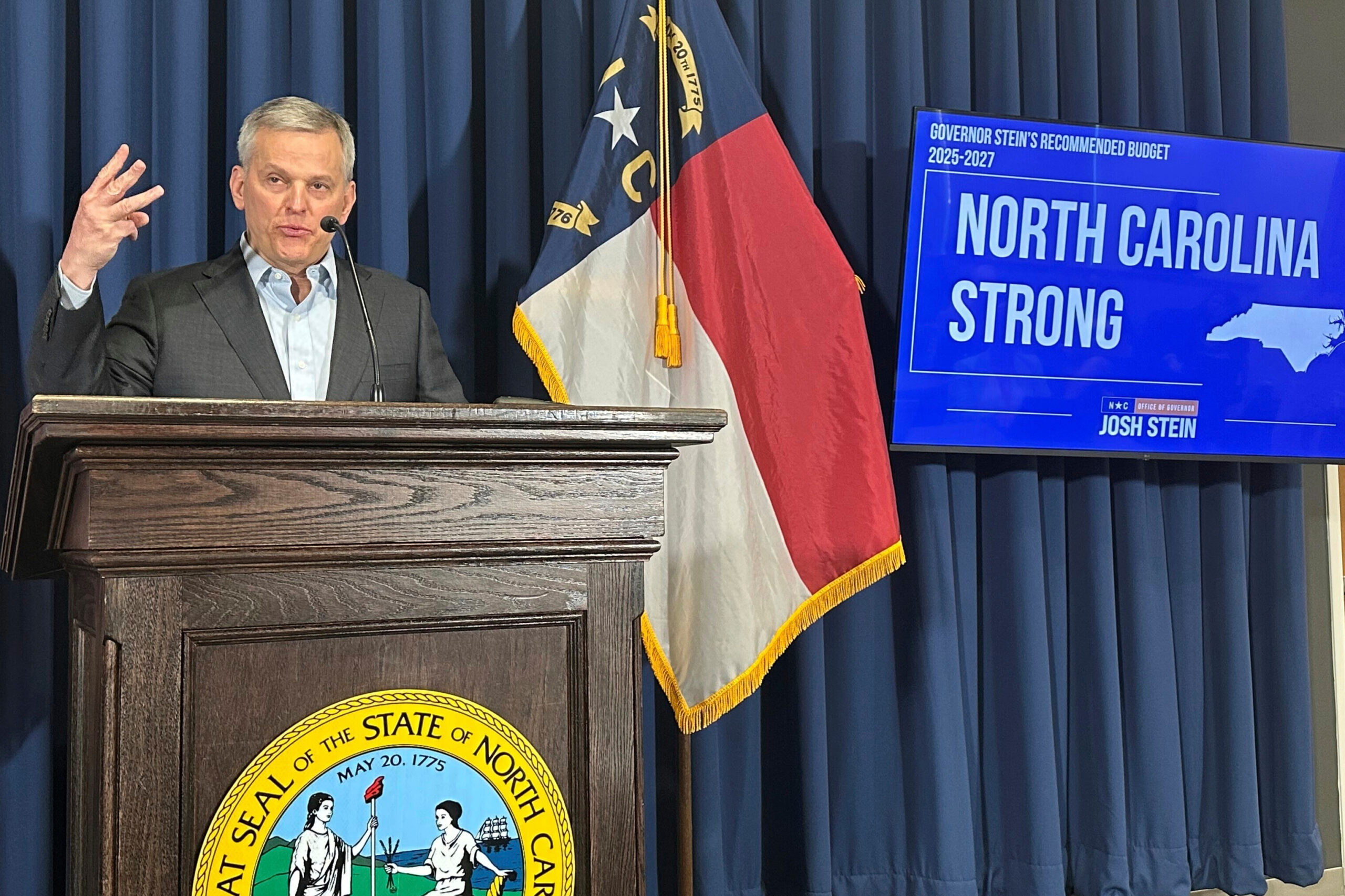

New North Carolina Governor Seeks To Freeze Tax Cuts, Phase Out School Vouchers in BudgetNorth Carolina Democratic Gov. Josh Stein urged Republicans to roll back upcoming income tax rate cuts and private school vouchers.

Trump Moves With Dizzying Speed on His To-Do List. But There Are Warning Signs in His First MonthAt the one-month mark, President Donald Trump has moved with dizzying speed and blunt force to reorder American social and political norms.

North Carolina Home Insurance Premium Base Rates Increasing About 15% by Mid-2026Base rates for North Carolina homeowners' insurance premiums will increase on average by about 15% by mid-2026, state leaders said last week.

US Inflation Slowed Again in July, Clearing the Way for the Fed To Begin Cutting RatesWritten by CHRISTOPHER RUGABER Year-over-year inflation reached its lowest level in more than three years in July, the latest sign that the worst price spike in four decades is fading and setting up the Federal Reserve for an interest rate cut in September. Wednesday’s report from the Labor Department showed that consumer prices rose just 0.2% from […]

›