Written by GARY D. ROBERTSON

The state House on Thursday overwhelmingly backed legislation that would give additional state tax breaks to businesses that took federal loans to weather the COVID-19 pandemic. But the Senate isn’t yet fully on board with the idea, which comes with a hefty price tag.

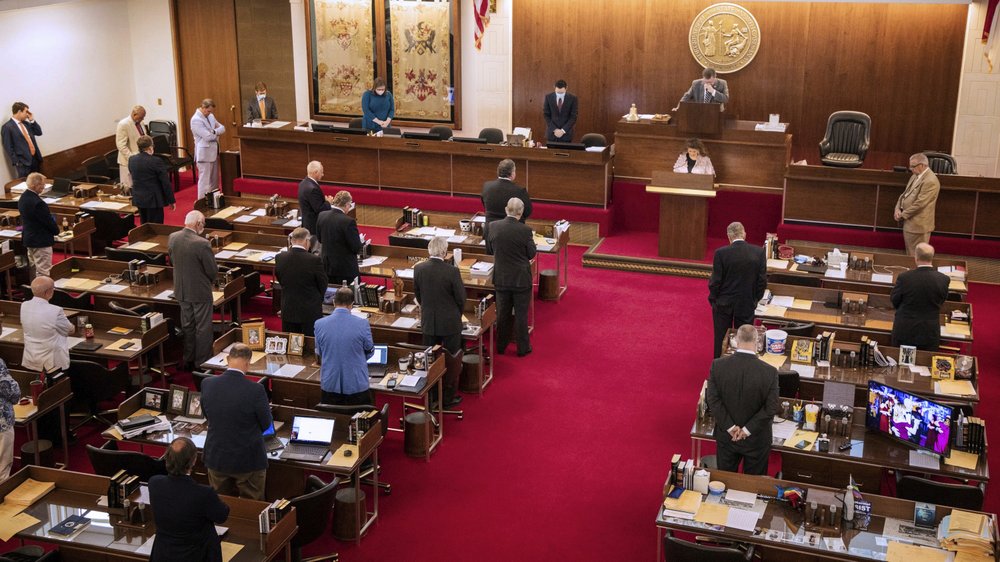

Supporters of the House measure, including Republican Speaker Tim Moore and top Democrats, held a news conference before the initial floor vote on the measure related to Payroll Protection Program loans.

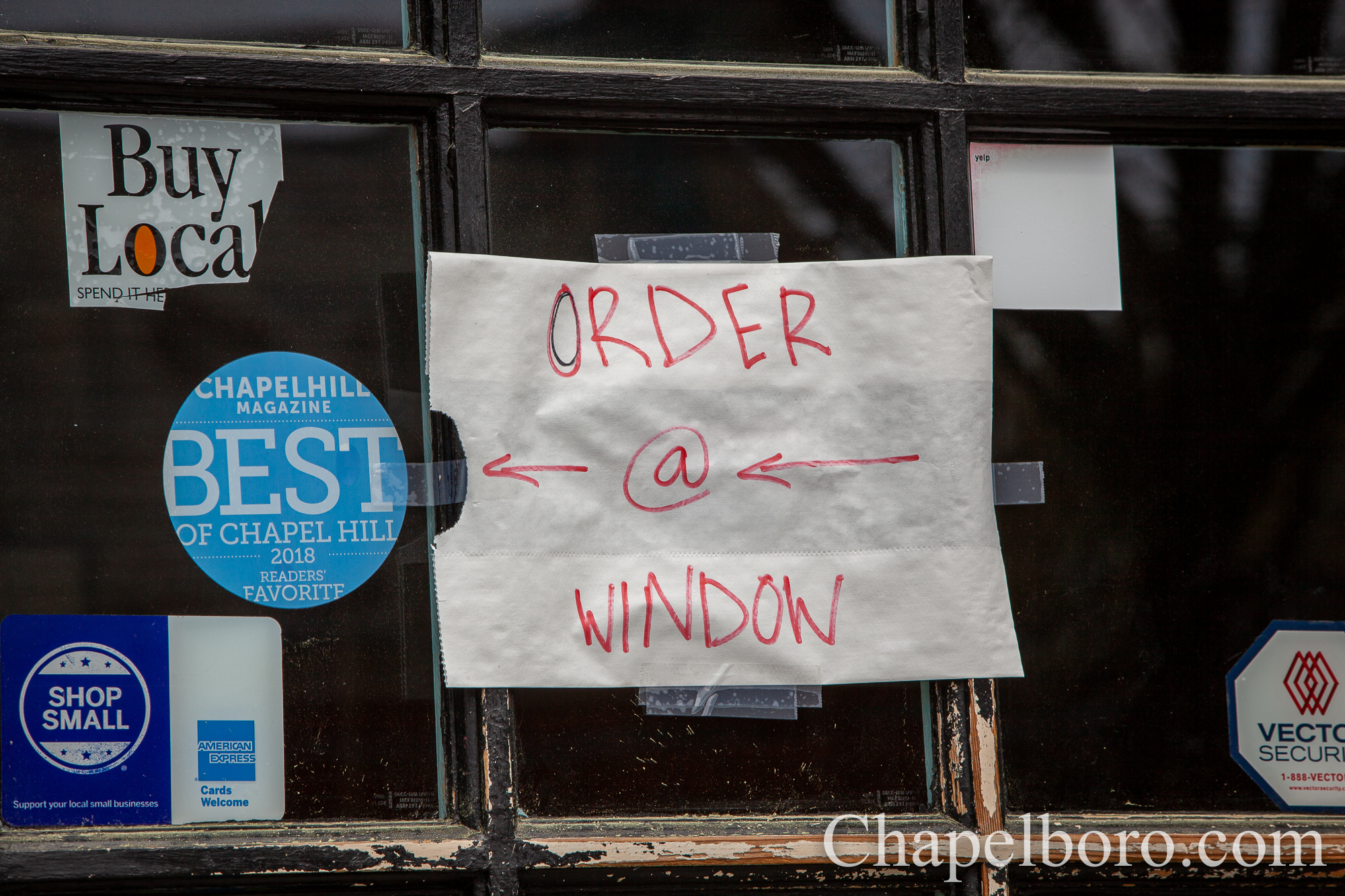

They said restaurants, fitness centers and other businesses trying to emerge from eased lockdown restrictions don’t need an extra tax burden currently required as the May 17 filing date for many approaches. The PPP money was designed primarily to keep workers at shuttered or scaled back firms employed and paid.

More than 129,000 loans for North Carolina entities totaling $12.3 billion had been approved as of last August, according to the U.S. Small Business Administration. Nearly all went to for-profit entities. Beneficiaries included many legislators who own businesses.

“We still don’t have our financial footing,” said Jason Smith, who operates two Triangle-area restaurants. The PPP proceeds that his business received helped return employment levels from 15% of pre-pandemic levels to 85%. “This would be a terrible time to tax the PPP money that I received and that I already spent.”

The legislation would align more closely North Carolina tax laws with federal rules on proceeds from PPP loans created by Congress. Businesses that received the money and spent it according to certain conditions saw their loans cancelled.

The federal government decided the canceled debt is exempt from a business’ taxable income and the expenses paid with the money can be deducted, helping a company lower their tax bill. But the General Assembly had only agreed the forgiven loans would be excluded from income on state returns. North Carolina is one of only three states that don’t allow expenses as deductions, lawmakers said.

A business generating $50,000 in taxable income last year and and receiving $50,000 in forgiven loan proceeds could have to pay $2,625 in state taxes under current law. But that payment falls to zero if $50,000 in expenses paid with loaned money is included, according to an legislative analysis of the bill.

“Without this type of assistance, a lot of these businesses are never going to recover,” said Rep. David Willis, a Union County Republican and child care center owner.

The legislative analysis estimates the bill would result in $400 million less going into the state tax coffers for the two years starting July 1. The shift would only apply to PPP recipients for the 2020 tax year only. Top House Republicans said the revenue could be made up with either federal stimulus dollars or perhaps unspent state funds that have accumulated since 2019.

The bill, given initial approval by a vote of 111-2 on Thursday, needs one more vote before heading to the Senate, where Republicans are mixed on the idea, chamber leader Phil Berger said.

“No decision has been made at this point,” Berger said. He added that some GOP members are interested in providing alternate financial relief for those business that can’t use the deduction.

Moore and several House members acknowledged at the news conference that their businesses had received PPP loans, meaning they could receive preferential tax treatment as well if the proposal became law.

Moore and other lawmakers defended their active support for the proposal. They said loan recipient information is public and longstanding General Assembly ethics rules generally allow them to participate in legislative action because the bill would apply equally to all PPP loan recipients. Moore provided an email this week from an attorney on the General Assembly’s nonpartisan staff confirming that conflict-of-interest principle.